Participants in the ELFA MLFI-25:

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SunTrust Robinson Humphrey

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

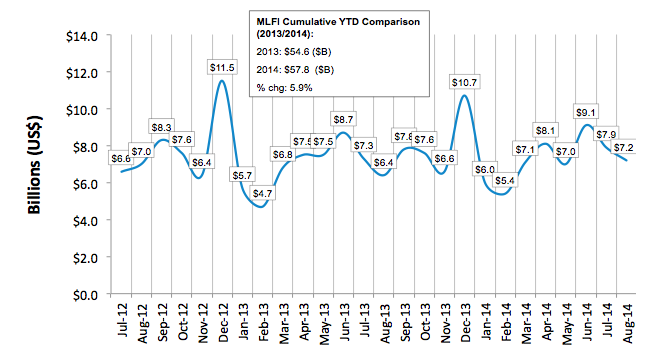

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $827 billion equipment finance sector, showed their overall new business volume for August was $7.2 billion, up 13 percent from new business volume in August 2013. Month over month, new business volume was down 9 percent from July. Year to date, cumulative new business volume increased 6 percent compared to 2013.

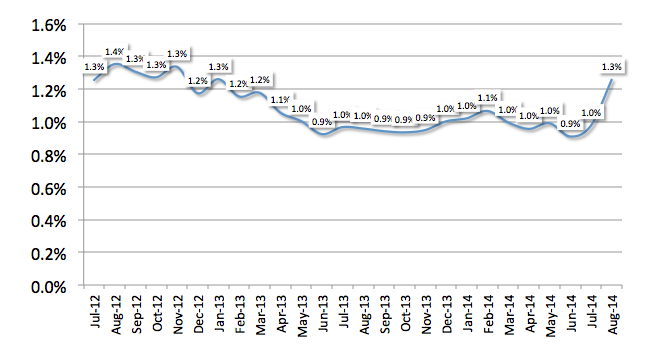

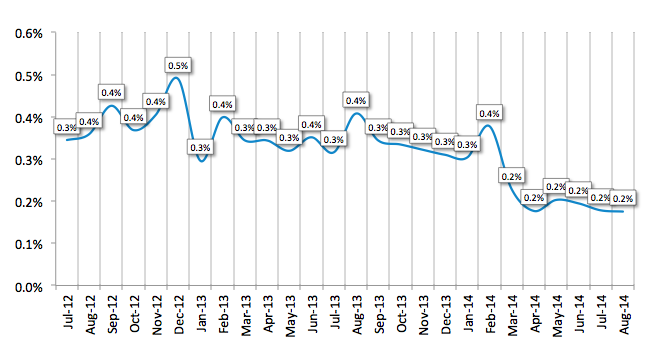

Receivables over 30 days increased from the previous month to 1.3 percent, and were up from 1 percent in the same period in 2013. Charge-offs were unchanged for the fifth consecutive month at an all-time low of 0.2 percent.

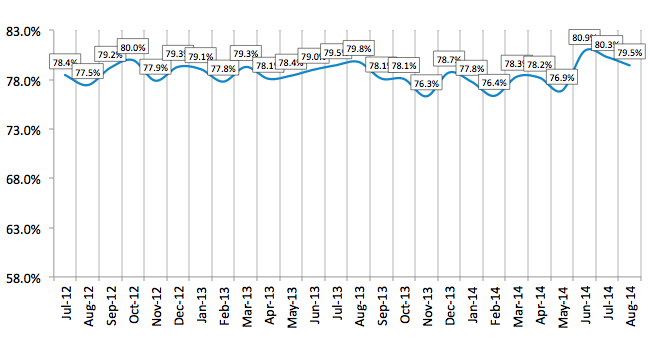

Credit approvals totaled 79.5 percent in August, a slight decrease from 80.3 percent the previous month. Total headcount for equipment finance companies was up 1 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for September is 60.2, an increase from the previous month's index of 58.9.

ELFA President and CEO William G. Sutton, CAE, said: "Continued strength in new business volume reflects the uptick in overall economic activity most economists forecast for the second half of 2014. Solid fundamentals—modest GDP growth; an improving labor market; increased consumer spending, as evidenced by strong auto sales; and low interest rates—all bode well for continued business investment in general, and the equipment finance sector, in particular. Credit quality appears manageable as well, although the index shows a slight uptick in delinquencies. Tempering this relatively good news is concern over recent geopolitical events relating to the fight against terrorism."

Larry R. Stevens, President and Chief Executive Officer, Med One Capital, said,

"The YTD-2014 metric measured by the MLFI-25 demonstrates a solid year in the equipment finance industry. If the month-to-month trends continue for the remainder of 2014, our industry will experience the strongest new business performance since well before the beginning of the recession. The industry seems to have recovered much of the strength and momentum that was lost during the financial meltdown and resultant uncertainties experienced in 2009 and 2010. This trend is largely consistent with what we are experiencing in healthcare equipment financing. The high quality reflected in the portfolios of the reporting companies demonstrates that in the face of increasing volume, credit quality remains a high priority within our industry. If this continues, it will serve us well as pressure grows to increase new business volumes in the years ahead."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

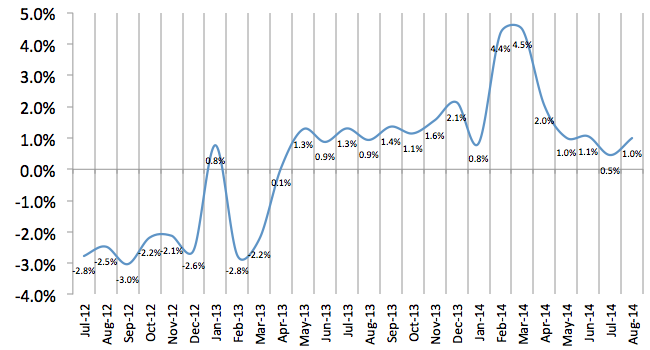

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP