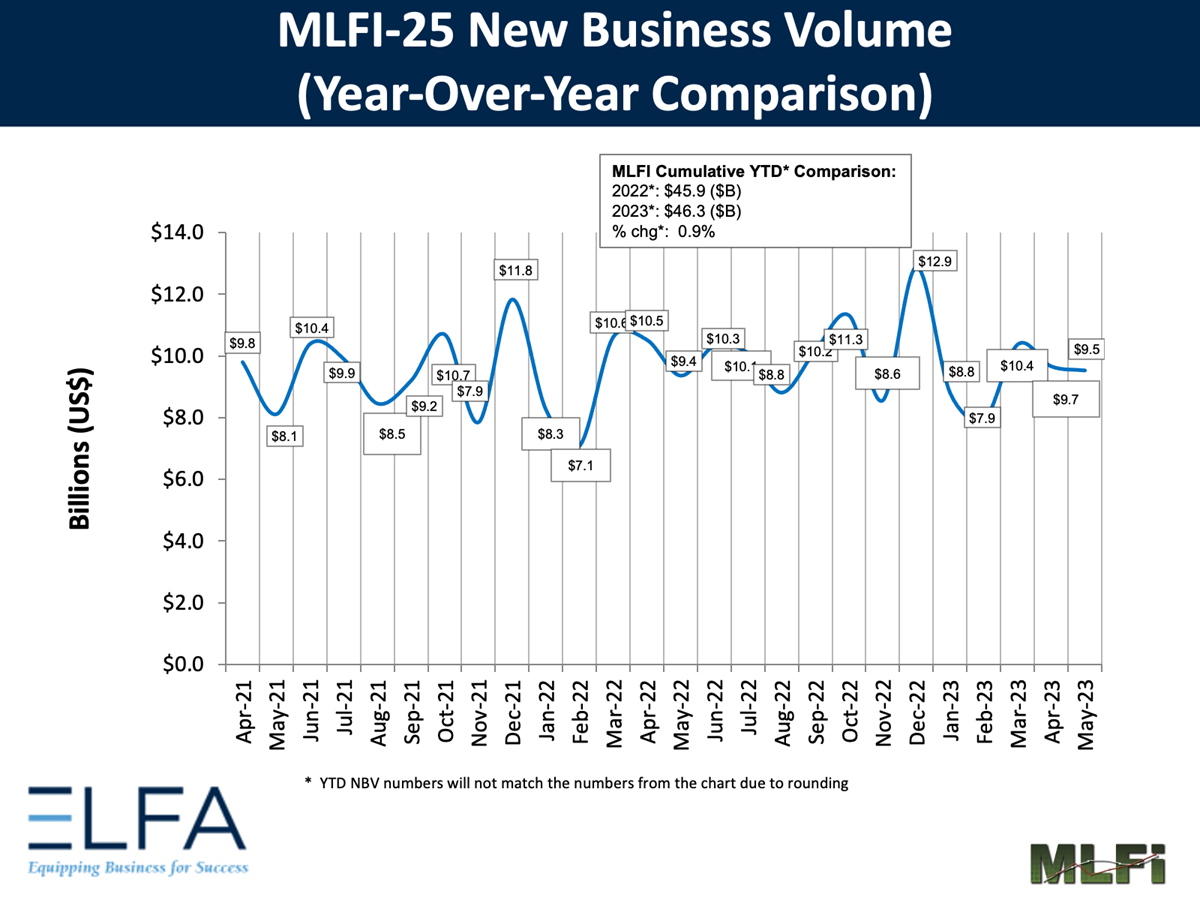

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for May was $9.5 billion, up 1 percent year-over-year from new business volume in May 2022. Volume was down 2 percent from $9.7 billion in April. Year-to-date, cumulative new business volume was up 0.9 percent compared to 2022.

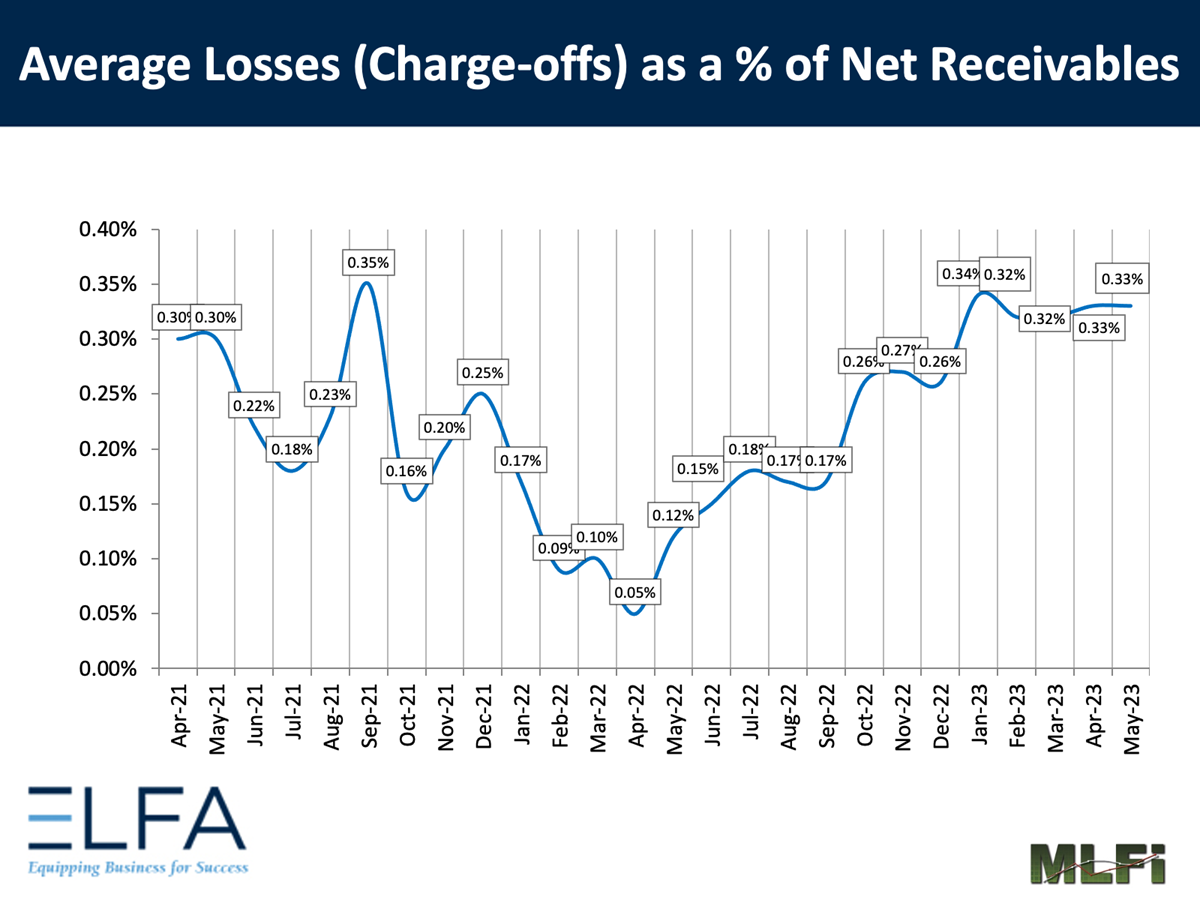

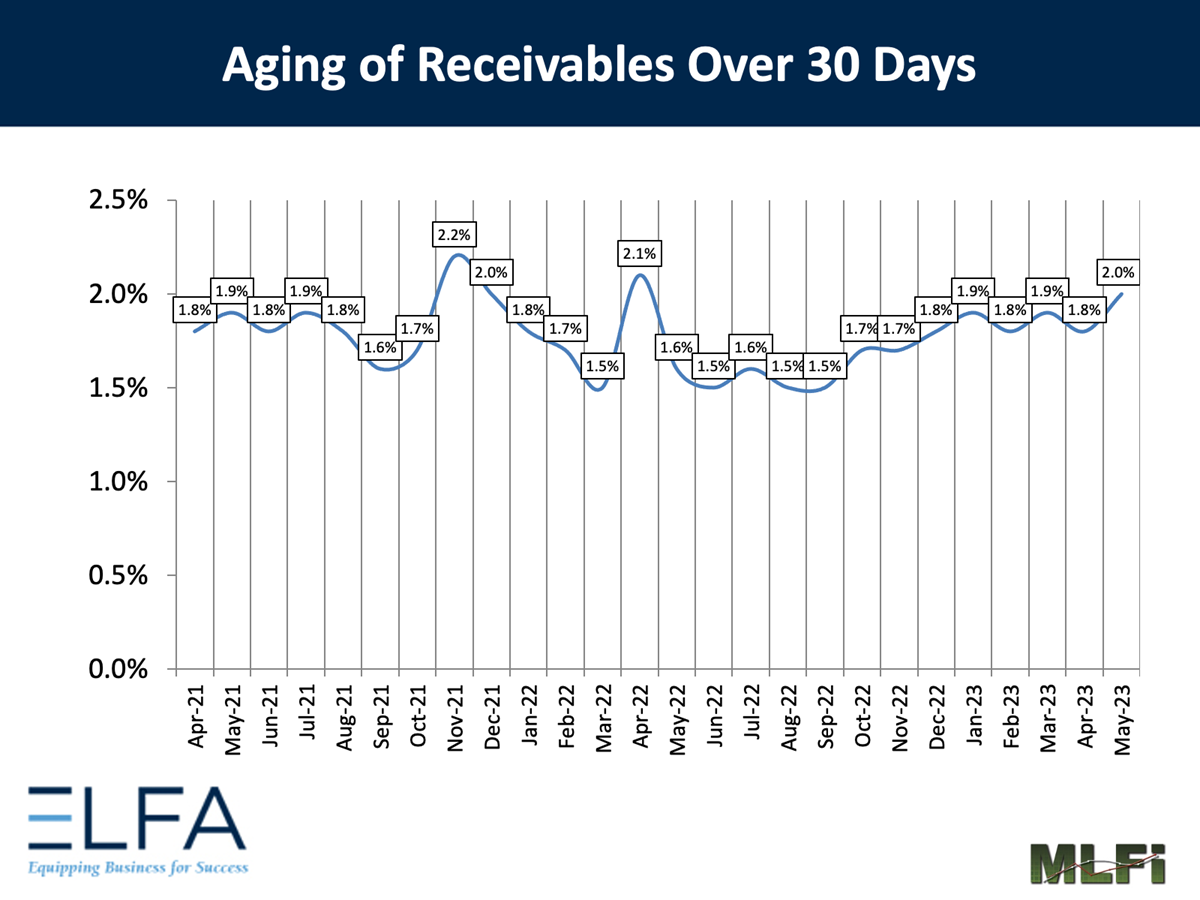

Receivables over 30 days were 2.0 percent, up from 1.8 percent the previous month and up from 1.6 percent in the same period in 2022. Charge-offs were 0.33 percent, unchanged from the previous month and up from 0.12 percent in the year-earlier period.

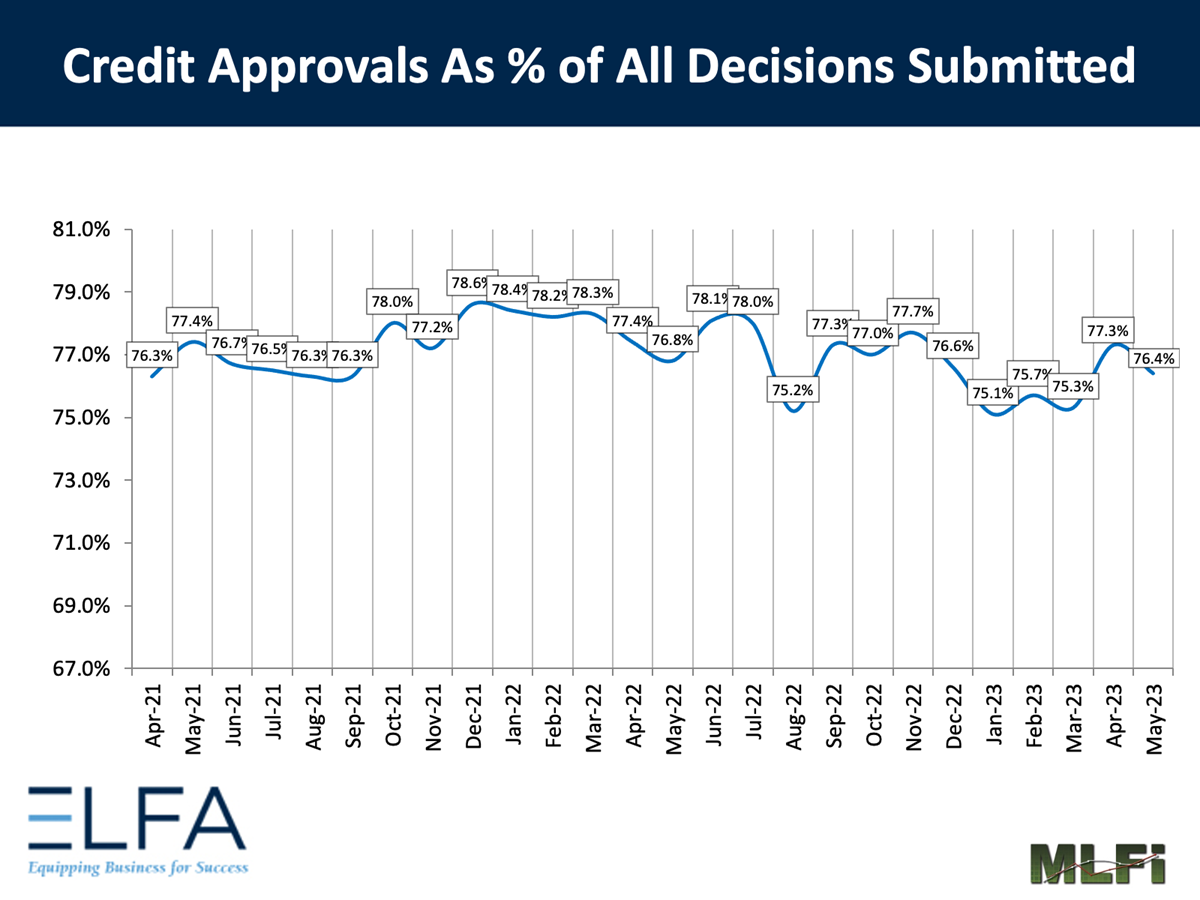

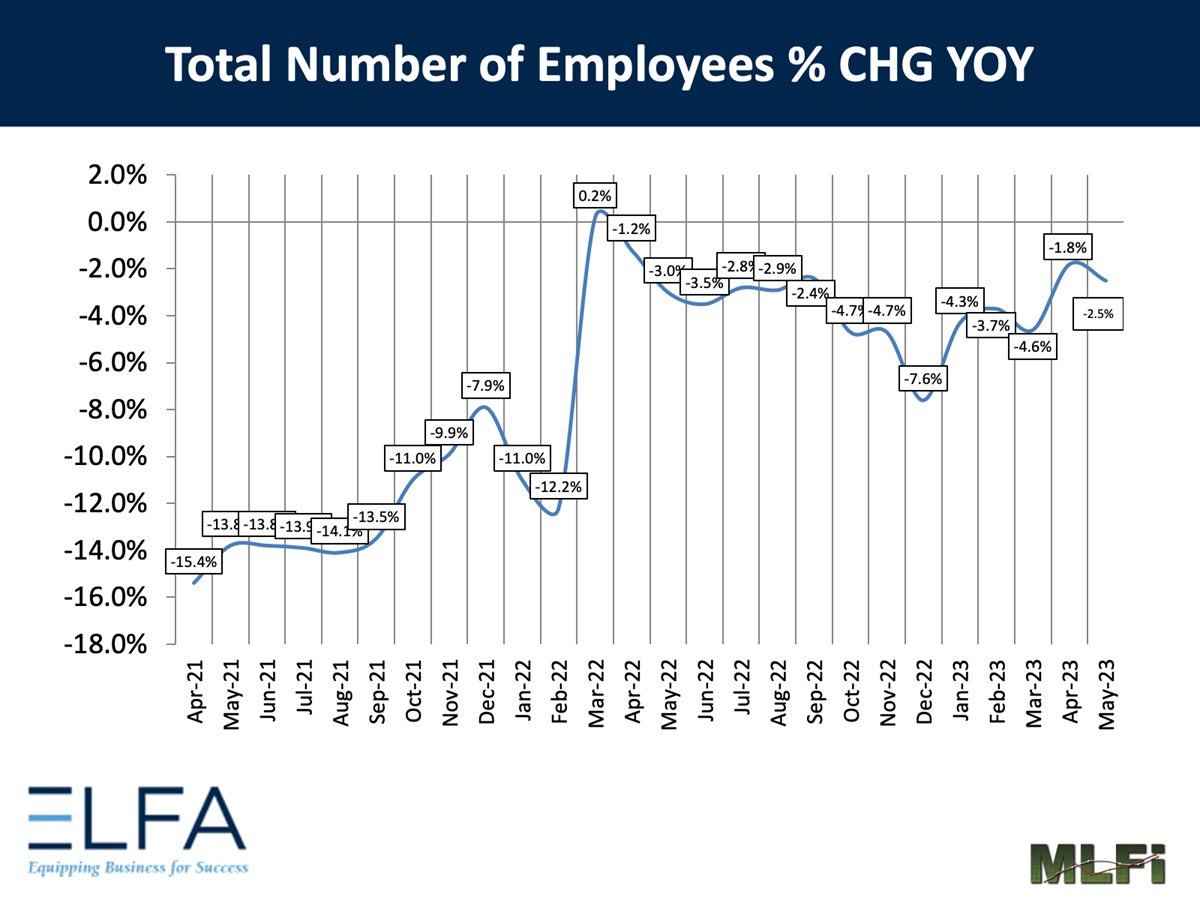

Credit approvals totaled 76.4 percent, down from 77.3 percent in April. Total headcount for equipment finance companies was down 2.5 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in June is 44.1 an increase from the May index of 40.6.

ELFA President and CEO Ralph Petta said, “MLFI respondents show steady new business volume for the month of May. As the Fed puts a pause on interest rate hikes and the U.S. economy refuses to accede to a recession—at least for the time being—equipment finance companies continue to do what they do best, i.e., provide the necessary capital for businesses to grow and prosper. A number of equipment finance executives polled recently have expressed a sense of heightened optimism that the industry will continue to show steady growth, at least in the near term.”

Daryn Lecy, Vice President and Chief Operating Officer, Oakmont Capital Services, said, “We are cautiously optimistic about the stability of the economy based on both the recent indicators and what continues to be resilient demand from businesses. The tightened liquidity remains a concern, but we have seen some small signs of localized stabilization with previously shy banks and finance companies slowly showing interest in exploring equipment finance assets. Our industry provides great support during these times by continuously thinking creatively, remaining nimble, and finding niches and opportunities as they arise.”

View the full list of participants