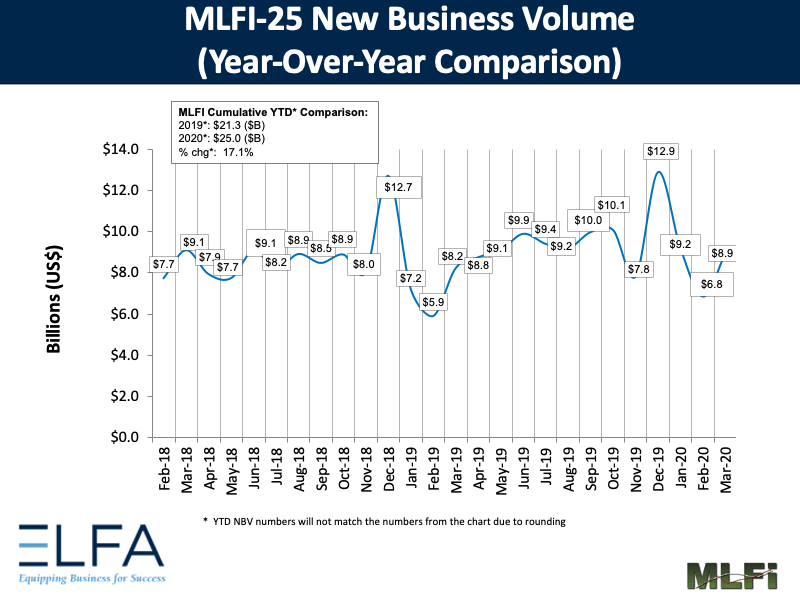

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for March was $8.9 billion, up 9 percent year-over-year from new business volume in March 2019. Volume was up 31 percent month-to-month from $6.8 billion in February. Year-to-date, cumulative new business volume was up 17 percent compared to 2019.

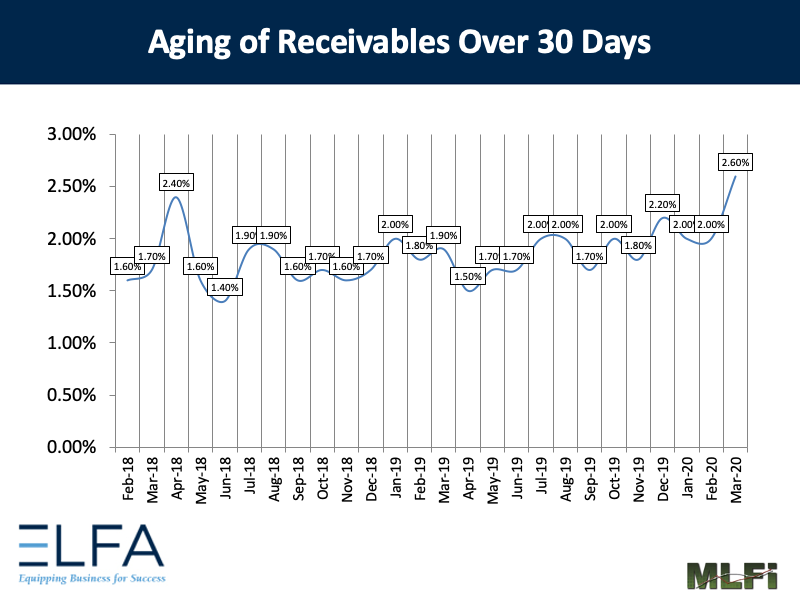

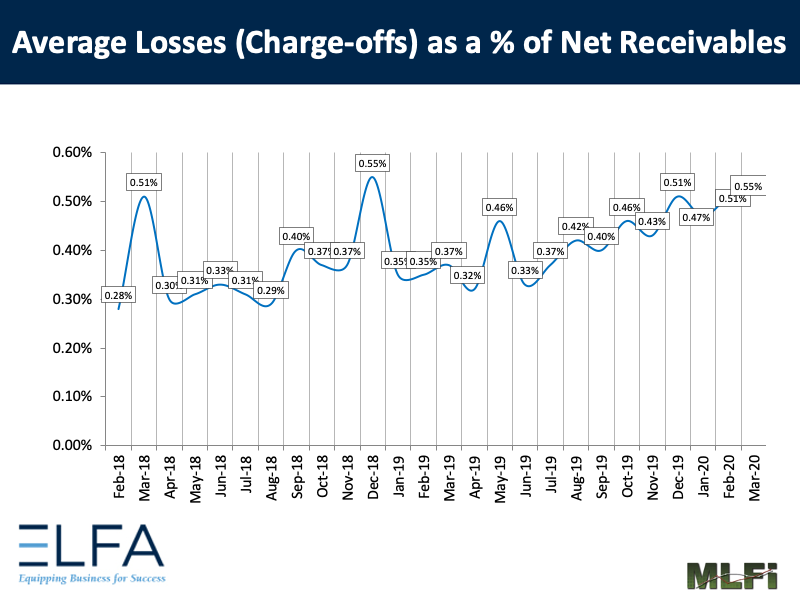

Receivables over 30 days were 2.60 percent, up from 2.00 percent the previous month and up from 1.90 percent the same period in 2019. Charge-offs were 0.55 percent, up from 0.51 percent the previous month, and up from 0.37 percent in the year-earlier period.

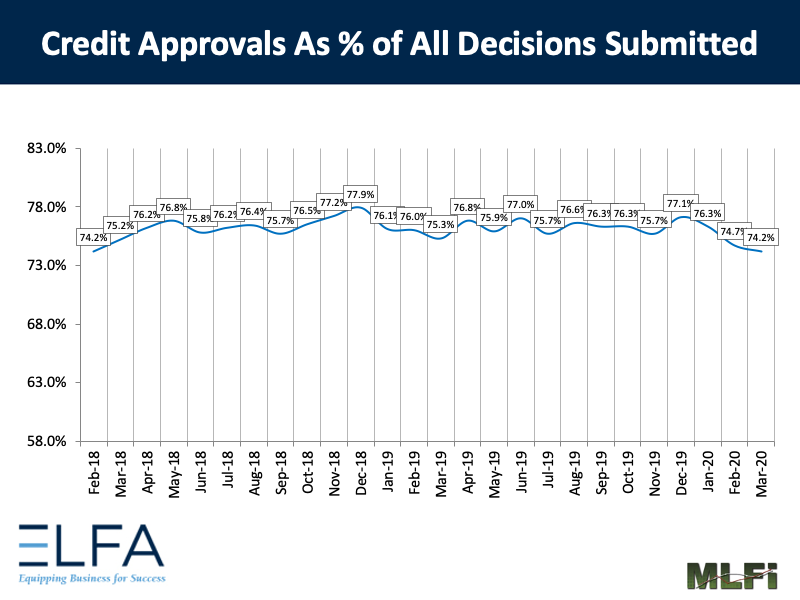

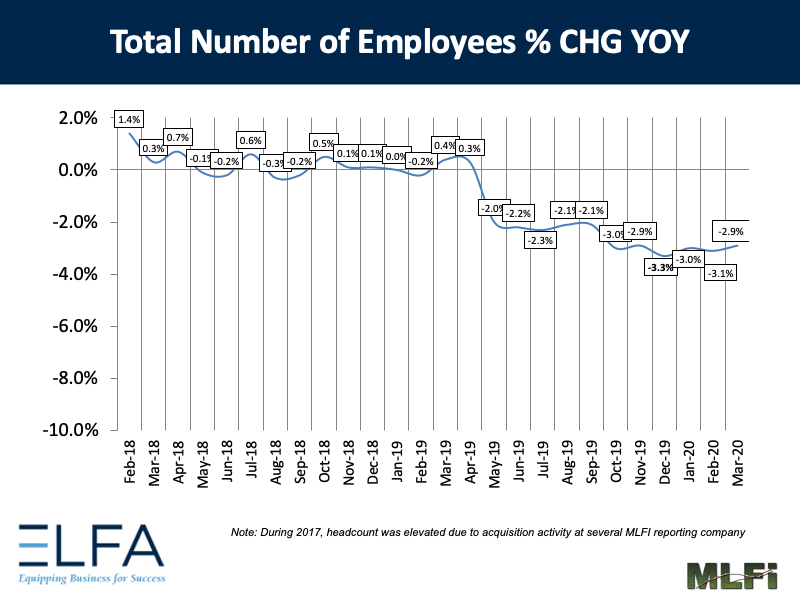

Credit approvals totaled 74.2 percent, down from 74.7 percent in February. Total headcount for equipment finance companies was down 2.9 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) decreased from 46.0 in March to a historic low of 22.3 in April due to the impact of COVID-19.

ELFA President and CEO Ralph Petta said, “The increase in March new business volume data is misleading. It presents a ‘tale of two cities.’ During the first half of the month, economic activity and industry performance were strong, mirroring overall strength in the U.S. economy. However, during the second half of March, as the coronavirus pandemic’s impact—both from a health and economic standpoint—entered the country’s consciousness, all that changed. One need not look any further than the delinquency and charge-off data to understand the myriad challenges confronting U.S. businesses, both large and small, in the weeks and months ahead as this insidious disease grips the nation and our people. For now, acquiring and financing business equipment takes a back seat to critical efforts by families vitally concerned about their health and safety. Things we know: this crisis is temporary; the equipment leasing and finance industry’s resilience and resolve are enduring.”

Nancy Pistorio, CLFP, President, Madison Capital LLC, said, “March results for the equipment finance industry illustrate how robust activity was as we headed into the final month of the first quarter. However, due to coronavirus-induced containment measures, many businesses began to close in mid-March and, not unexpectedly, delinquency is beginning to rise. As evidenced by declining approvals, new business is and will continue to be negatively impacted. This will be an extremely challenging time for our industry. I believe independents in the small-ticket space will be hit particularly hard as their customers—small and medium-sized businesses—struggle to survive in the wake of widespread shutdowns. With a developing global economic recession, the Equipment Leasing & Finance Foundation currently projects an 8.6% to 13.5% contraction in equipment and software investment for this year. Government officials relaxing stay-at-home orders and allowing those at low risk to return to work under a responsible plan, sooner rather than later, will be essential in mitigating further economic decline.”

View the full list of participants