Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

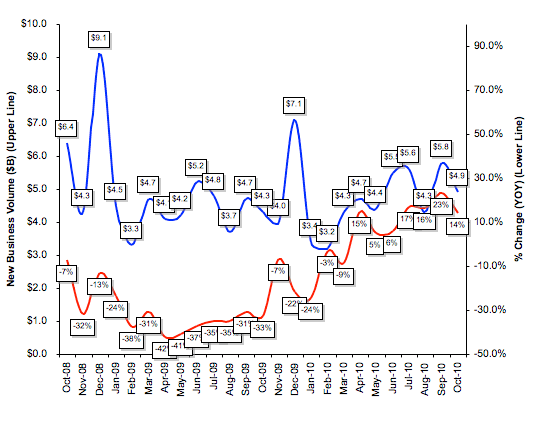

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for October was $4.9 billion, up 14 percent compared to the same period in 2009, and down 15.5 percent from September's volume of $5.8 billion.

Year-to-date new business volume is $46.1 billion, up 6.0 percent compared to the cumulative year-to-date total from 2009.

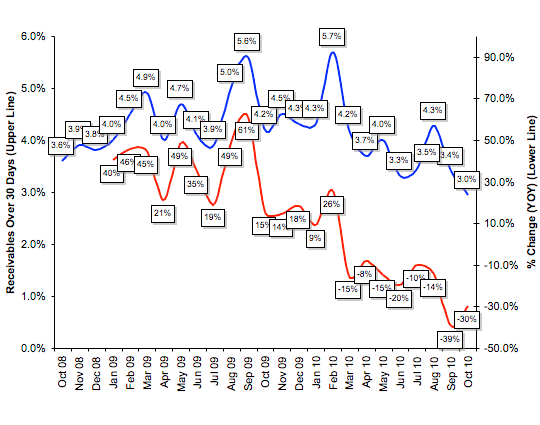

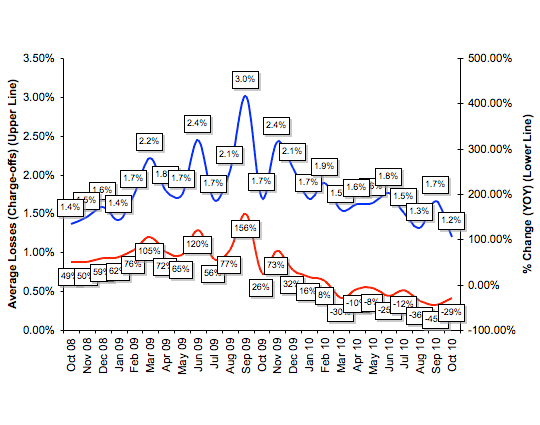

Credit quality is improved. Receivables over 30 days decreased to 3.0 percent in October from 3.4 percent in September, the lowest level in two years. Losses decreased to 1.2 percent in October, down from 1.7 percent in the prior month

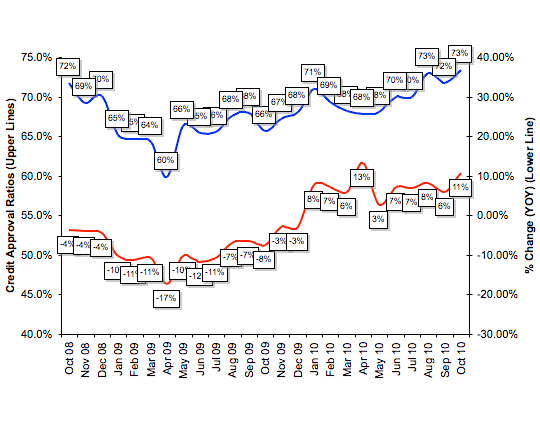

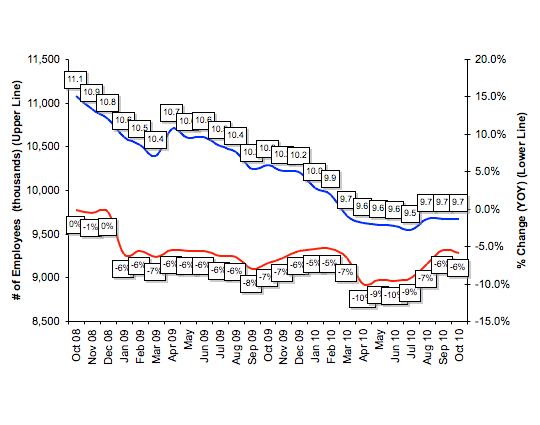

The percentage of credit approvals increased a percentage point to 73 percent in October, matching the highest approval ratio (in August 2010) in the last two years. Seventy-four percent of participating organizations reported submitting more transactions for approval during the month, another high mark from the last two years. Finally, total headcount for equipment finance companies was flat from September to October. Year-over-year employment is down six percent. Supplemental data shows that construction and small and medium-sized businesses lead the underperforming sectors.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for November is 65.5, an increase from 58.8 in October. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA president William G. Sutton said, "We are pleased that all indicators point to an improved equipment finance industry. Hopefully, these positive trends will continue as the broader economy struggles to recover."

"The recovery is progressing slowly; however, the recent MLFI trends are clearly positive," said William Verhelle, Chief Executive Officer of First American Equipment Finance. "Consistent with the larger economy, it appears that commercial equipment finance companies are slow to hire new employees, despite improving industry fundamentals," added Verhelle.

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP