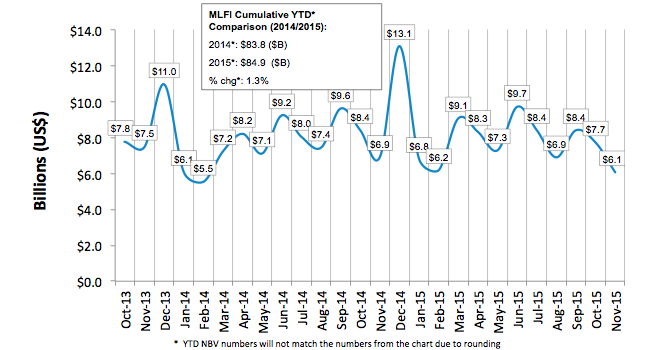

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for November was $6.1 billion, down 12 percent from new business volume in November 2014. Volume was down 21 percent from $7.7 billion in October. Year to date, cumulative new business volume increased 1 percent compared to 2014.

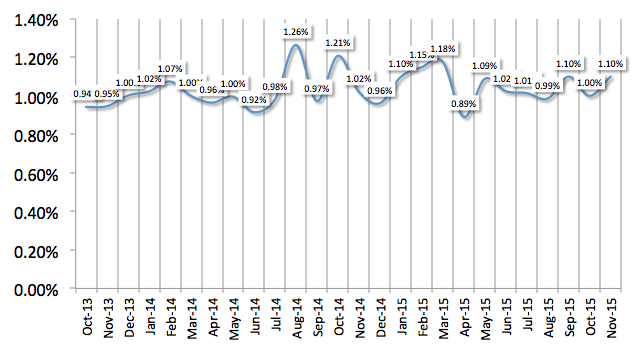

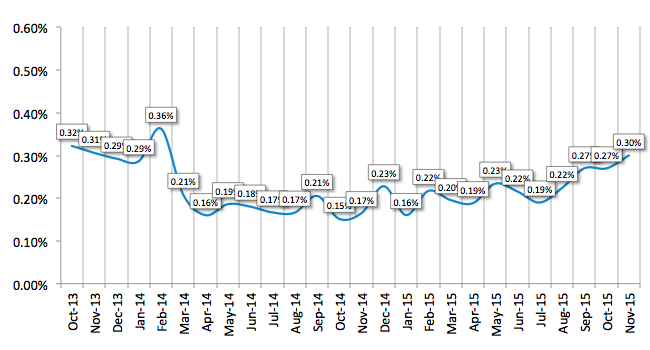

Receivables over 30 days were 1.1 percent, up from 1.0 percent the previous month and up from 1.02 percent in the same period in 2014. Charge-offs were 0.30 percent, up from 0.27 the previous month.

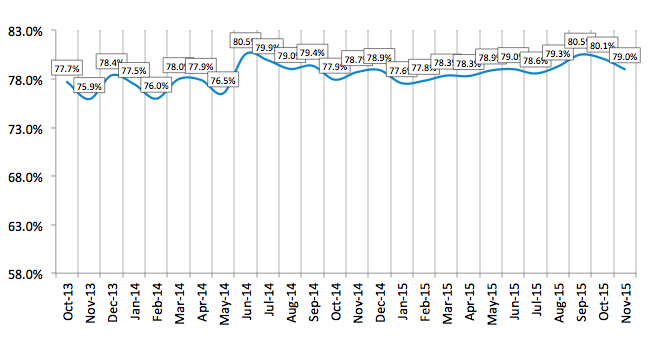

Credit approvals totaled 79.0 percent in November, down slightly from 80.1 percent in October. Total headcount for equipment finance companies was up 4.7 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for December is 60.2, unchanged from last month's index.

ELFA President and CEO William G. Sutton, CAE, said, "Volume in the equipment finance sector, with some exceptions, continued to slow, reflecting a pull-back in consumer spending and business investment during the second half of the year. Credit quality is beginning to move off its historic lows, as some sectors including energy, mining and related industries continue to weaken. With one month left in the year—typically, a strong period for the equipment finance business—it remains to be seen whether total volume for 2015 remains in positive territory. Also to be monitored is the impact of slowly rising interest rates on industry performance as we move into the new year."

Edward Hetherington, President, Doosan Infracore Financial Solutions, said, "Our core business remains strong and up over 10% for the year. Portfolio performance continues to remain at historic lows. Leasing business continues to grow and used equipment values remain strong."

:: View the full list of participants

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

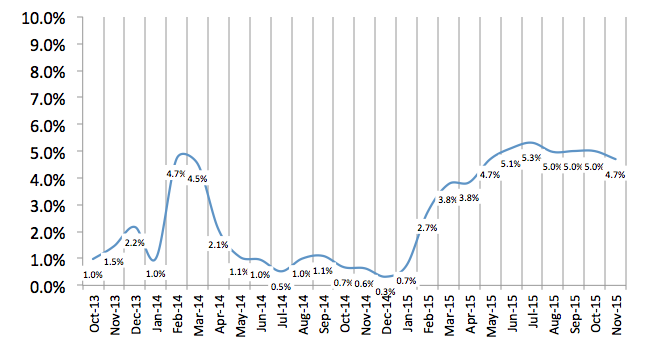

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP