Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

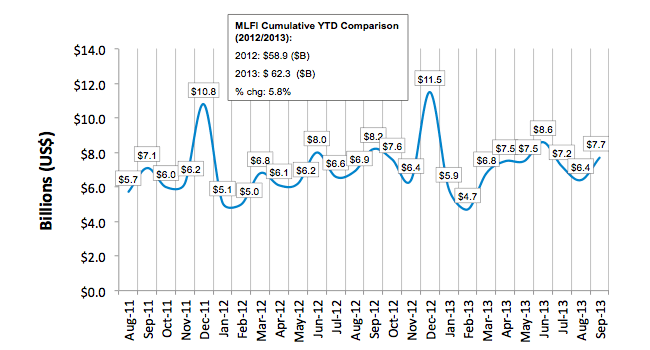

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $725 billion equipment finance sector, showed their overall new business volume for September was $7.7 billion, down 6 percent compared to volume in September 2012. Month-over-month, new business volume was up 20 percent from August. Year to date, cumulative new business volume increased 6 percent compared to 2012.

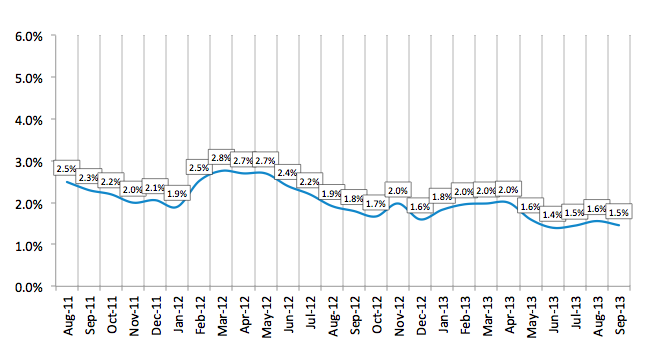

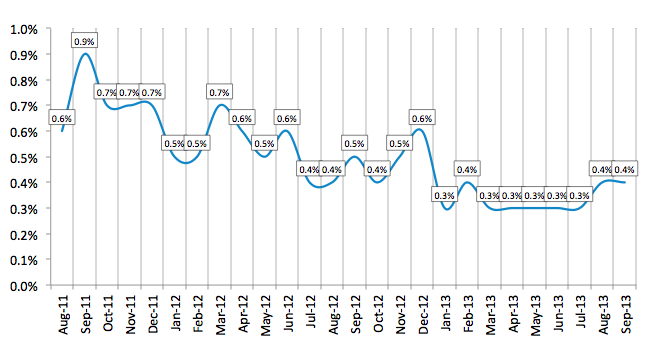

Receivables over 30 days were at 1.5 percent in September, down slightly from 1.6 percent in August. Delinquencies declined from 1.8 percent in the same period in 2012. Charge-offs were unchanged from August at 0.4 percent, and only slightly higher than the previous five months' all-time low of 0.3 percent.

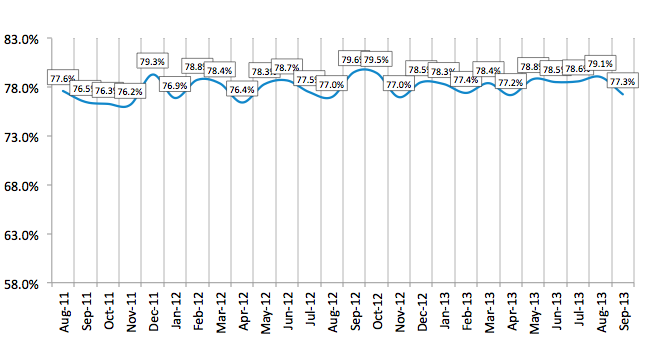

Credit approvals totaled 77.3 percent in September, down from 79.1 percent the previous month. Fifty-six percent of participating organizations reported submitting more transactions for approval during September, unchanged from the previous month.

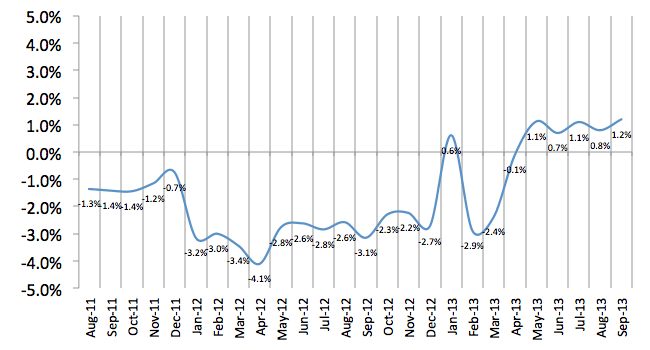

Finally, total headcount for equipment finance companies was up 1.2 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for October is 54.0, a decline from the September index of 61.3, demonstrating the negative impact of the federal government's budget response on an otherwise steady industry outlook.

ELFA President and CEO William G. Sutton, CAE, said: "September's year-over-year drop in new business volume seems to reflect a pull-back in corporate confidence in the U.S. economy spawned by the fiscal crisis in Washington. Uncertainty created by the inability of policy makers to come together to agree on sustained tax and spending policy is holding back the U.S. economy, and in particular, capital investment. The equipment finance industry and our members look forward to getting past this crisis and on with the business of supporting sound growth policies that stimulate capital formation, stabilize the capital markets, and, ultimately, strengthen our economy."

Daniel Krajewski, Vice President, Business Development, Direct Capital Corporation, said, "After an expected decline in the summer months there was a healthy rebound in activity in September, which exceeded the early Q2 spike. We remain cautiously optimistic about the continued growth in the sector and are encouraged to see that average delinquency metrics remain low. We believe that we will close out the year strong, but are consistently monitoring the economic and governmental issues that may impact demand."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP