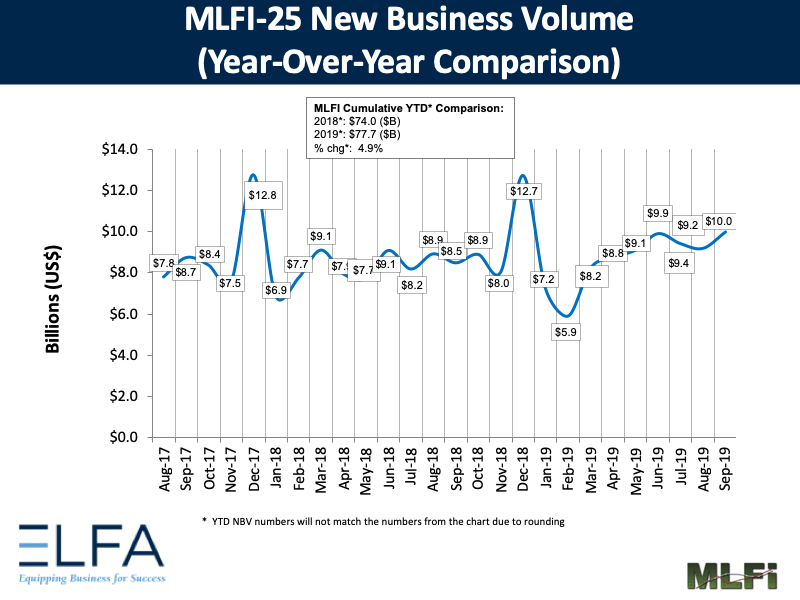

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for September was $10 billion, up 18 percent year-over-year from new business volume in September 2018. Volume was up 9 percent month-to-month from $9.2 billion in August. Year to date, cumulative new business volume was up 5 percent compared to 2018.

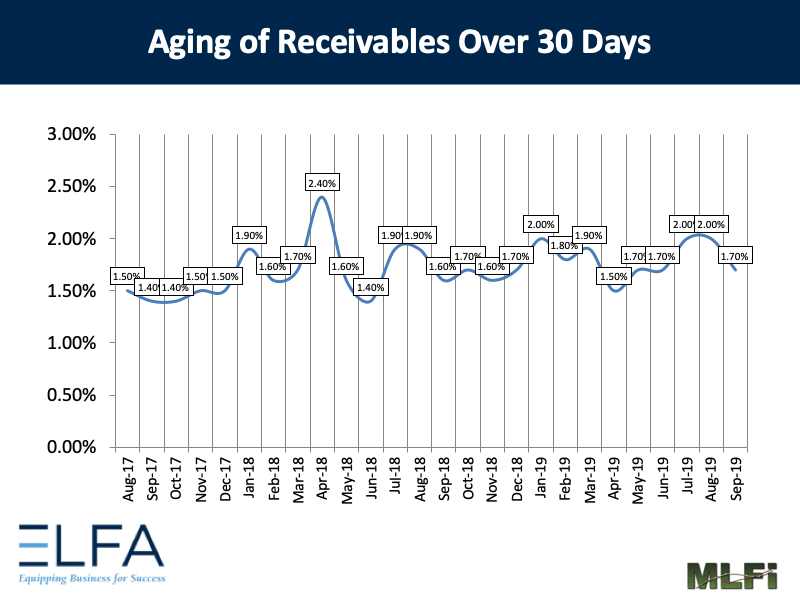

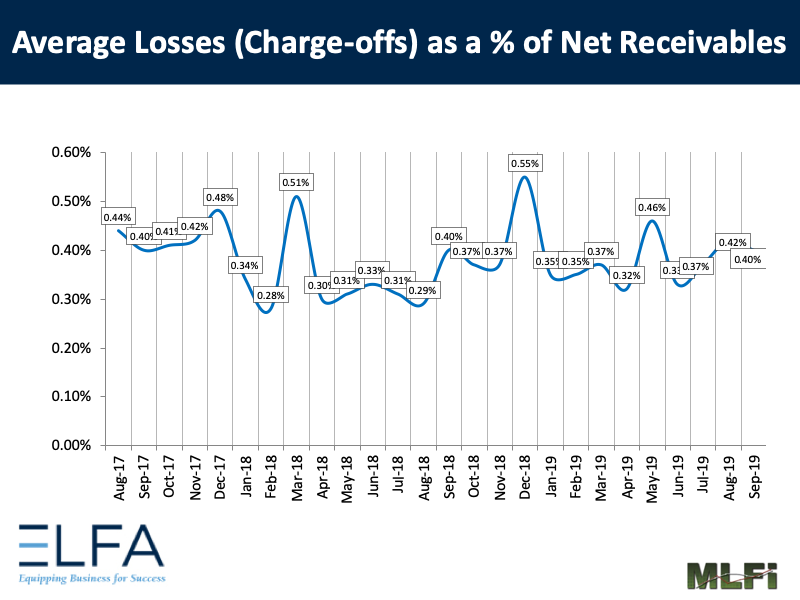

Receivables over 30 days were 1.70 percent, down from 2.0 percent the previous month and up from 1.60 percent the same period in 2018. Charge-offs were 0.40 percent, down from 0.42 percent the previous month, and unchanged from the year-earlier period.

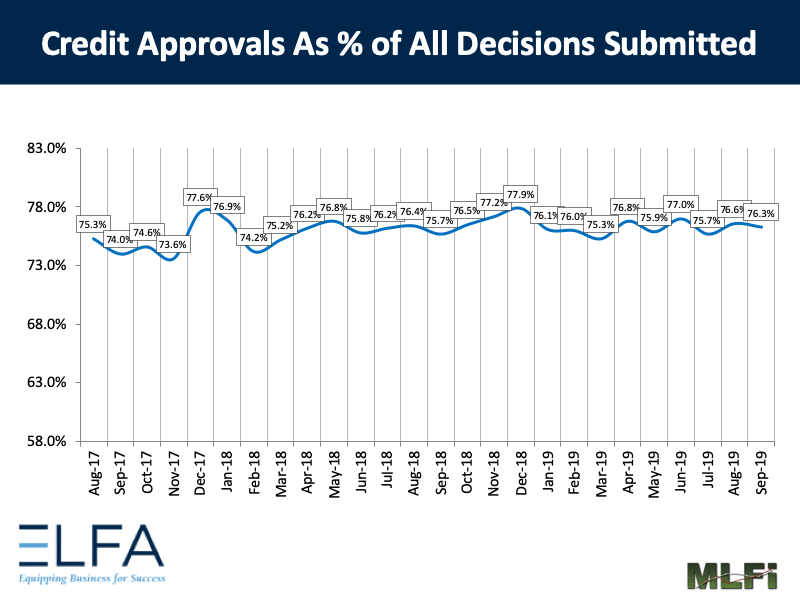

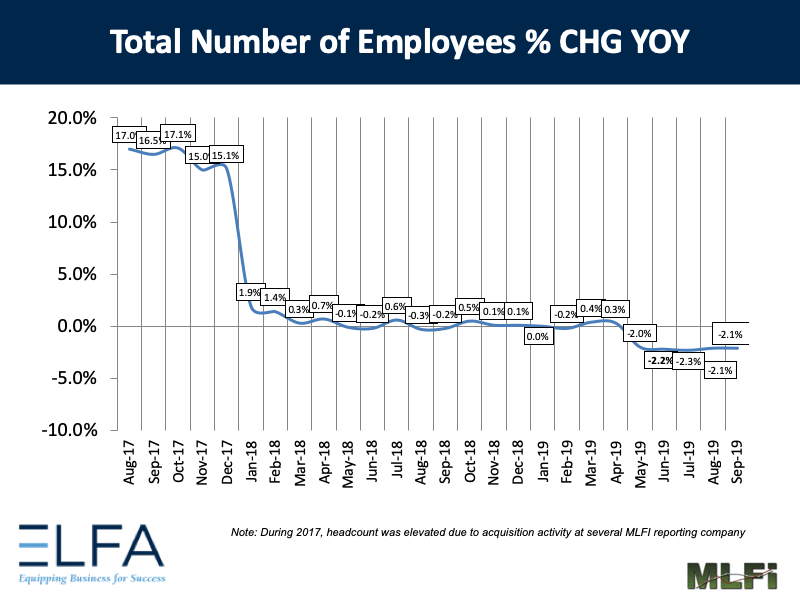

Credit approvals totaled 76.3 percent, down from 76.6 percent in August. Total headcount for equipment finance companies was down 2.1 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in October is 51.4, down from the September index of 54.7.

ELFA President and CEO Ralph Petta said, “September data reflect solid performance on the part of equipment finance companies participating in the MLFI-25 survey. Another month of relatively strong fundamentals in the U.S. economy creates a favorable environment for businesses to continue to grow and expand, driving the equipment finance industry forward. Consumer spending continues to fuel the economy, notwithstanding signs of caution and concern raised by some over the impact of trade frictions with China, a pull-back in the U.S. manufacturing sector and recent geopolitical events in Syria, Hong Kong and elsewhere.”

Michael DiCecco, Executive Vice President, Huntington Asset Finance, said, “Growth of 18 percent in new business volume on a year-over-year basis for September and 5 percent year-to-date demonstrates the strength of the industry and confidence that businesses had over the last 9-12 months to invest in equipment. However, it is important to note that the Foundation’s Confidence Index is showing a downward trend over the last three months and is now at the lowest level since 2016, reflecting a more cautious outlook on the strength of the economy heading into 2020.”

View the full list of participants