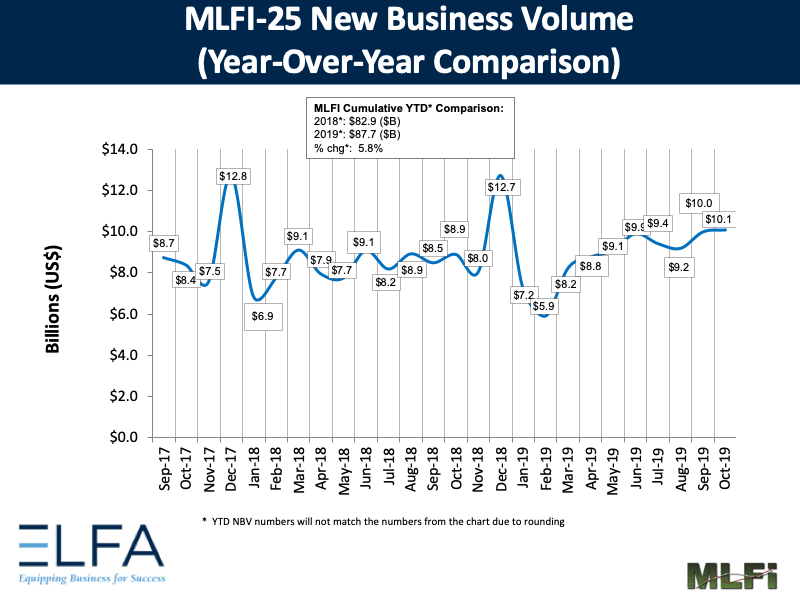

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for October was $10.1 billion, up 14 percent year-over-year from new business volume in October 2018. Volume was up 1 percent month-to-month from $10.0 billion in September. Year to date, cumulative new business volume was up 6 percent compared to 2018.

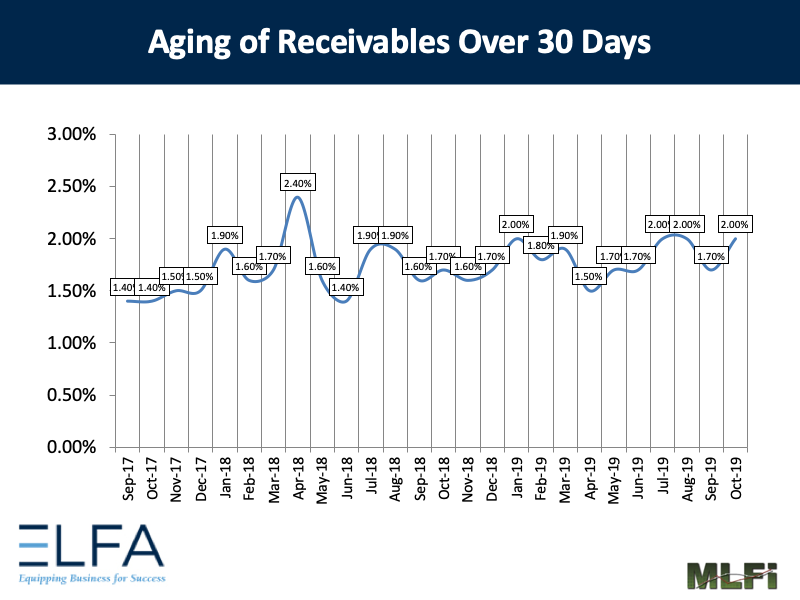

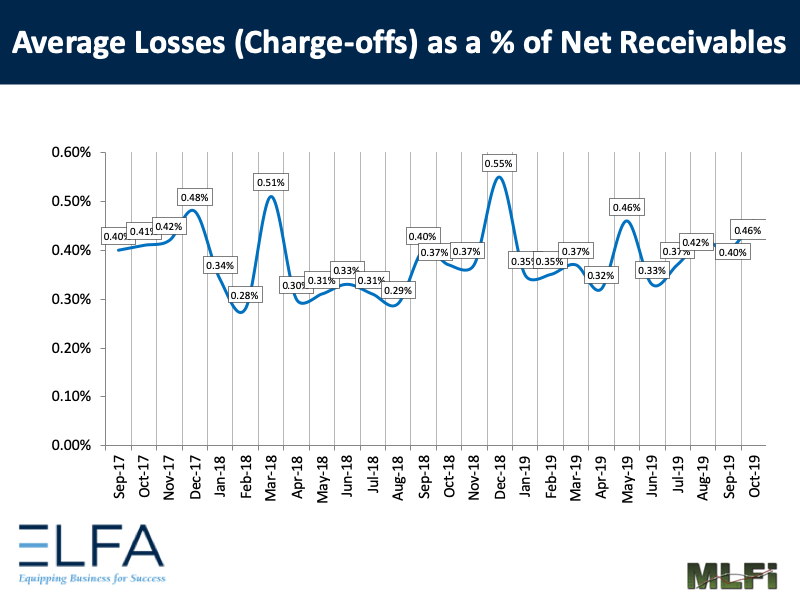

Receivables over 30 days were 2.0 percent, up from 1.70 percent the previous month and up from 1.70 percent the same period in 2018. Charge-offs were 0.46 percent, up from 0.40 percent the previous month, and up from 0.37 percent in the year-earlier period.

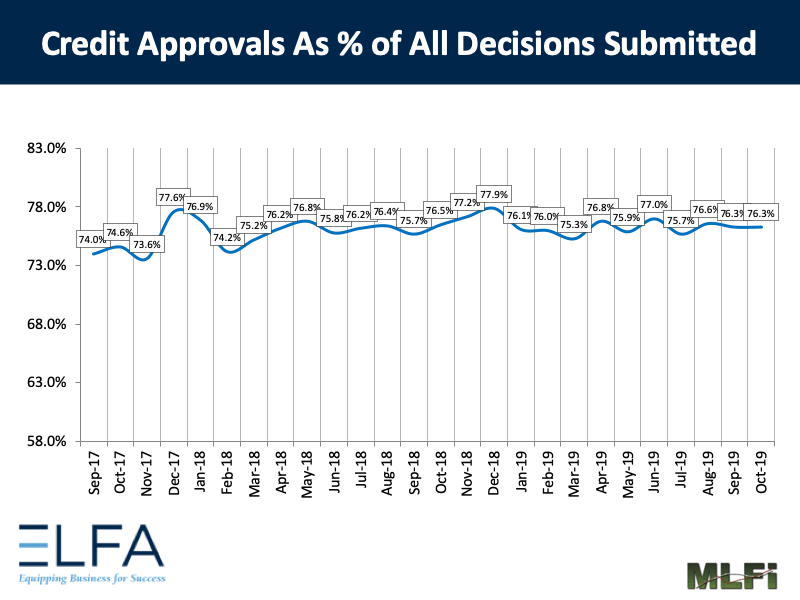

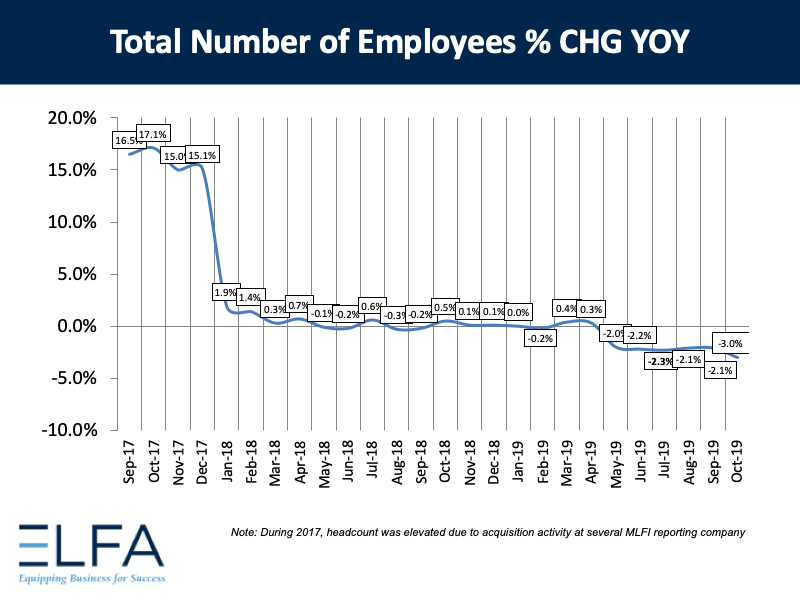

Credit approvals totaled 76.3 percent, unchanged from September. Total headcount for equipment finance companies was down 3.0 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in November is 54.9, an increase from the October index of 51.4.

ELFA President and CEO Ralph Petta said, “Buoyed by solid fundamentals in the U.S. economy, new business volume reported in the October MLFI-25 survey increased yet again. These data, coupled with anecdotal information gathered from members across multiple industry sectors at ELFA’s Annual Convention later in the month, reflect the broader equipment finance industry continuing to fire on most, if not all, cylinders. Of some concern is slightly elevated charge-off and delinquency data. This bears monitoring as the year comes to a close.”

Robert Neagle, President, Merchant Finance, Ascentium Capital LLC, said, “The upward trend in new business volume continued with an increase of 14 percent in October year-over-year growth, and an increase of 6 percent year-to-date compared to last year. With predictions that economic growth will hold up through year-end, and an uptick in the Foundation’s Monthly Confidence Index, we should expect business sentiment and investment to continue to spur positive trends for the industry.”

View the full list of participants