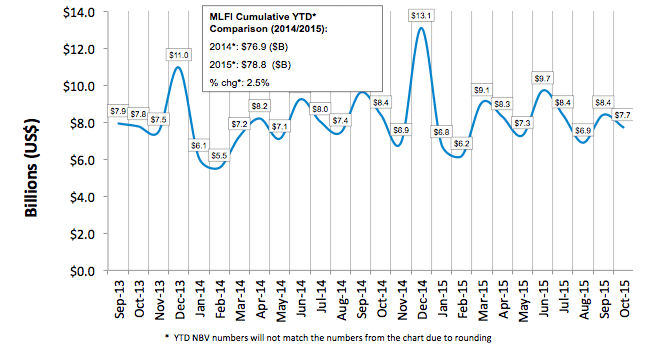

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1.046 trillion equipment finance sector, showed their overall new business volume for October was $7.7 billion, down 8 percent from new business volume in October 2014. Volume was down 8 percent from $8.4 billion in September. Year to date, cumulative new business volume increased 3 percent compared to 2014.

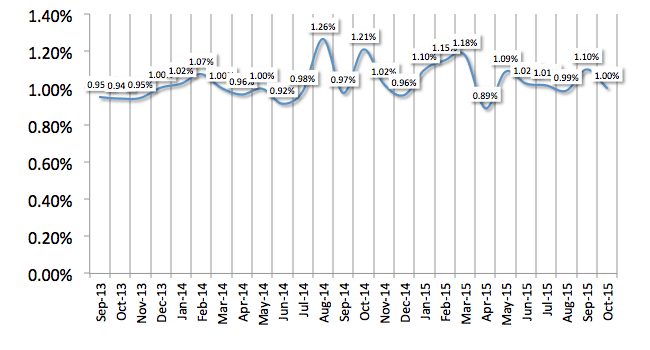

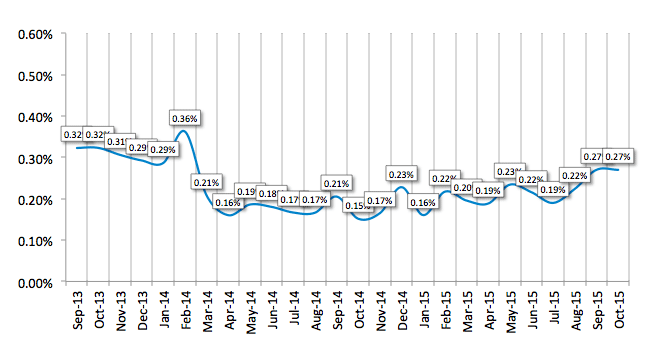

Receivables over 30 days were 1.0 percent, down from 1.1 percent the previous month and down from 1.26 percent in the same period in 2014. Charge-offs were 0.27 percent, unchanged from the previous month.

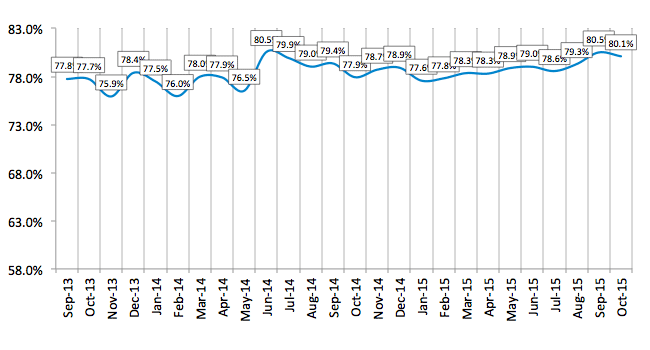

Credit approvals totaled 80.1 percent in October, down slightly from 80.5 percent in September. Total headcount for equipment finance companies was up 5 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for November is 60.2, an increase from the previous month's index of 58.7.

ELFA President and CEO William G. Sutton, CAE, said, "Performance in the equipment finance market was mixed in October: new business volume weakened somewhat—both in terms of the month- and year-earlier periods—while portfolio quality remained steady. Some members report a softening in the demand side of the business and it remains to be seen whether and to what extent the specter of rising interest rates will impact the sector."

Anthony Cracchiolo, President and CEO, U.S. Bank Equipment Finance, said, "The markets continue to grow marginally year over year which is favorable. This points to a positive-leaning economy that also shows considerable inconsistency. Credit quality remains strong and at historical levels and the industry is well positioned for solid growth as the economy expands."

:: View the full list of participants

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

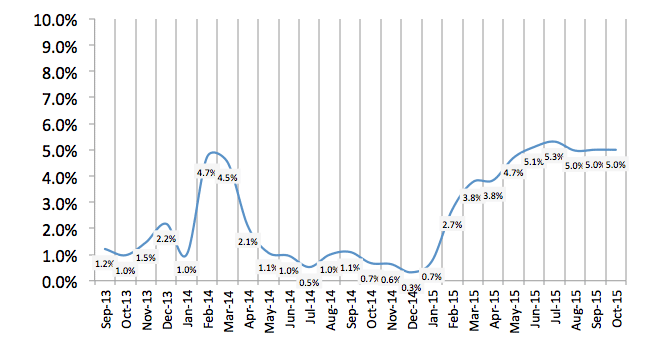

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP