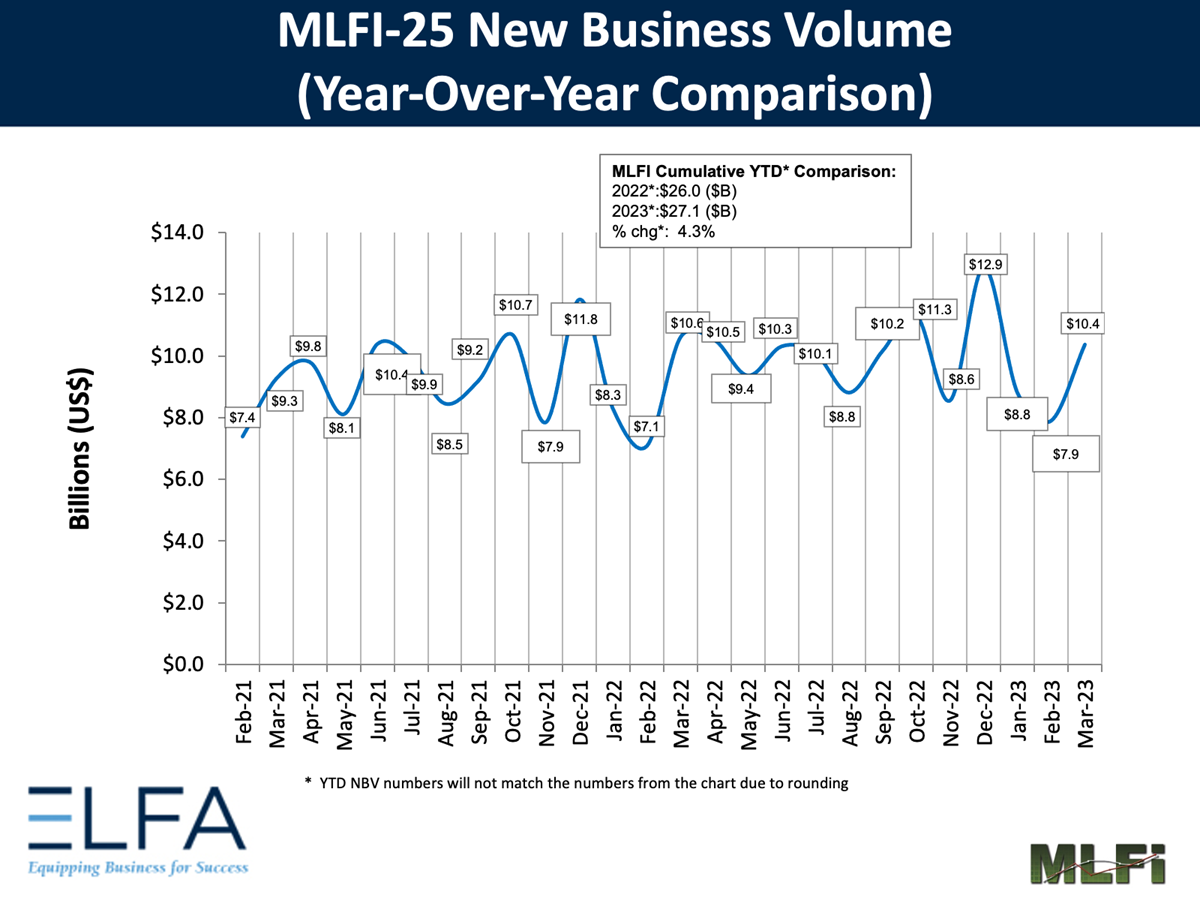

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for March was $10.4 billion, down 2 percent year-over-year from new business volume in March 2022. Volume was up 32 percent from $7.9 billion in February. Year-to-date, cumulative new business volume was up 4 percent compared to 2022.

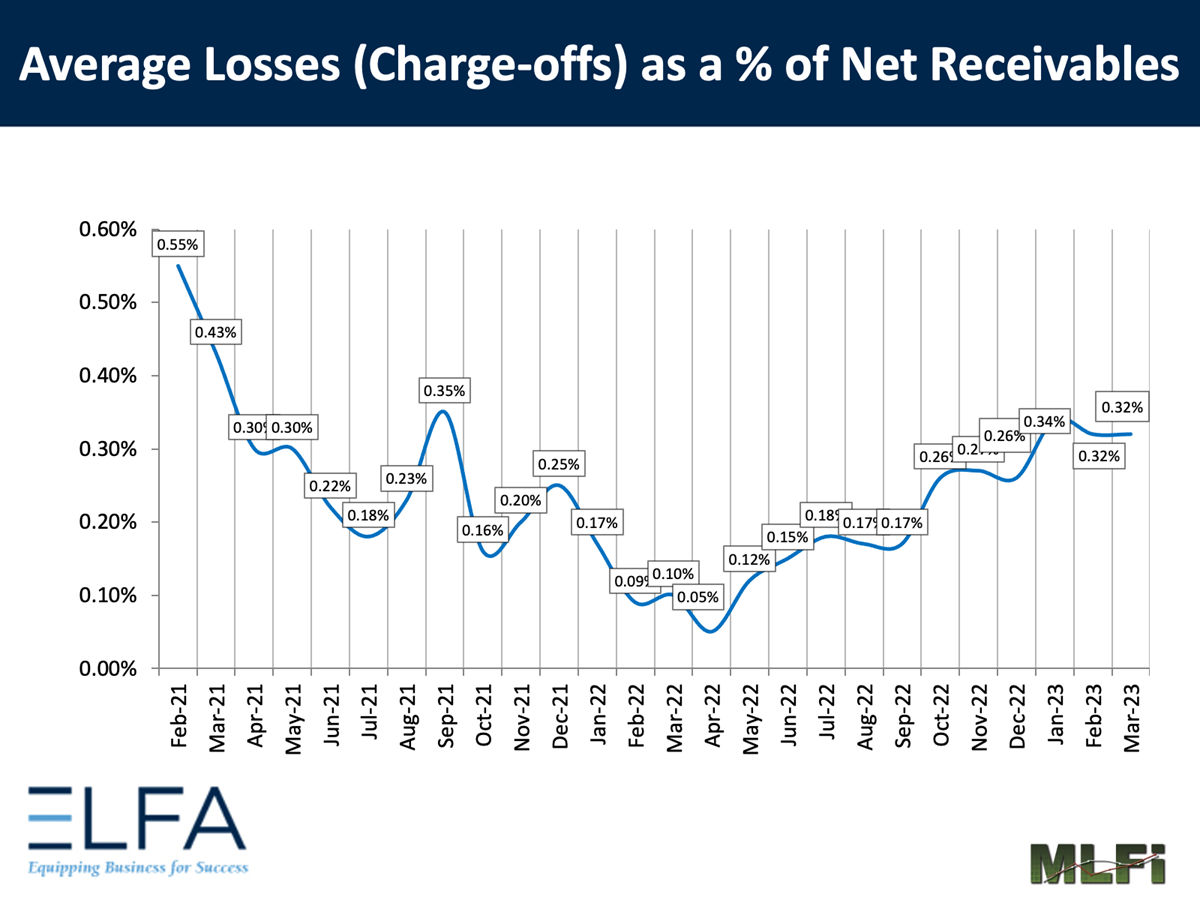

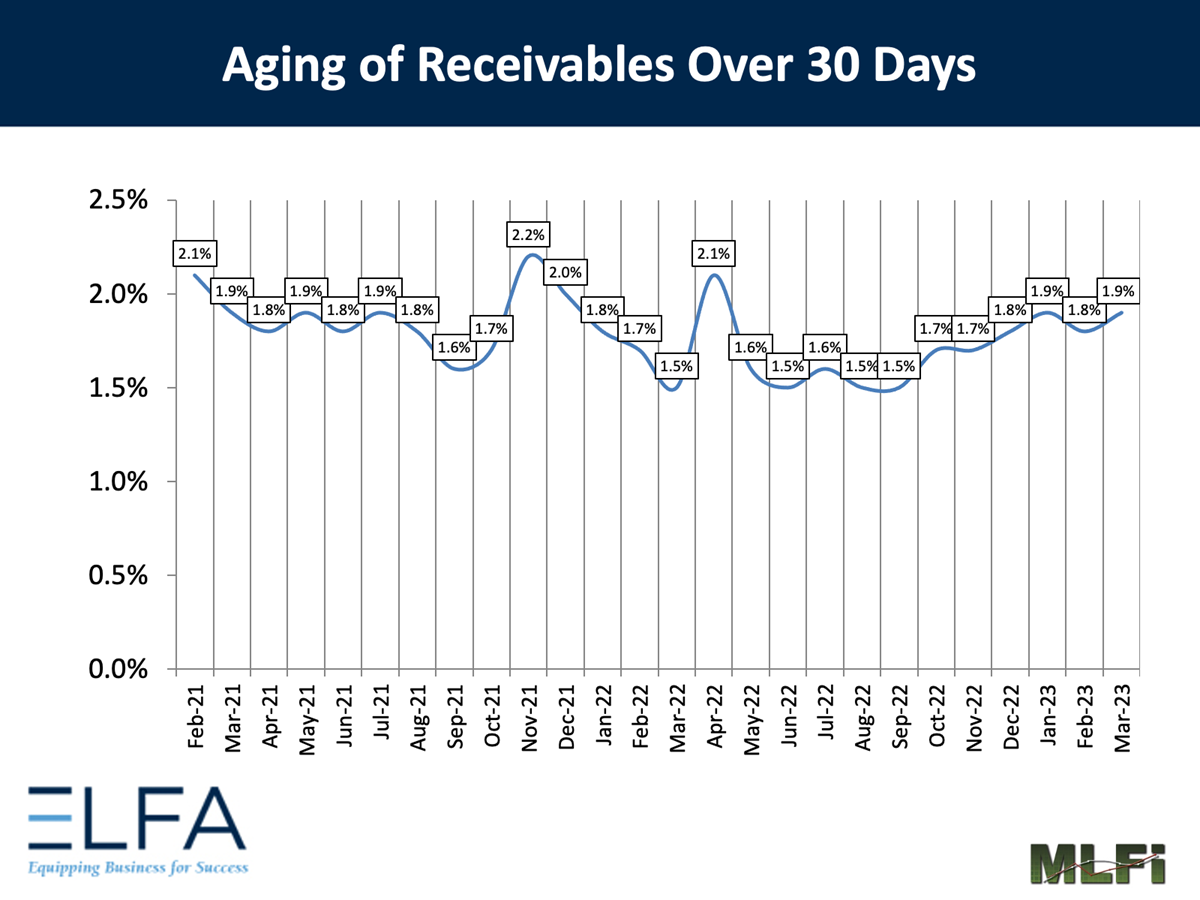

Receivables over 30 days were 1.9 percent, up from 1.8 percent the previous month and up from 1.5 percent in the same period in 2022. Charge-offs were 0.32 percent, unchanged from the previous month and up from 0.10 percent in the year-earlier period.

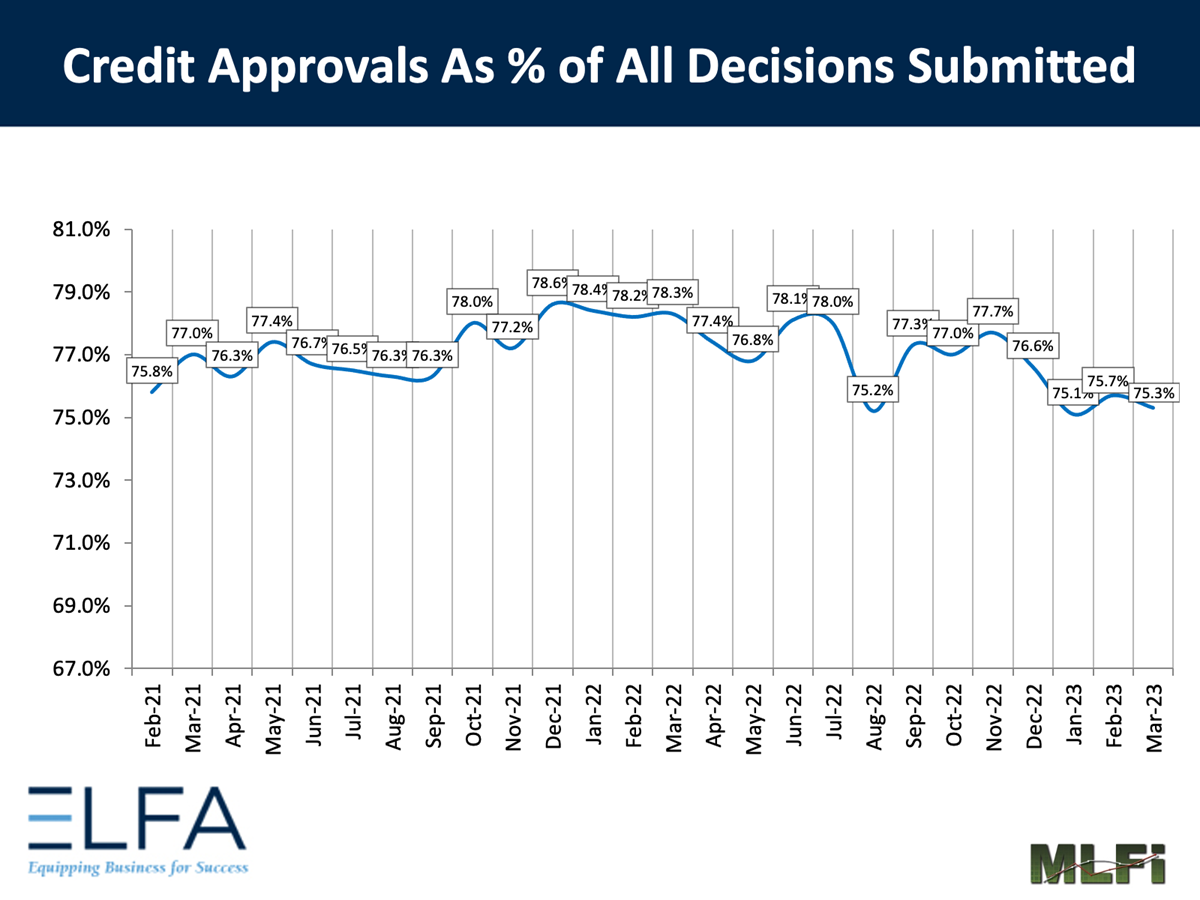

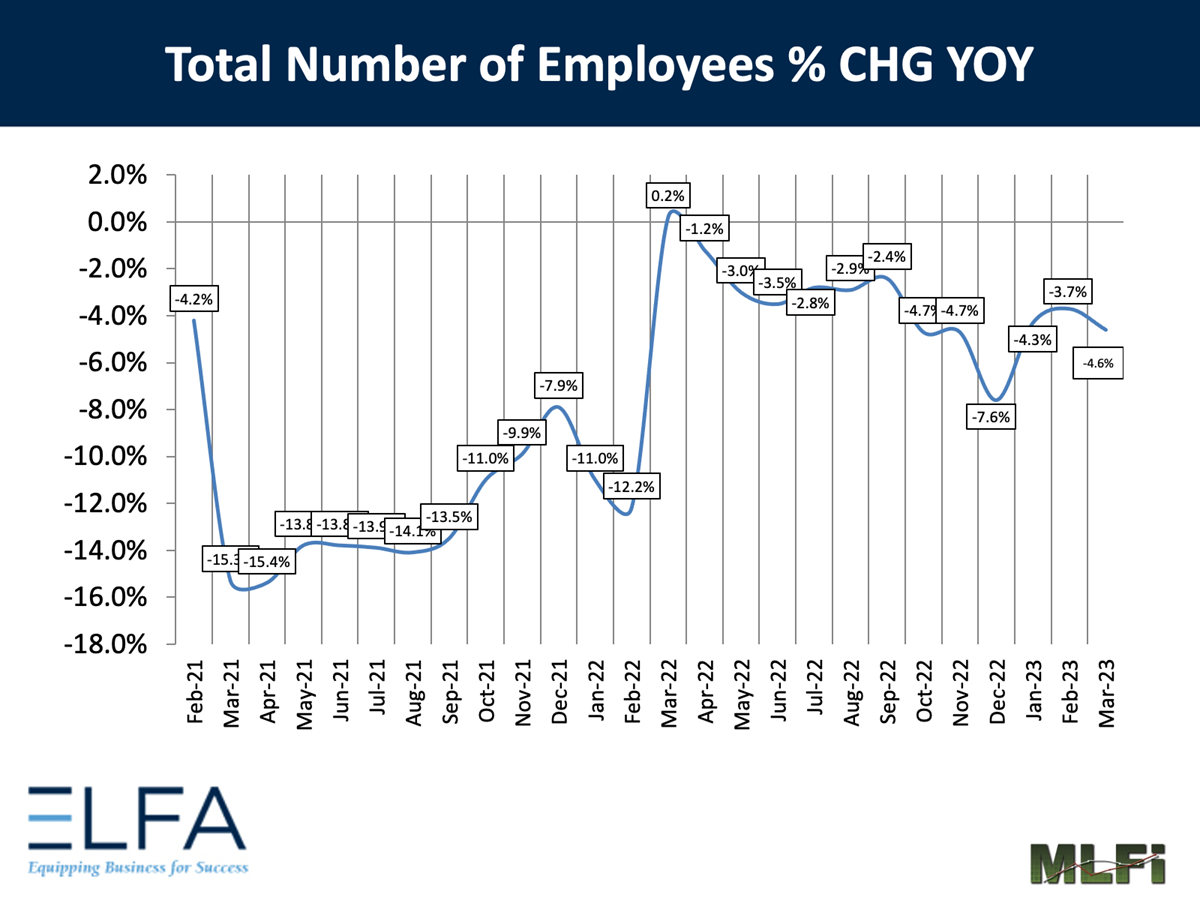

Credit approvals totaled 75.3, down from 75.7 percent in February. Total headcount for equipment finance companies was down 4.6 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in April is 47.0, a decrease from the March index of 50.3.

ELFA President and CEO Ralph Petta said, “ While originations for the month are strong—in the face of a persistently high interest rate and inflationary environment—the metrics that bear monitoring deal with portfolio quality. Delinquencies and losses are up compared to the same period last year, indicating a potential softness in the economy that is making it more difficult for lessees to honor their lease and financing obligations.”

Linda Redding, Head of Equipment Finance, J.P. Morgan Commercial Banking, said, “Despite continued economic uncertainty, rising interest rates and other challenges, the equipment finance industry remains resilient, as seen in the increase in cumulative new business volume in the first quarter. The industry continues to demonstrate its viability throughout economic cycles, as there is a consistent need for companies of all industries and sizes to invest in equipment. Times of economic uncertainty can even create unique opportunities for the equipment finance industry, as its flexible solutions can allow businesses to preserve strong liquidity and cash positions when they need them most.”

View the full list of participants