Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Tygris Vendor Finance

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

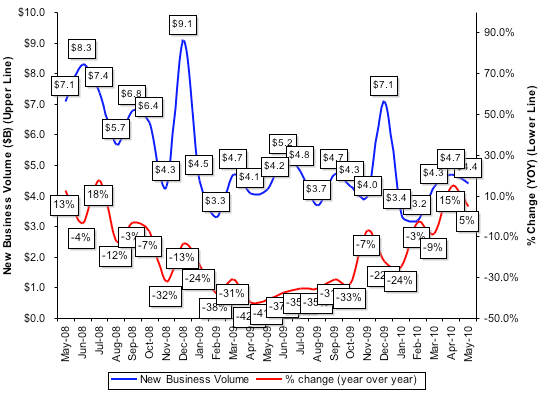

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $518 billion equipment finance sector, showed overall new business volume for May increased five percent when compared to the same period in 2009. When compared to the prior month, the MLFI-25 reported new business volume decreased by six percent, from $4.7 billion to $4.4 billion. Only 28 percent of the MLFI participants reported a year-over-year decline in new business volume in May 2010.

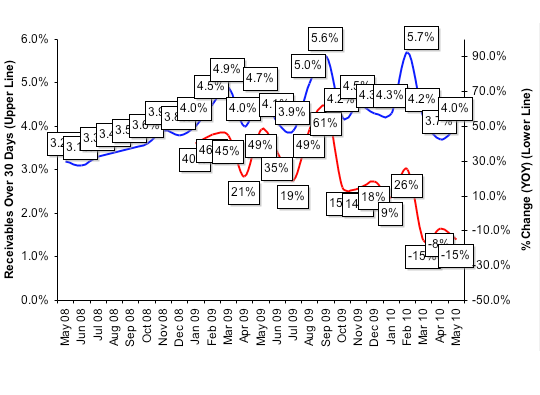

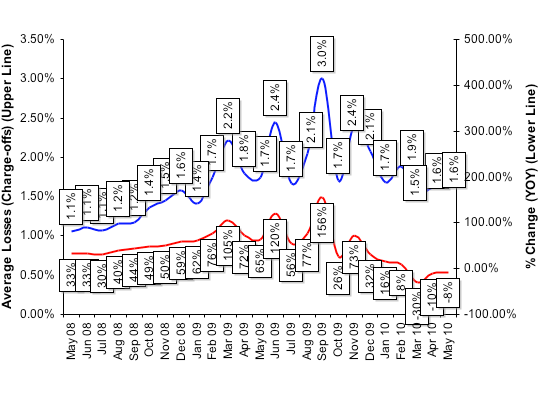

Delinquencies increased slightly from the previous month, but showed significant improvement compared to the year-earlier period. Charge-offs also improved, from 1.7 percent in May 2009 to 1.6 percent in May 2010.

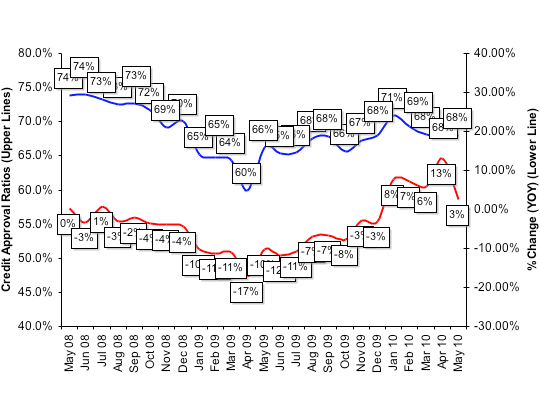

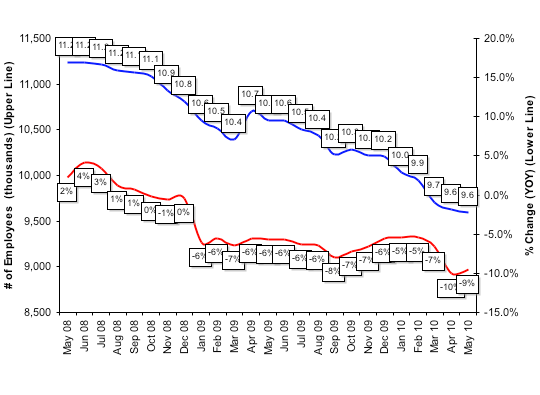

Credit approvals remained flat at 68 percent when compared to the prior month, but were up slightly compared to the same period the prior year. Total headcount for equipment finance companies remained flat in the April-May period, but showed a significant drop from May 2009.

According to a CFO Survey conducted by Duke University, respondents forecasted stronger capital spending in the next 12 months. According to the survey, hiring and borrowing conditions continue to remain tight in the near future.

A related index, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI), for June was at 65.0, down from the May 2010 index of 67.4. "While new business volume was somewhat sluggish early in the year, we are seeing a significant increase in pipeline activity during the second quarter," said Larry Smilie, Managing Director, Banc of America Leasing. "Overall, we continue to see 2010 as a challenging year which for us will require disciplined origination and increased market coverage to overcome weaker than expected demand."

"Despite a modest growth spurt in new business volume in May, the data reflect what most economists recognize: a slowly recovering economy and somewhat soft demand by business for capital equipment," said William G. Sutton, ELFA President. "But the trend appears to be heading in the right direction."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP