Participants in the ELFA MLFI-25:

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- Dell Financial Services

- Direct Capital Corporation

- DLL

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SSunTrust Robinson Humphrey

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

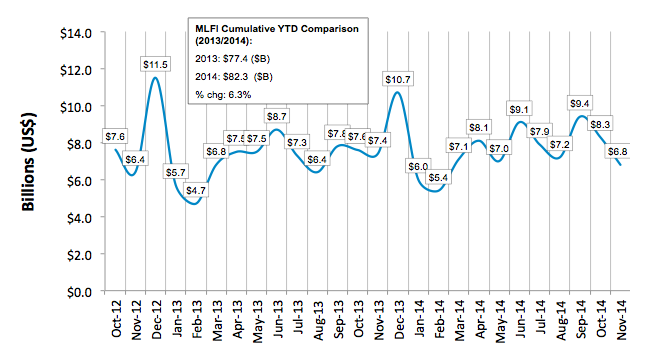

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $903 billion equipment finance sector, showed their overall new business volume for November was $6.8 billion, down 8 percent from new business volume in November 2013. Month over month, new business volume was down 18 percent from October. Year to date, cumulative new business volume increased 6 percent compared to 2013.

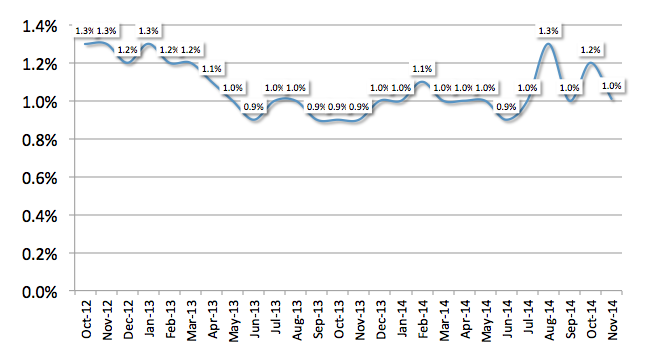

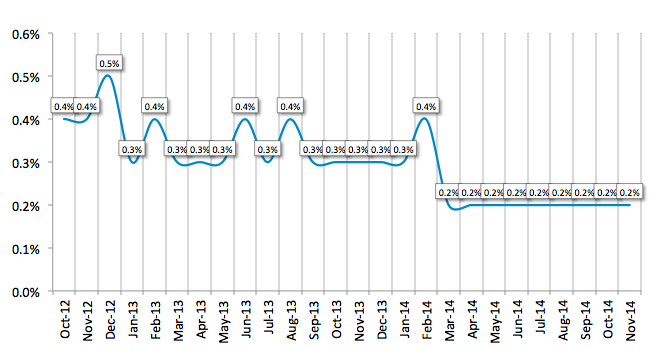

Receivables over 30 days decreased from the previous month to 1 percent, and were up from 0.9 percent in the same period in 2013. Charge-offs were unchanged for the eighth consecutive month at an all-time low of 0.2 percent.

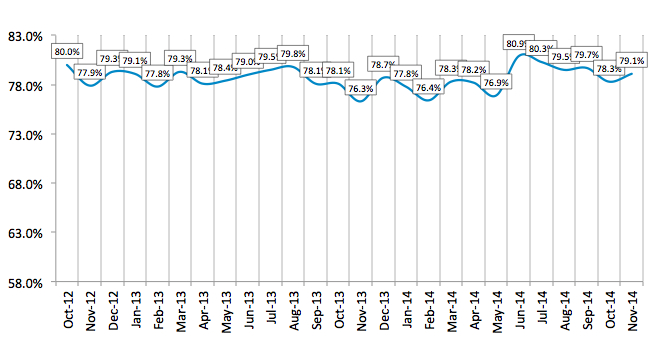

Credit approvals totaled 79.1 percent in November, an increase from 78.3 percent the previous month. Total headcount for equipment finance companies was up 0.7 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for December is 63.4, steady with the November index of 64.2.

ELFA President and CEO William G. Sutton, CAE, said: "The equipment finance sector has showed the kind of volatility experienced in other financial markets during this quarter. While new business volume dipped in November, member organizations' portfolios continue to perform well, indicating a healthy business sector. Liquidity continues to be plentiful, making for a hyper-competitive marketplace. Continued favorable pricing in the sector should provide a healthy environment for businesses—small and large—to make equipment investment decisions so necessary to run their business operations, add employees to their payrolls, and contribute to the overall health of the U.S. economy."

Scott Rafkin, President, Volvo Financial Services, said, "The MLFI-25 performance metrics for November indicate a favorable business environment. Strong originations and solid portfolio performance, together with stable customer delinquencies, all point to a continued good performance in the equipment finance sector as we close 2014 and enter into 2015. Volvo Financial Services is benefiting from a generally steady economic recovery in most of our global markets, highlighted by a very strong North America. Overall, I'm pleased with how the equipment finance industry performed this month and thus far in 2014."

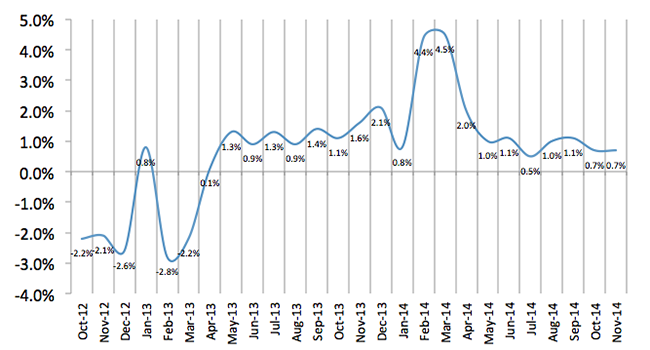

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP