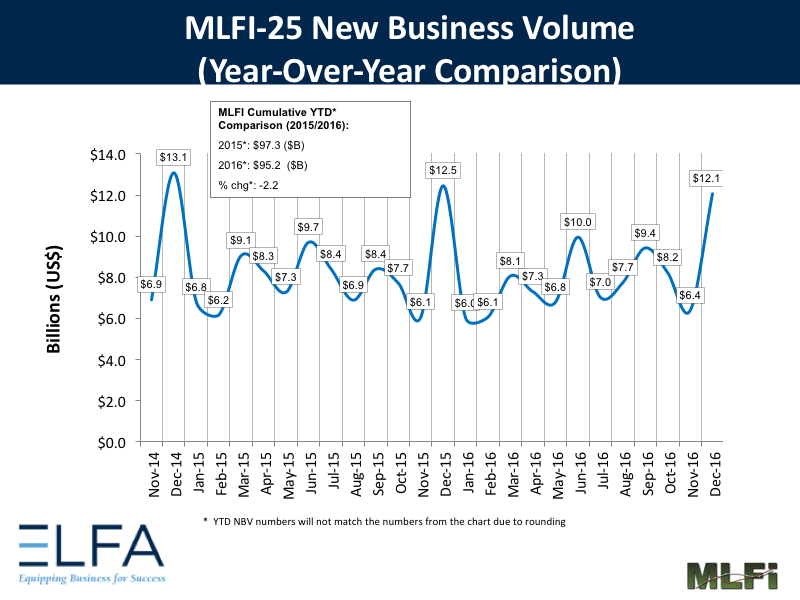

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for December was $12.1 billion, down 3 percent year-over-year from new business volume in December 2015. Volume was up 89 percent month-to-month from $6.4 billion in November in a typical end-of-year spike. Cumulative new business volume for 2016 was down 2 percent from 2015.

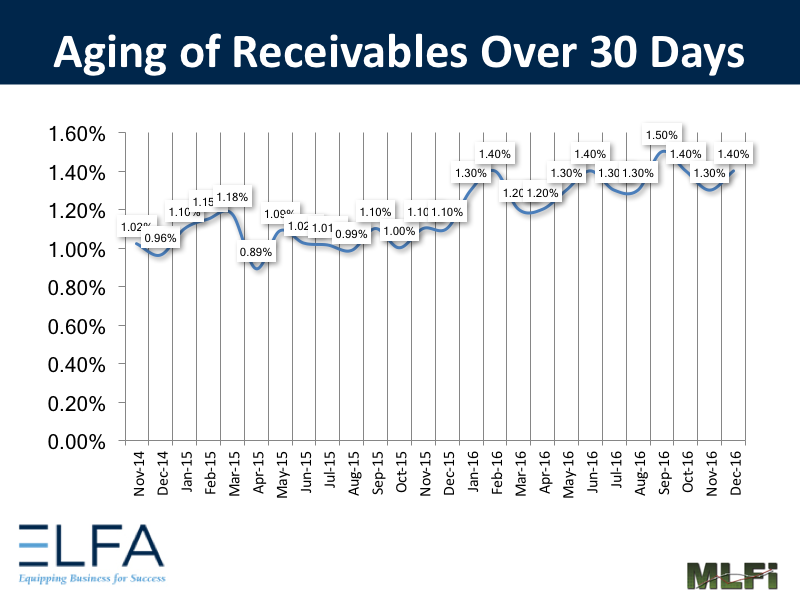

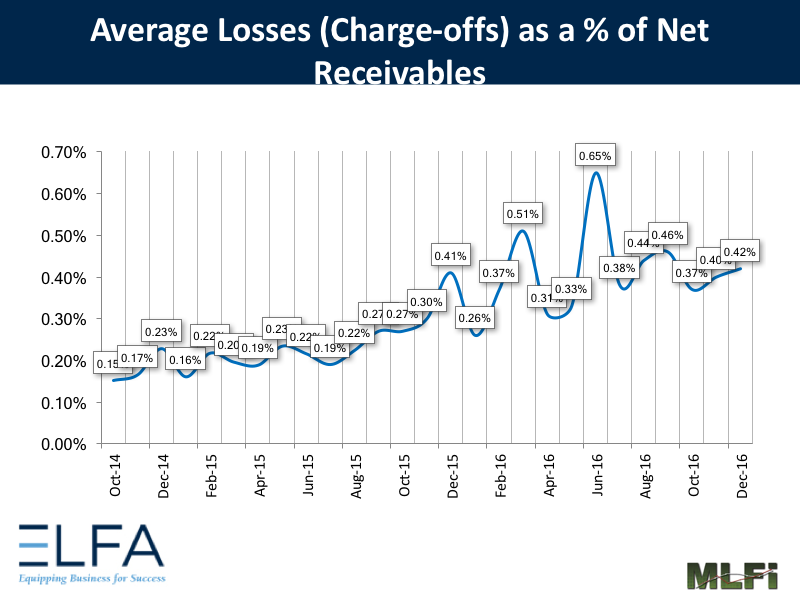

Receivables over 30 days were 1.40 percent, up from 1.30 percent the previous month and up from 1.10 percent in the same period in 2015. Charge-offs were 0.42 percent, up from 0.40 percent the previous month but virtually flat when compared to the year-earlier period.

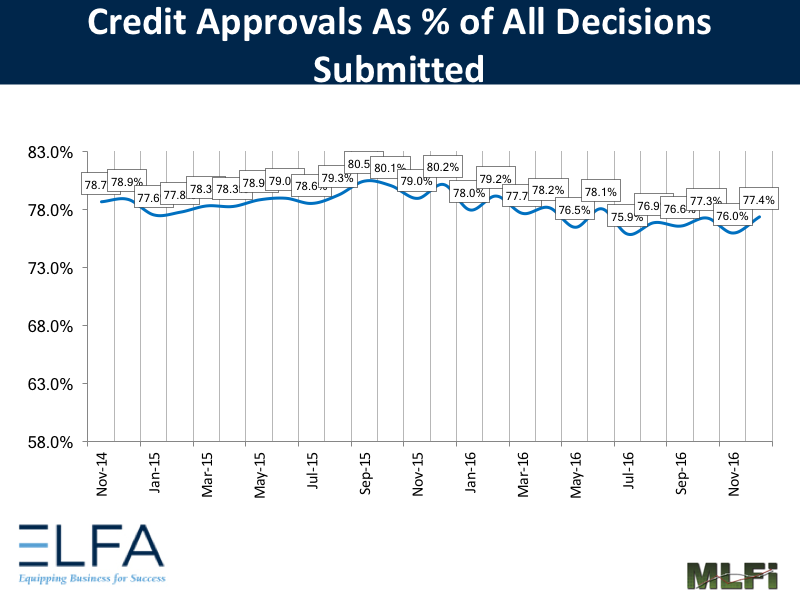

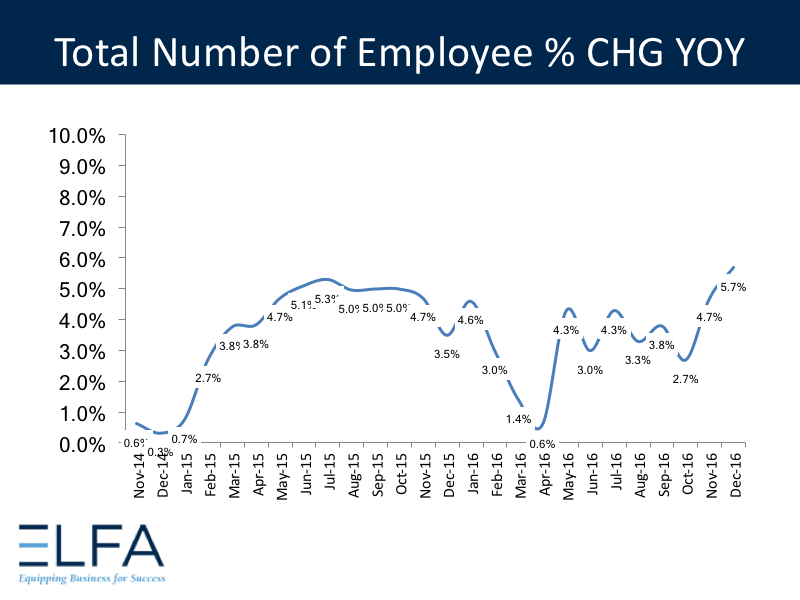

Credit approvals totaled 77.4 percent in December, up from 76.0 percent in November. Total headcount for equipment finance companies was up 5.7 percent year over year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) for January is 73.4, an increase from the December index of 67.5 and the highest index since the MCI was launched in May 2009 to track recovery after the 2008 downturn.

ELFA President and CEO Ralph Petta said, “New business volume ends the year on a relatively high note, despite a slight decline in full-year 2015-16 originations. Credit market metrics remain in acceptable ranges. With a seemingly business-friendly Trump Administration assuming the reins of power in Washington, business owners share a cautious optimism as they look to policies that hopefully will continue growing the U.S. economy and stimulate capital investment in the months and years ahead.”

Mike Jones, Managing Director, CIT Equipment Finance, a participating company in the MLFI-25, stated, “We finance the commercial sales for manufacturers, distributors and dealers in a number of industries. Through these relationships, we have a good overview of Main Street businesses. As a result, we are seeing greater commitment among small and medium-sized organizations to invest in capital equipment. We’re hearing that these companies are really excited about what they have to offer their customers and are making investments to support their growth. It is refreshing to hear the optimism again.”

View the full list of participants