August 25, 2025

8:00 am EDT

- FORECAST: The change in new business volumes (NBV) suggests a 0.1% increase in new durable goods orders in July.

- Total NBV among surveyed ELFA member companies was $9.7 billion on a seasonally adjusted basis in July, an increase of 1.7% from June.

- NBV year-to-date contracted by 3.8% relative to the same period in 2024.

- Year-over-year, NBV declined by 6.8% on a non-seasonally adjusted basis.

“The latest CapEx Finance Index data showed that conditions in the equipment finance industry continue to be steady, even as economic and financial volatility remains high,” said Leigh Lytle, President and CEO at ELFA. “Equipment demand improved, and 2025 is on pace to be one of the best in the history of the CFI survey, despite some cooling from last year’s record amount of new business volume. Financial conditions remain healthy as credit approvals jumped, losses declined, and the delinquency rate remains stable. The survey took place before the latest round of tariffs was enacted in early August, so we’ll be monitoring the data closely for any signs of cooling demand or financial stress, but the sector remains well-positioned for the second half of 2025.”

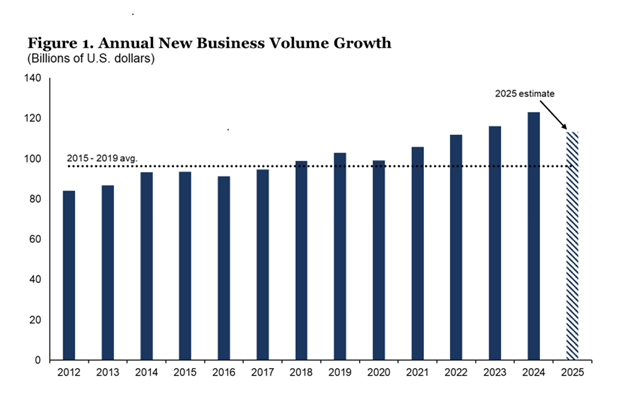

Equipment demand ticked up. Total new business volumes grew by $9.7 billion in July, a similar pace as the average over the first six months of 2025. As shown in Figure 1, total new activity is on pace to exceed $110 billion in 2025, less than the record of $123.2 billion set in 2024, but above the $96.3 billion average in the five years before the pandemic. Small deal activity rose by 8.3% and the pace of new volumes picked up at banks, captives, and independents. Volumes at banks rose by $4.6 billion, a change of 0.3% from June. The $2.9 billion in new volumes at captives was the highest dollar amount in 2025, and new activity at independents has been stable over the last year, rising by $2.0 to $2.1 billion every month since August 2024.

The credit approval rate jumped. The average credit approval rate rose

to 78.2% in July, its highest reading in the last two years. The overall

approval rate has been trending up since November 2024. The rate at banks

was up by 5.4 percentage points, but down by 4.6 and 2.3 percentage points at

captives and independents, respectively.

Losses dropped, and delinquencies

remained stable.

The overall delinquency rate edged up to 2.0% in July but remained below its

trailing six-month average of 2.1%. The delinquency rate on small ticket deals

dropped to 2.2%, tying its lowest reading of the year. The rate at banks rose

to 1.5%, an increase of 0.44 percentage points, while the rate at captives

dropped to 2.0%, the lowest rate since December 2024. The delinquency rate at

independents declined modestly to 3.2%.

The overall loss rate ticked down to

0.50% in the latest data. The rate at banks dropped 0.13 percentage points to

0.39%. The loss rate at captives rose modestly to 0.41%, while the rate at

independents increased by 0.14 percentage points to 0.80%.

“July’s CFI results underscore the

continued strength and resilience of the equipment finance industry,” said Keith Duggan, CEO of

First National Capital Corporation. “Demand for equipment edged higher,

approval rates reached a two-year high, and loss rates declined—clear

indicators of a healthy financial environment. In our personal experience,

overall volumes are tracking toward a solid year. We believe that the trend to

‘onshoring’ of manufacturing driven by tariffs will ultimately be good, but it

is very early to see the demand develop yet. Of course, the recent increase in

the Producer Price Index at 0.9% was a bit concerning on the ‘inflation front,’

but we're confident the economy will digest these changes and continue a steady

march forward. Overall, at First National, we view the current economic

indicators and business environment as evidence that our sector is

well-positioned to support business investment and stability."

Industry Confidence

The Monthly Confidence

Index from ELFA’s affiliate, the Equipment Leasing & Finance

Foundation tracks the sentiment of executives in the industry. The index dipped

to 60.2 in August, after

three consecutive months of increases.

Technical Note

New business volume data are

concurrently seasonally adjusted each month to capture the latest seasonal

patterns. Data in previous months and years may change due to updated seasonal

factors.

ELFA commissioned a white paper to explore the statistical

relationship between CFI survey data and broader economic indicators. The

report analyzes the capacity for various CFI measures to improve forecasting of

key government statistics. The analysis finds strong evidence that many CFI

indicators improve forecasting models of major economic statistics.

About ELFA’s CFI

The CapEx Finance Index (CFI) is the only

real-time dataset that tracks nationwide conditions in the equipment financing

industry. The information is compiled from a diversified set of businesses that

respond to questions about demand for equipment financing, employment, and

changes in financial conditions. The resulting data is organized by institution

type, such as banks, captives, and independents, and is classified into overall

activity and financing for small ticket equipment and software. The CFI is released

monthly from Washington, D.C., generally one day before the U.S. Department of

Commerce's durable goods report. More detail on the data and

methodology can be found at www.elfaonline.org/CFI.

About ELFA

The Equipment Leasing &

Finance Association (ELFA) represents financial services companies and

manufacturers in the $1.3 trillion U.S. equipment finance sector. ELFA’s over

600 member companies provide essential financing that helps businesses acquire

the equipment they need to operate and grow. Learn how equipment finance

contributes to businesses’ success, U.S. economic growth, manufacturing and

jobs at www.elfaonline.org.

###