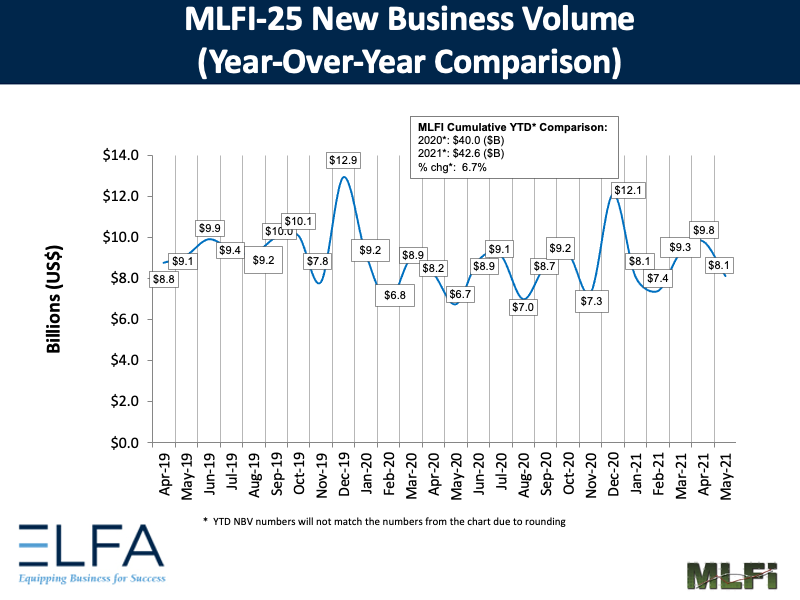

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for May was $8.1 billion, up 20 percent year-over-year from new business volume in May 2020. Volume was down 17 percent month-to-month from $9.8 billion in April. Year-to-date, cumulative new business volume was up nearly 7 percent compared to 2020.

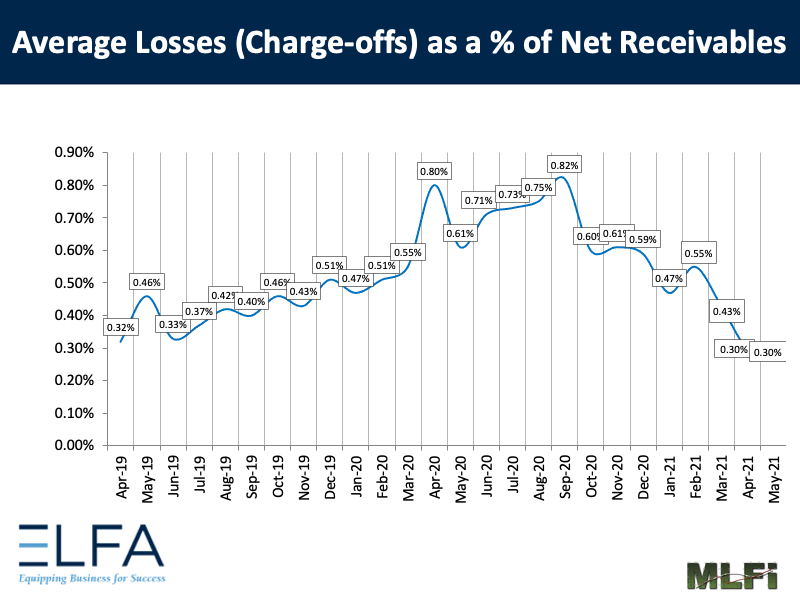

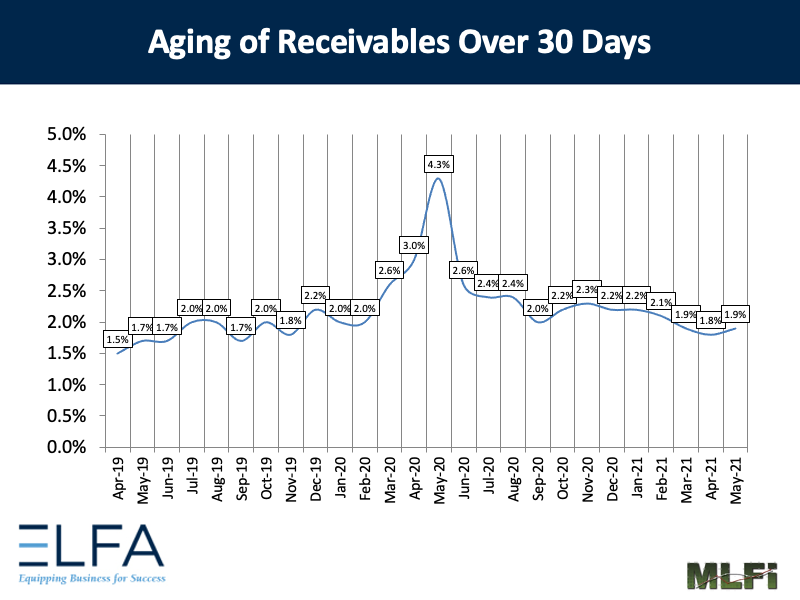

Receivables over 30 days were 1.9 percent, up from 1.8 percent the previous month and down from 4.3 percent in the same period in 2020. Charge-offs were 0.30 percent, unchanged from the previous month and down from 0.61 percent in the year-earlier period.

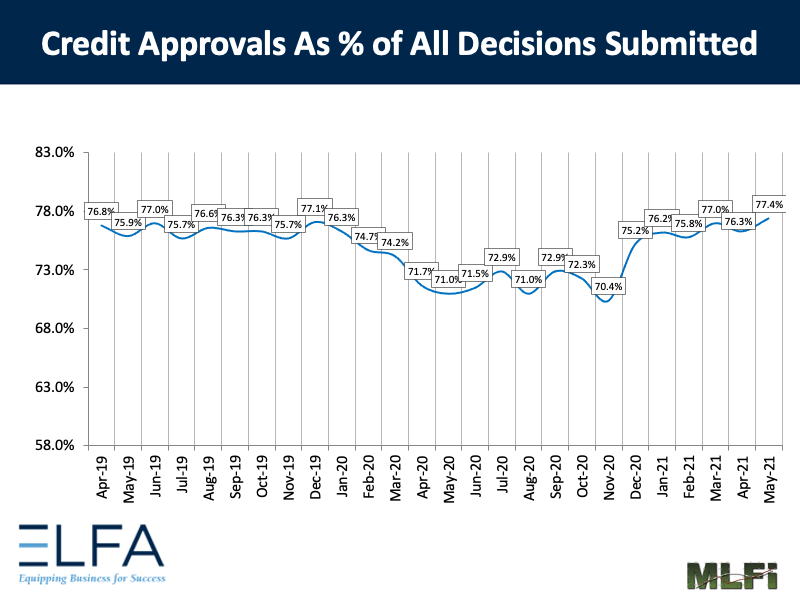

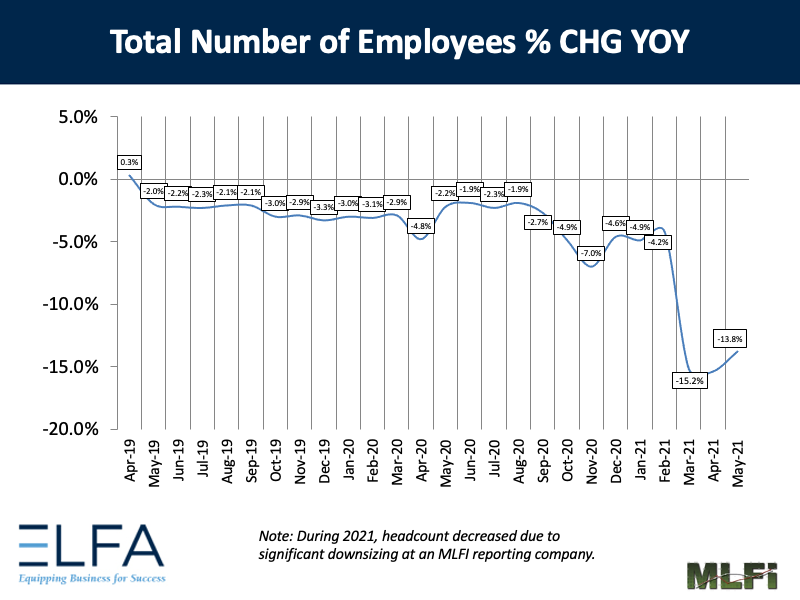

Credit approvals totaled 77.4 percent, up from 76.3 percent in April. Total headcount for equipment finance companies was down 13.8 percent year-over-year, a decrease due to significant downsizing at an MLFI reporting company.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in June is 71.3, steady with the May index of 72.1.

ELFA President and CEO Ralph Petta said, “Solid May new business volume growth, put in perspective, compares favorably to a low y-o-y base when the pandemic was raging at the beginning of the summer last year. While overall industry performance is relatively strong during the first half of this year, even more robust demand for financing is being constrained by supply chain shortages in several economic subsectors. And, with covid-related payment modifications resolved for the most part, ELFA members report their portfolios performing well.”

Jeffrey Walker, CEO, CIMC Capital, said, “Customer requests for loans and finance leases are strong with demand for our manufactured products (trailers and containers) at all-time highs. Economic conditions for transportation equipment are robust, driving customers to expand their fleets. Current headwinds continue to be supply chain shortages and shipping delays. The trend in these conditions and headwinds seem likely to continue for the foreseeable future.”

View the full list of participants