Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Equipment Finance, a City National Bank Company

- First American Equipment Finance

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

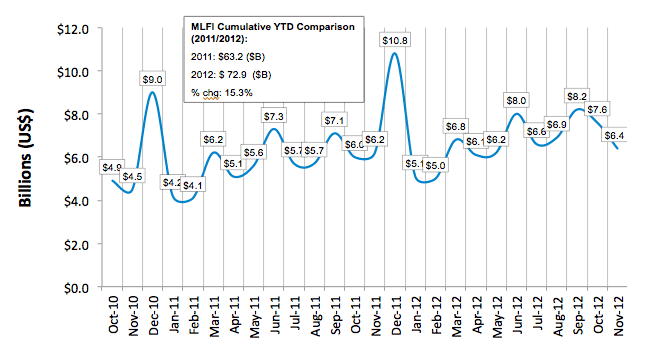

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $725 billion equipment finance sector, showed their overall new business volume for November was $6.4 billion, up 3 percent from volume of $6.2 billion in the same period in 2011. Their volume was down 16 percent from the previous month, and their year-to-date cumulative new business volume increased 15 percent.

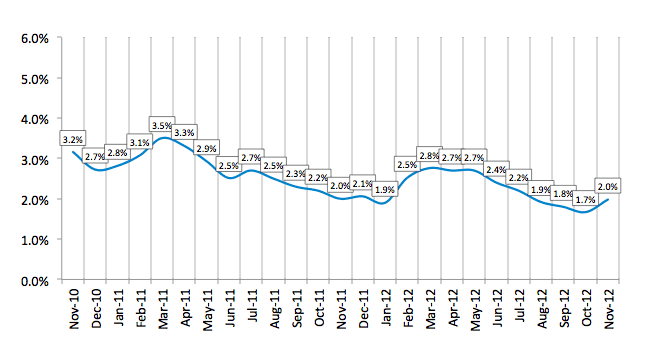

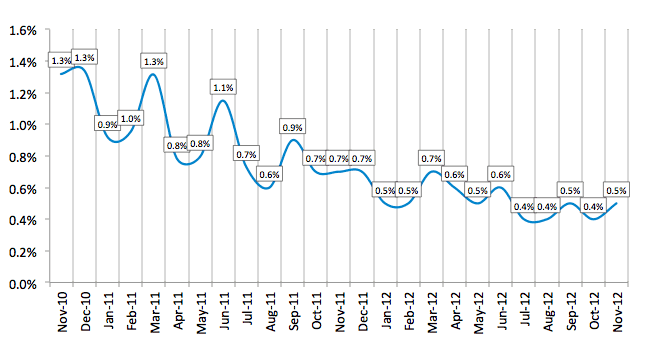

Receivables over 30 days increased for the first time in six months to 2.0 percent, up from 1.7 percent in October, and they were unchanged when compared to the same period in 2011. Charge-offs were up from the previous month at 0.5 percent, and down by 28.6 percent compared to the same period last year.

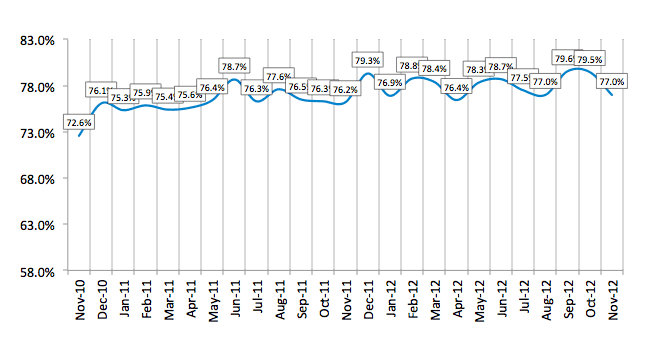

Credit approvals totaled 77.0 percent in November, down from 79.5 percent in October. Forty-six percent of participating organizations reported submitting more transactions for approval during November, down from 66 percent the previous month.

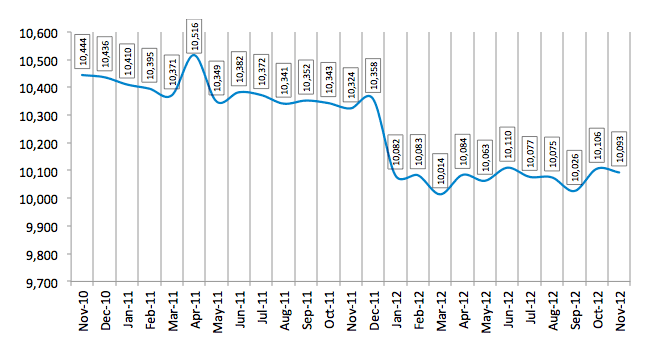

Finally, total headcount for equipment finance companies was down 1 percent from the previous month, and declined 2 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for December is 48.5, a decrease from the November index of 49.9, reflecting industry participants' concerns regarding the impact of fiscal issues on capital expenditures, despite an overall sense of optimism in the equipment finance industry.

ELFA President and CEO William G. Sutton, CAE, said: "New business volume in the equipment finance sector of the U.S. economy continues to show slow, but steady, growth. Credit quality and portfolio performance also trend positively as delinquencies and losses remain under control for MLFI-25 respondents. We are hopeful that, as recent 'fiscal cliff' negotiations between the White House and the Congress seem to be entering a decisive phase, businesses will interpret this as a sign that the economy gradually will pick up steam and is poised for a more robust recovery. Only with a confident business sector will the equipment finance marketplace thrive and, indeed, expand, as investment spending strengthens going forward."

Tony Golobic, Chairman and CEO, GreatAmerica Financial Services, said, "For much of the year, we at GreatAmerica Financial Services had experienced a solid increase in our overall commercial equipment lease volume from throughout the country; however, as we edged our way into the fourth quarter we began to feel the effects of the lack of clarity in Washington regarding the budget deficit. Without question, concerns about the ballooning budget deficit and the resulting lack of tax clarity are causing indecision related to new capital expenditures within the business community. While cautiously optimistic with respect to the underlying economy, we certainly need to have greater clarity on the new tax structure and where the spending cuts will be positioned. To the extent there is some business-friendly clarity, I believe we will see a return to the type of growth we had seen earlier in the year."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP