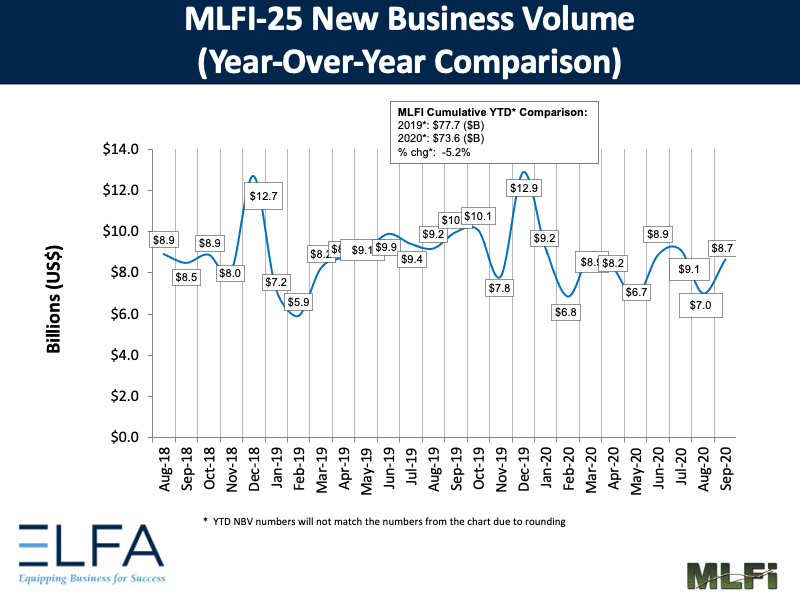

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for September was $8.7 billion, down 13 percent year-over-year from new business volume in September 2019. Volume was up 24 percent month-to-month from $7 billion in August. Year-to-date, cumulative new business volume was down 5 percent compared to 2019.

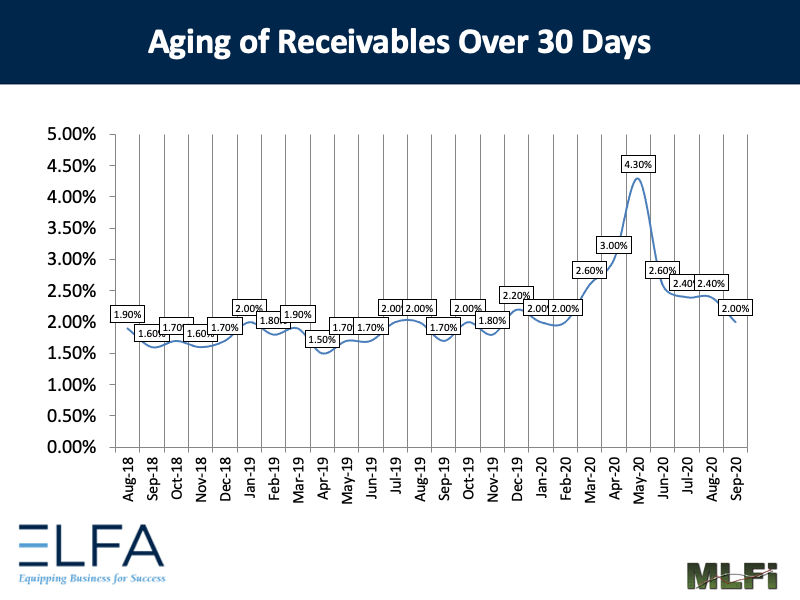

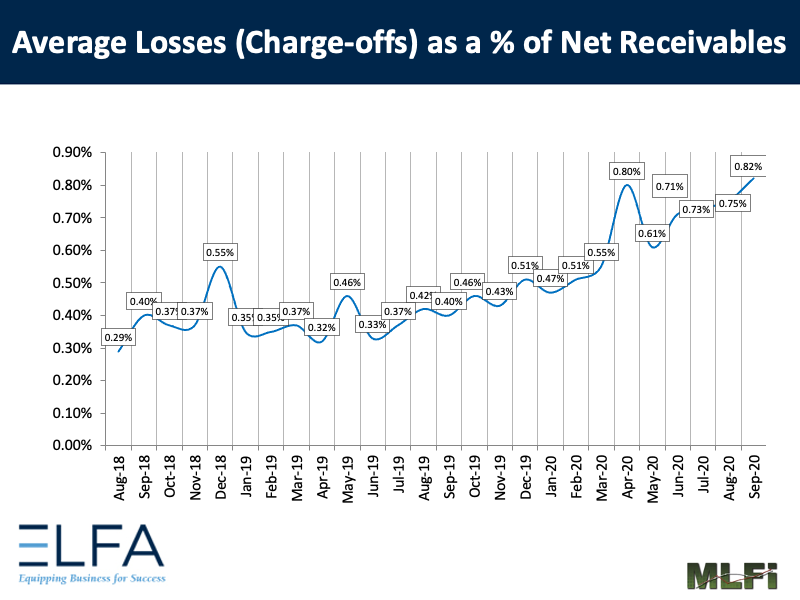

Receivables over 30 days were 2.00 percent, down from 2.40 percent the previous month and up from 1.70 percent the same period in 2019. Charge-offs were 0.82 percent, up from 0.75 percent the previous month and up from 0.40 percent in the year-earlier period.

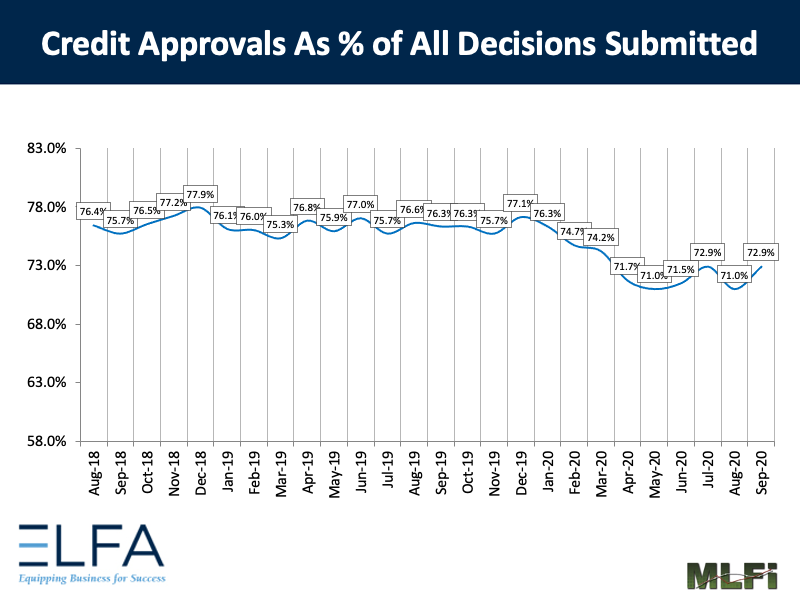

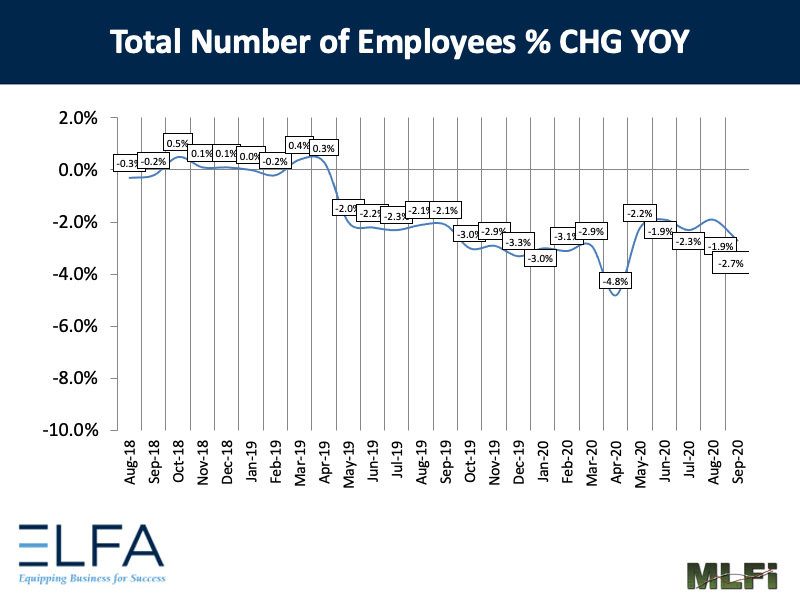

Credit approvals totaled 72.9 percent, up from 71.0 percent in August. Total headcount for equipment finance companies was down 2.7 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in October is 55.0, easing from the September index of 56.5.

ELFA President and CEO Ralph Petta said, “Despite the drop in September year-over-year new business, a look at the data beginning with the advent of the pandemic in February shows that the industry, in general, is holding its own. In fact, anecdotal evidence from some ELFA member companies indicates they are enjoying a very strong year. Tempering this positive data point, however, is a spike in losses—not surprising, given that the losses, in all likelihood, reflect customers in distressed industry sectors significantly impacted by the economic downturn resulting from the COVID pandemic.”

“The pandemic continues to have a negative impact on the overall economy, and this data demonstrates that our industry is not immune. However, the 24 percent growth in month-to-month volume in the September 2020 MLFI-25 is promising,” said Anthony Sasso, Head of TD Equipment Finance. “Within any disruption, there is opportunity. Here at TDEF, we have seen our customers find innovative ways to continue to grow, and we ourselves have been able to increase our portfolio. The low interest rate environment, combined with rising spot rates within trucking, presents a good opportunity for those companies who are in a position to expand.”

View the full list of participants