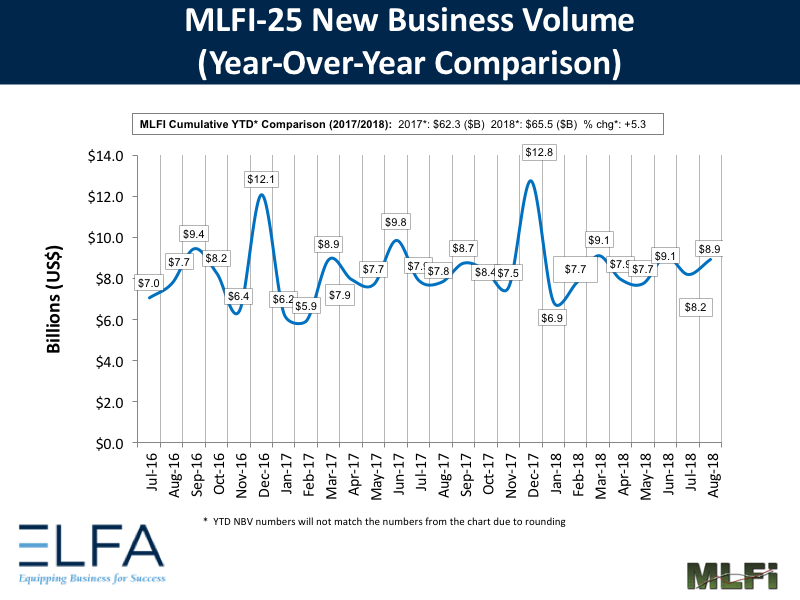

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for August was $8.9 billion, up 14 percent year-over-year from new business volume in August 2017. Volume was up 9 percent month-to-month from $8.2 billion in July. Year to date, cumulative new business volume was up 5 percent compared to 2017.

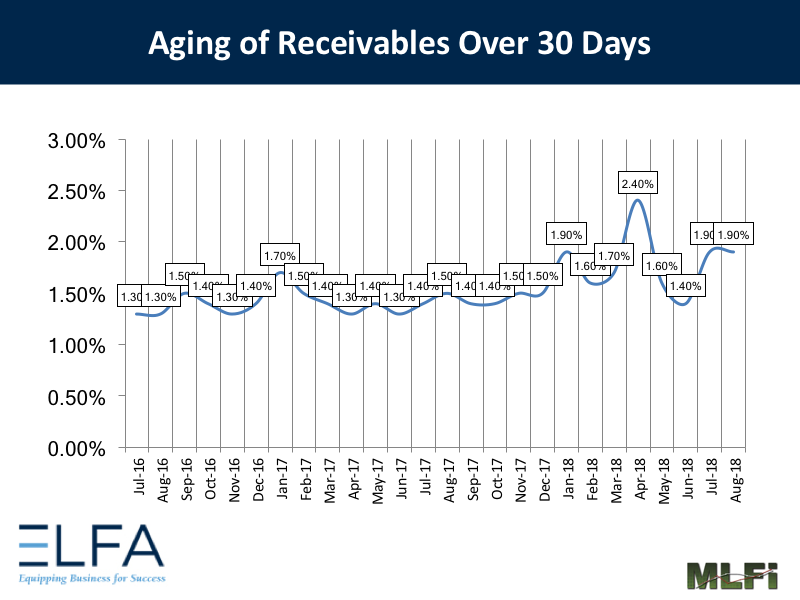

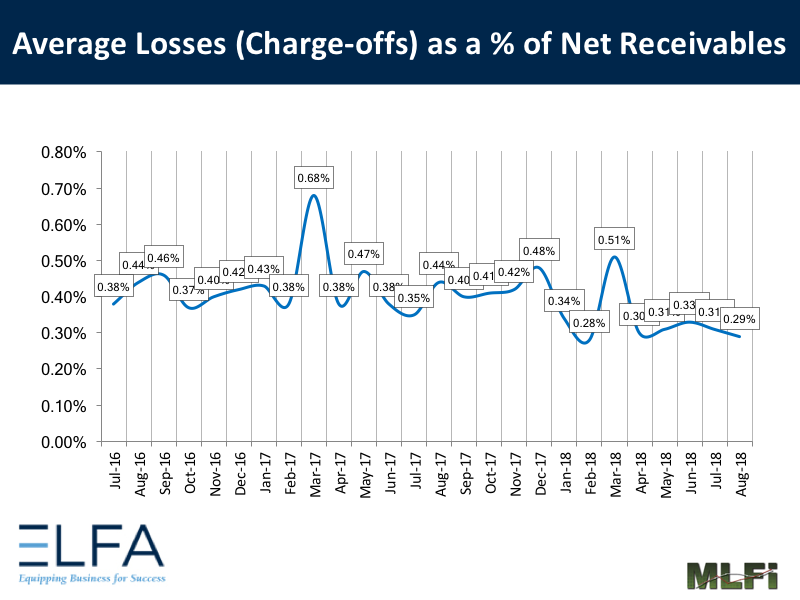

Receivables over 30 days were 1.90 percent, unchanged from the previous month and up from 1.50 percent the same period in 2017. Charge-offs were 0.29 percent, down from 0.31 percent the previous month, and down from 0.44 percent in the year-earlier period.

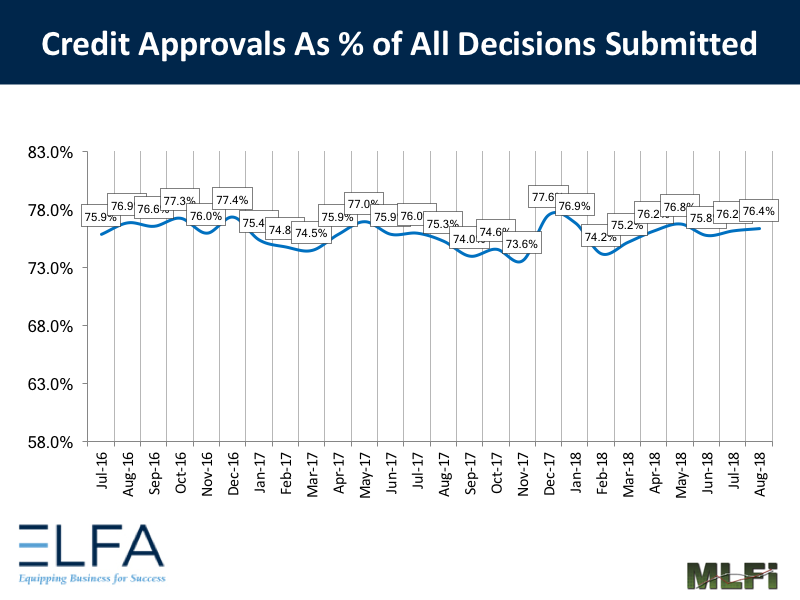

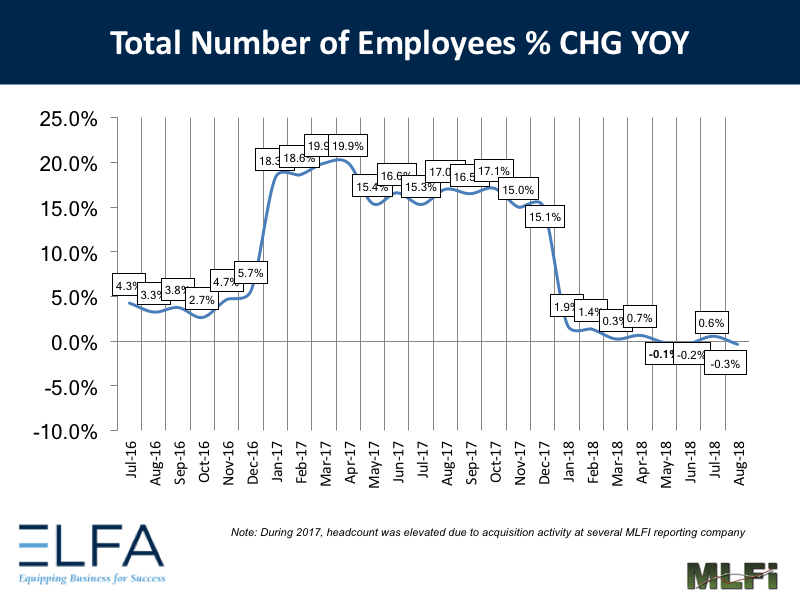

Credit approvals totaled 76.4 percent in August, up slightly from 76.2 percent in July. Total headcount for equipment finance companies was down 0.3 percent year over year. During 2017, headcount was elevated due to acquisition activity at an MLFI reporting company.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in September is 65.5, up from the August index of 60.7.

ELFA President and CEO Ralph Petta said, “Members report continued strong origination volume as the summer comes to a close. Fundamentals in the U.S. economy are favorable for capex investment by both large and small borrowers, and a number of asset classes and equipment verticals are benefiting. Steadily rising interest rates, a spate of disagreements with our trading partners and a powerful hurricane have seemingly little, to no, effect on the U.S. economy and its continued vitality.”

Mark Duncan, Executive Vice President and General Manager, Commercial Finance and Corporate Development, Hitachi Capital America Corp., said, “The August MLFI shows continued broad-based volume growth. However, economic headwinds may be appearing on the horizon; we expect these to impact specific sectors uniquely and not necessarily in the same timeframe. Accordingly, at Hitachi Capital America, along with many other ELFA members, we are executing a diversified strategy and continue monitoring our clients’ underlying fundamentals closely. It is our hope that the market works its way through any potential turbulence with minimal impact on both our clients and our industry.”

View the full list of participants