Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

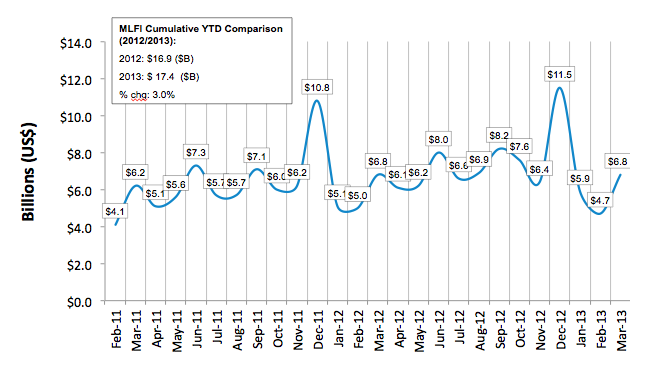

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $725 billion equipment finance sector, showed their overall new business volume for March was $6.8 billion, flat compared to volume in March 2012. Month-over-month, new business volume was up 45 percent from February. Year to date, cumulative new business volume was up three percent compared to 2012.

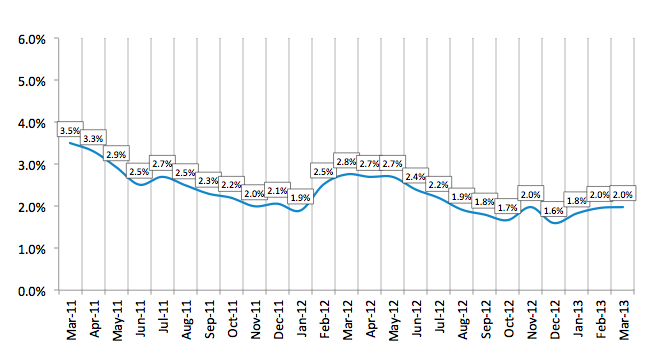

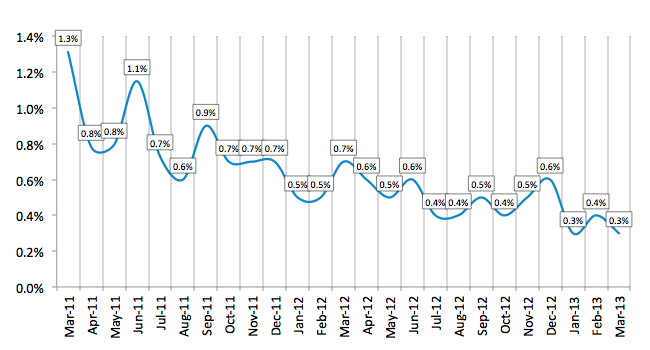

Receivables over 30 days were unchanged in March from the previous month at 2.0 percent. They were down from 2.8 percent in the same period in 2012. Charge-offs were down slightly, returning to the all-time low of 0.3 percent from 0.4 percent in February.

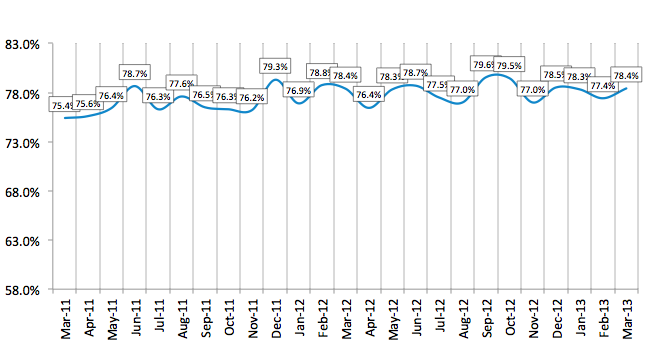

Credit approvals totaled 78.4 percent in March, up 1 percent from February. Fifty percent of participating organizations reported submitting more transactions for approval during March, down from 53 percent the previous month.

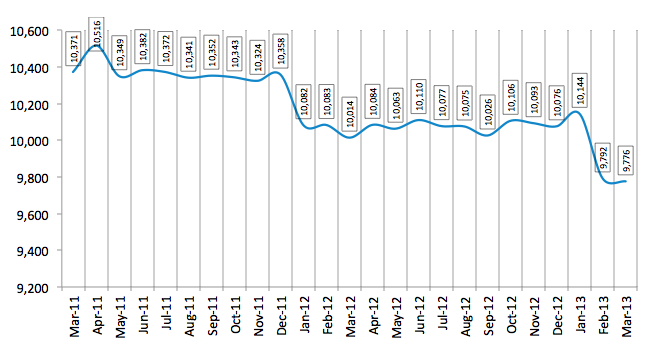

Finally, total headcount for equipment finance companies was relatively unchanged from the previous month, and decreased 2 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for April is 54.0, a decrease from the March index of 58.0, reflecting industry participants' continuing concerns over the economy and the impact of federal policies on capital expenditures.

ELFA President and CEO William G. Sutton, CAE, said: "After a sluggish February, March business activity returned to a degree of normalcy that hopefully is sustainable into the second half of the year. The continued low interest rate environment promoted by the Fed together with relatively benign fundamentals in the broader economy bode well for businesses planning to expand and grow in the coming months and invest in capital equipment."

Russell Nelson, President, CoBank Farm Credit Leasing, said: "Given the continuation of the low interest rate environment, favorable credit quality trends, industry discipline for sustainable growth with acceptable risk-adjusted returns, and customer demand for financing primarily replacement assets, the pace of activity in the first quarter has been steady, but less robust than the fourth quarter of 2012. Influencing factors weighing on future capex, both replacement and expansion, are continued uncertainty and volatility in the current domestic/global economies, pending tax, accounting, and regulatory changes, and political uncertainty in Washington.

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP