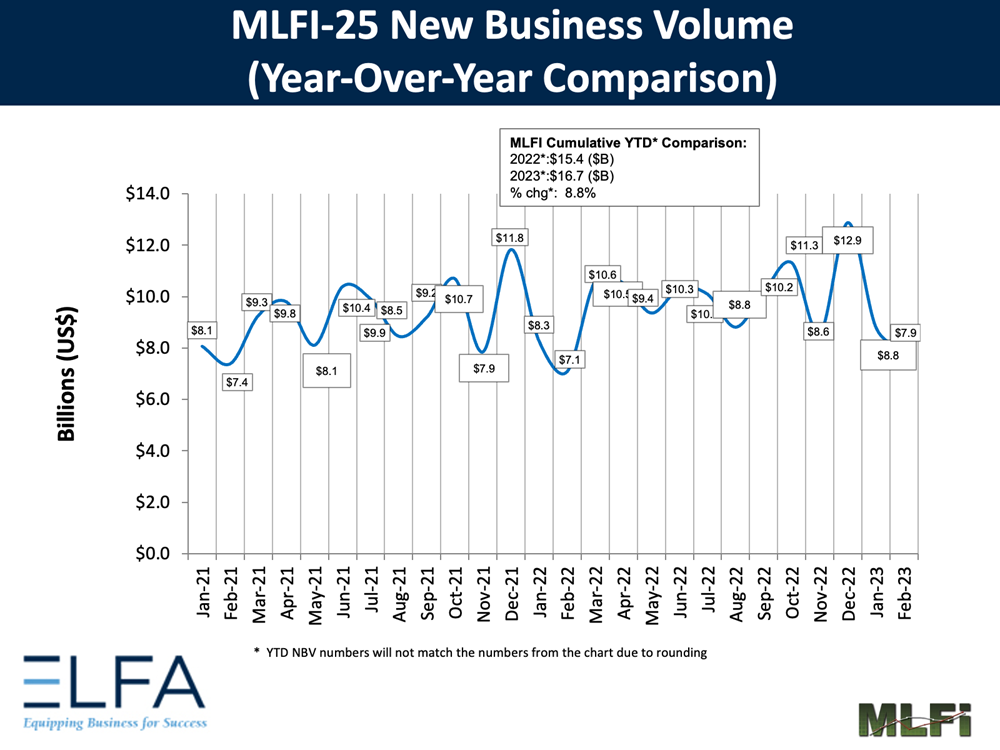

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for February was $7.9 billion, up 11 percent year-over-year from new business volume in February 2022. Volume was down 10 percent from $8.8 billion in January. Year-to-date, cumulative new business volume was up nearly 9 percent compared to 2022.

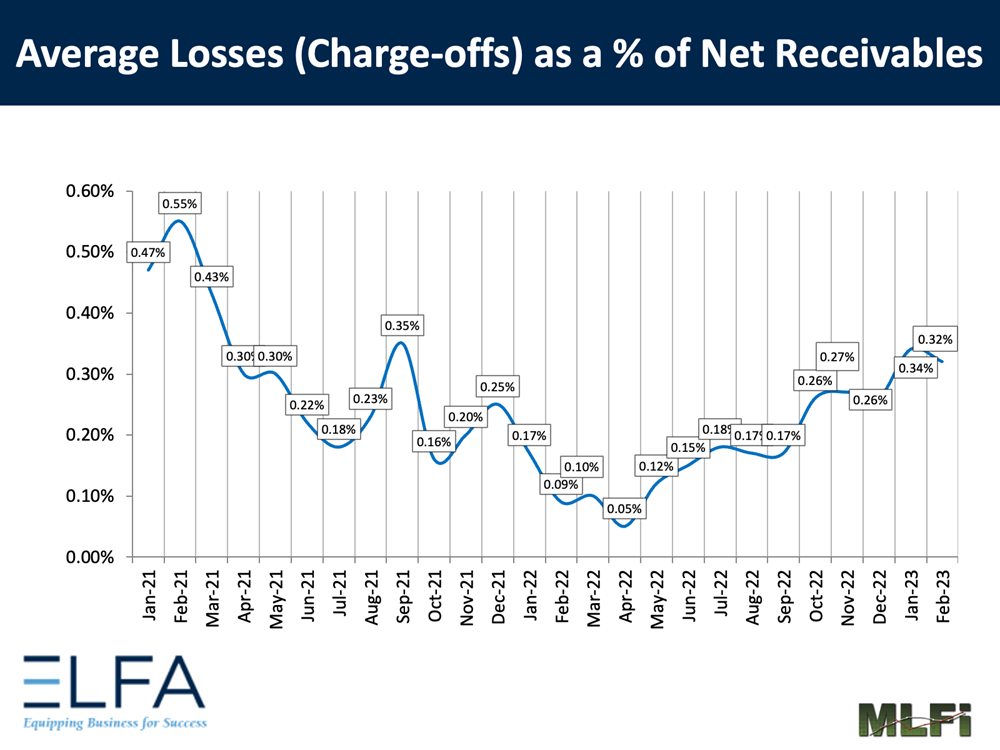

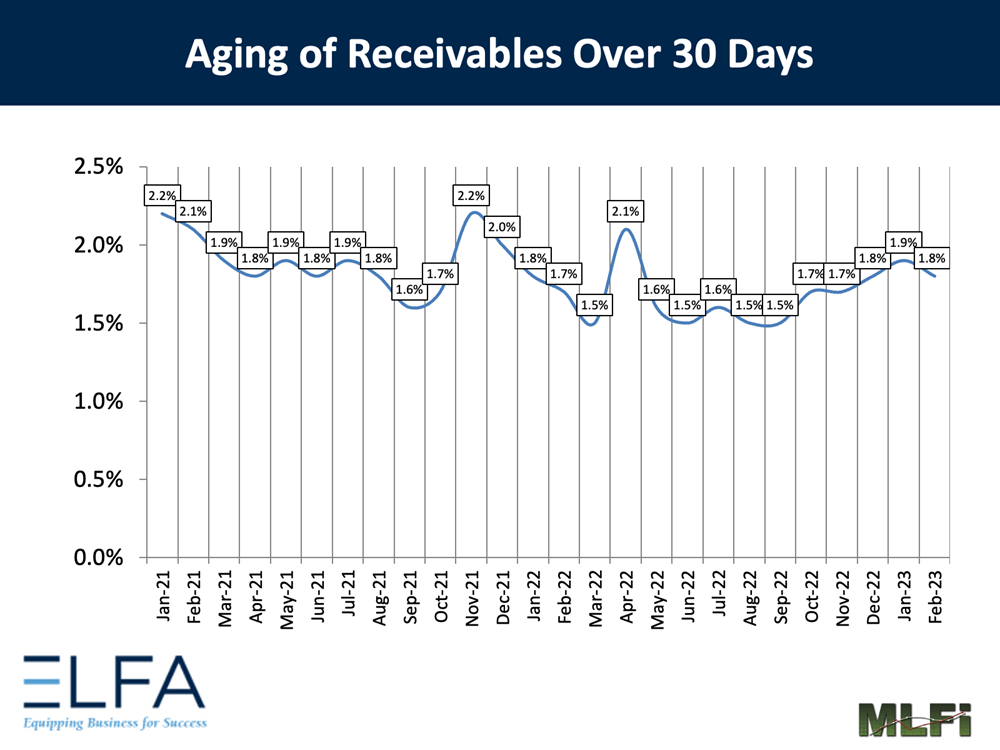

Receivables over 30 days were 1.8 percent, down from 1.9 percent the previous month and up from 1.7 percent in the same period in 2022. Charge-offs were 0.32 percent, down from 0.34 percent the previous month and up from 0.09 percent in the year-earlier period.

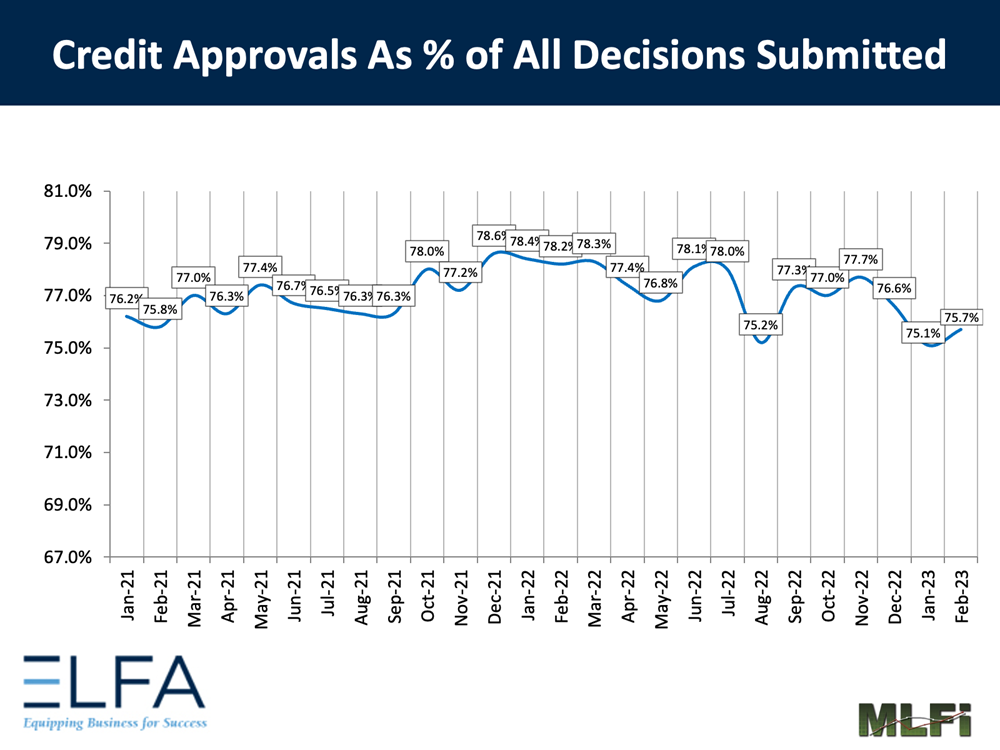

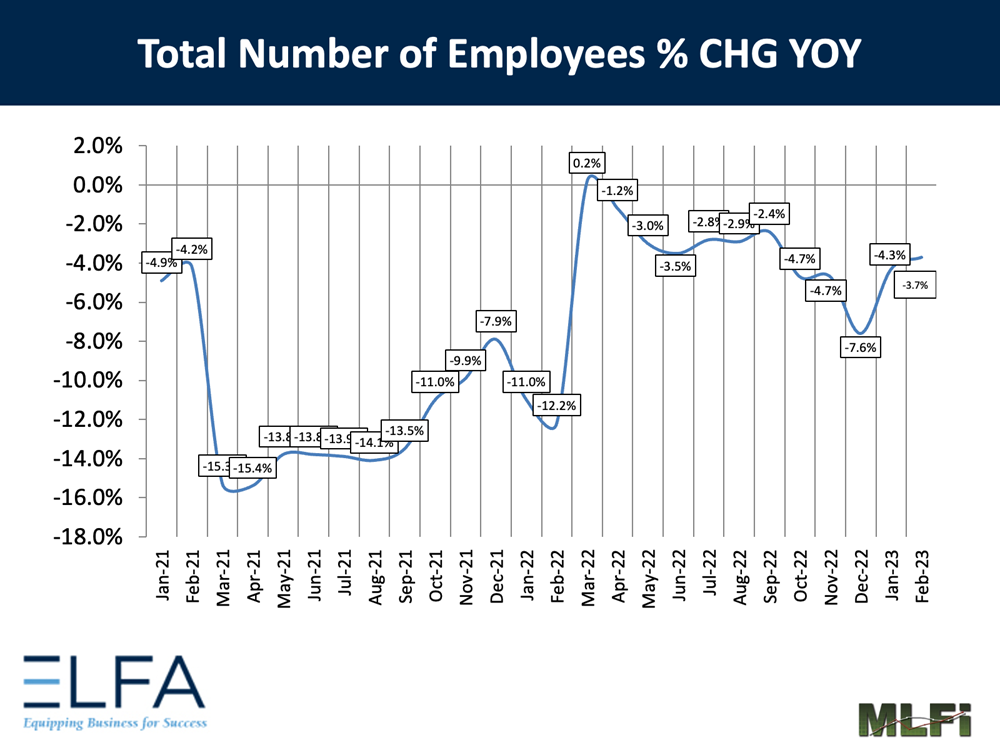

Credit approvals totaled 75.7, up from 75.1 percent in January. Total headcount for equipment finance companies was down 3.7 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in March is 50.3, a decrease from the February index of 51.8.

ELFA President and CEO Ralph Petta said, “Monthly data for February shows a substantial rise in new business volume compared to the same period last year. The steady rise in short-term interest rates and stubborn inflationary pressures do not seem to have suppressed demand for productive equipment by U.S. businesses. A mild winter and steady return to a more normalized supply chain in a number of important sectors also contributed to the strong February data. Portfolios of MLFI respondents continue to perform well.”

Marc Gingold, CLFP, Vice President of Syndication, Fleet Advantage, said, “The February MLFI index and increase in year-over-year new business volume are reflective of our results in our core markets. In the transportation sector, we expect origination growth during 2023 as these supply-chain issues diminish and accelerating deliveries fulfill a healthy backlog. Alternative fuel vehicles are gaining some traction with extensive customer interest, but we foresee very limited volumes as there remains limited qualified long-haul applications. Overall, we remain optimistic but sensitive to credit quality as economic conditions are volatile.”

View the full list of participants