Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SunTrust Robinson Humphrey

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

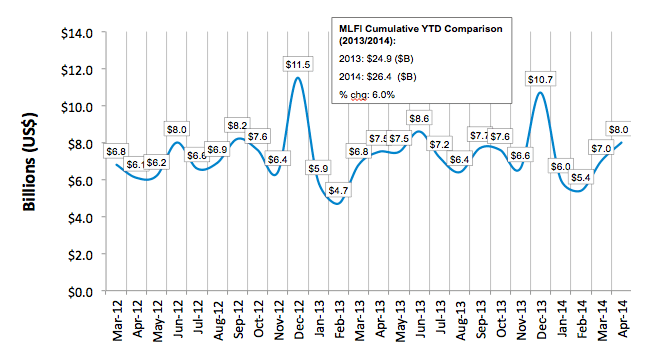

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $827 billion equipment finance sector, showed their overall new business volume for April was $8 billion, up 7 percent from new business volume in April 2013. Month-over-month, new business volume was up 14 percent from March. Year to date, cumulative new business volume increased 6 percent compared to 2013.

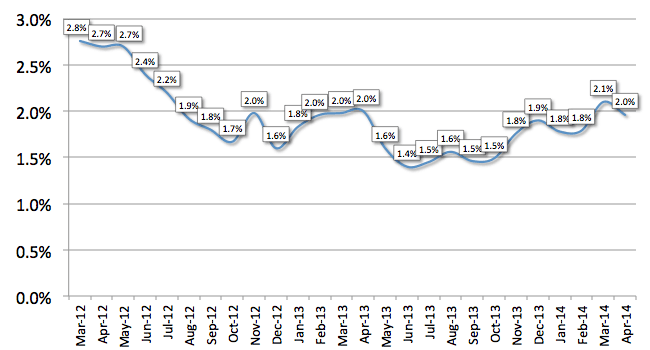

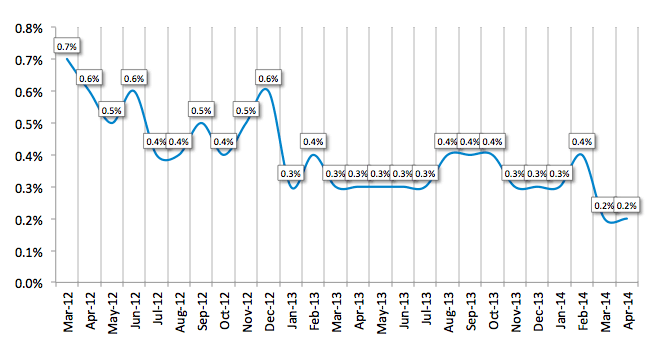

Receivables over 30 days decreased to 2.0 percent from 2.1 percent the previous month, and were flat with the same period in 2013. Charge-offs were unchanged from the previous month at an all-time low of 0.2 percent.

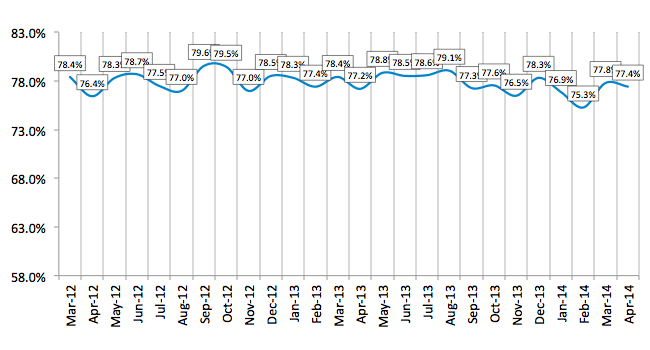

Credit approvals totaled 77.4 percent in April, a slight decrease from 77.8 percent the previous month. Forty-four percent of participating organizations reported submitting more transactions for approval during April, a decrease from 65 percent during March.

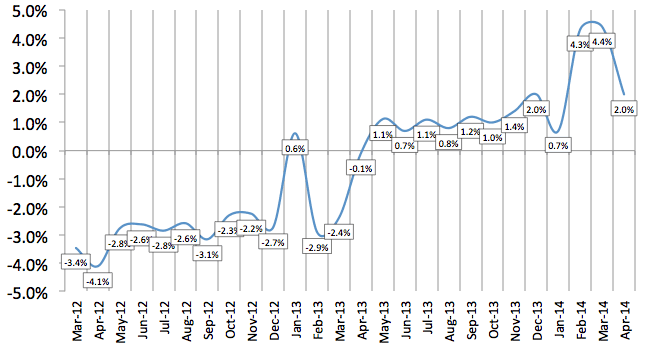

Finally, total headcount for equipment finance companies was up 2.0 percent year over year. This result is more line with industry employment trends than the previous two months' year-over-year increases, which reflected a rebounding from large decreases the prior year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for May is 65.4—relatively unchanged from 65.1 in April—the highest index level in two years for the third consecutive month.

ELFA President and CEO William G. Sutton, CAE, said: "After a relatively soft first quarter, new business volume picked up steam in April. Equipment finance companies are taking advantage of abundant, available liquidity. This, coupled with a very competitive marketplace, is creating favorable conditions for end-users to invest in capital assets to continue adding capacity to their business operations. Equipment finance and leasing companies also report continued high-quality portfolios, for the most part, which is a result of an improving economy."

Shad Peterson, President and Chief Operating Officer, Sasser Family Holdings, Inc., said, "Continual positive new business volume coming out of one of the worst first quarter deep freezes, in addition to stronger receivables and historic low charge-offs as indicated in the MLFI-25, signal continued strength within the equipment leasing and finance industry. If the industry can continue to maintain prudent and forward-looking credit decisions along with a measured fiscal policy by the Federal Reserve, 2014 into 2015 looks to be very positive for growth in our industry."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP