Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SunTrust Robinson Humphrey

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

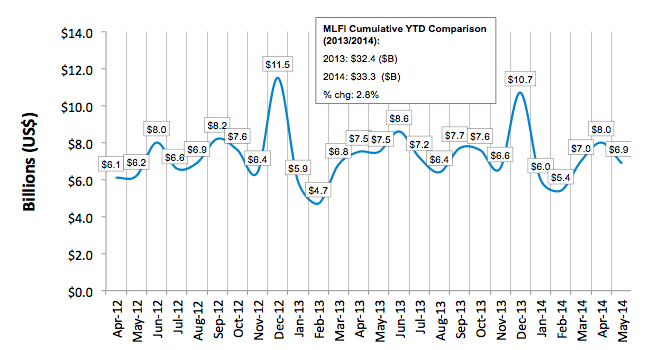

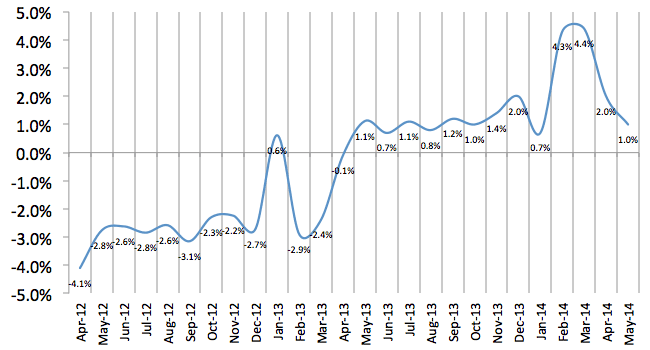

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $827 billion equipment finance sector, showed their overall new business volume for May was $6.9 billion, down 8 percent from new business volume in May 2013. Month-over-month, new business volume was down 14 percent from April. Year to date, cumulative new business volume increased 3 percent compared to 2013.

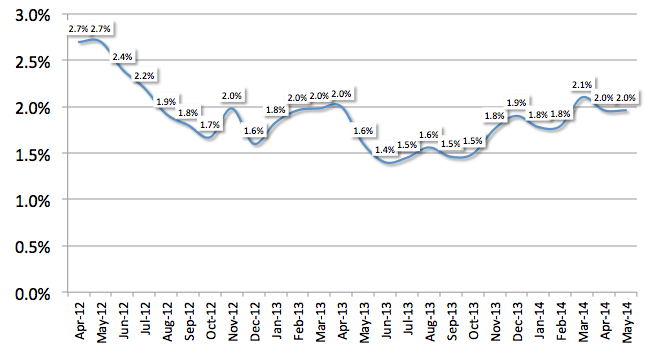

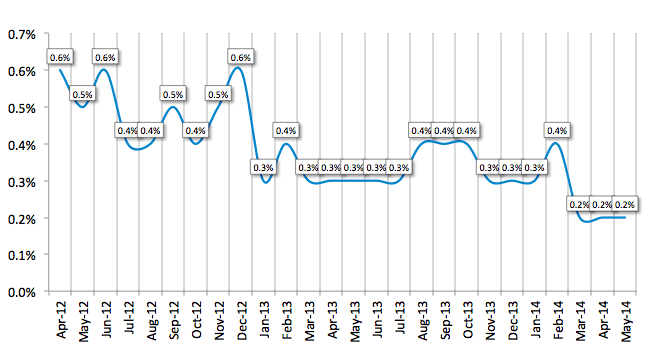

Receivables over 30 days were unchanged from the previous month at 2.0 percent, and were up from 1.6 percent from the same period in 2013. Charge-offs were unchanged from the previous two months at an all-time low of 0.2 percent.

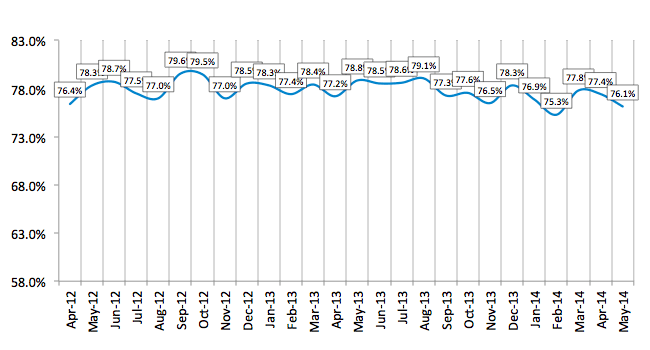

Credit approvals totaled 76.1 percent in May, a decrease from 77.4 percent the previous month. Total headcount for equipment finance companies was up 1.0 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for June is 61.4, an easing from three consecutive months of two-year high levels which topped at 65.4.

ELFA President and CEO William G. Sutton, CAE, said: "The small decline in new business volume makes the case for a slow recovery in certain sectors of the economy in which equipment financing plays an important role. As noted previously, the momentum created by monthly increases in equipment financings on a consistent basis will be difficult to maintain, particularly as certain segments of the U.S. economy try to regain their footing from the economic downturn experienced a few years ago. It is important to note, however, that cumulative new business volume is still up for the year."

Daniel McKew, President, Capital One Equipment Finance, said, "While you could look at the collective data reported for the month of May and conclude that there may be an across the board easing in equipment finance, it is so modest that I see it as a minor pause in preparation for the final half of the year that naturally produces more velocity. I am also very encouraged that the Fed's continued quantitative easing could impact interest rates. Even a modest rise will help the market balance, allow it to arbitrage and create increased velocity."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP