Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

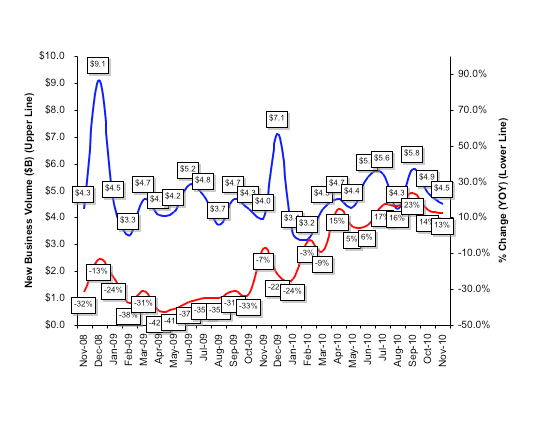

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for November was $4.5 billion, up 13 percent compared to the same period in 2009, but down 8.0 percent from October's volume of $4.9 billion.

Year-to-date new business volume is $50.6 billion, up 6.5 percent compared to the cumulative year-to-date total from 2009.

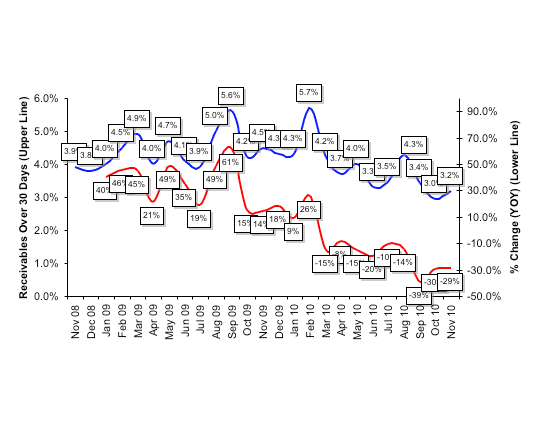

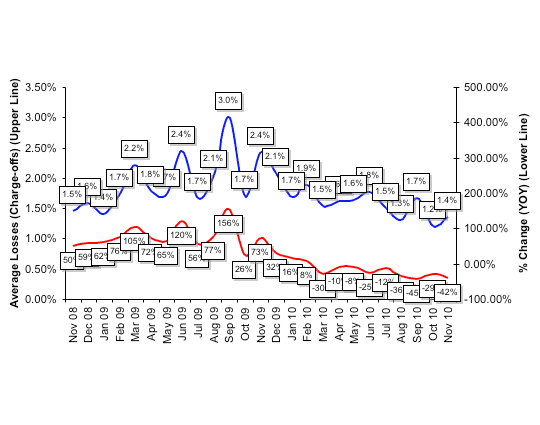

Credit quality is mixed. Receivables over 30 days increased to 3.2 percent in November from 3.0 percent in October, which was the lowest level in two years. Receivables over 30 days decreased by 29 percent in November 2010 compared to the same period in 2009. Losses increased to 1.4 percent in November, up from 1.2 percent in the prior month. But, these losses declined dramatically when compared to the year-earlier period.

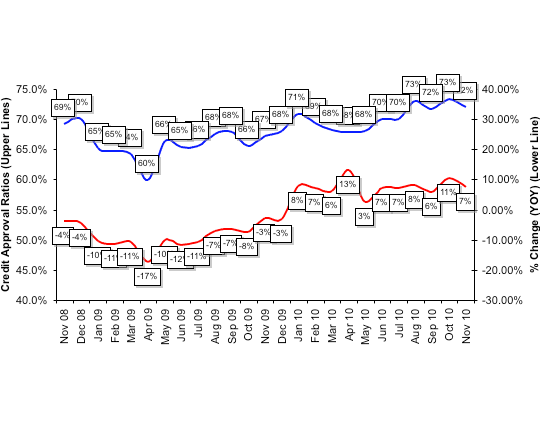

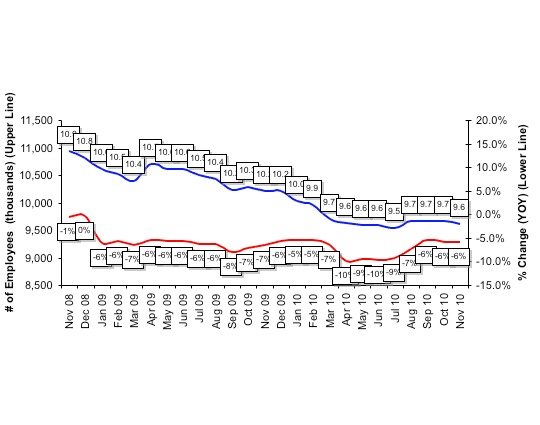

Credit approvals decreased a percentage point to 72 percent in November, but remained fairly consistent when compared to the prior several months. Seventy-three percent of participating organizations reported submitting more transactions for approval during the month, also one percentage point off from the high mark of the last two years. Finally, total headcount for equipment finance companies was virtually flat from October to November. Supplemental data shows that construction and small and medium-sized businesses again led the underperforming sectors from October to November.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for December is 64.8, a decrease from 65.5 in November. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA president William G. Sutton said, "The data continue to show an uneven recovery for the equipment finance business. While total volume is up, portfolio quality still is a concern for some ELFA members."

"We are beginning to see signs of growing pipelines and a strengthening in fourth quarter bookings that combine to foster increased optimism heading into 2011," said Kenneth A. Turner, President and CEO, SunTrust Equipment Finance & Leasing Corp., located in Towson, MD. "New business volume appears to be most robust in the areas of trucking, technology and healthcare. Competition is evident, creating nominal downward pressure on margin, and there is still a bias toward stronger credits. Economic, political, regulatory, and accounting standard uncertainty are causing corporations to maintain cash reserves at record levels and combining to slow the pace of growth."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP