Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bancorp South Equipment Finance

- Bank of America

- Bank of the West

- BB&T

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Financial

- Key Equipment Finance

- M&I Equipment Finance

- Marlin Leasing Corporation

- Merchants Capital

- National City Commercial Corp.

- RBS Asset Finance

- Siemens Financial Services

- Stearns Bank

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

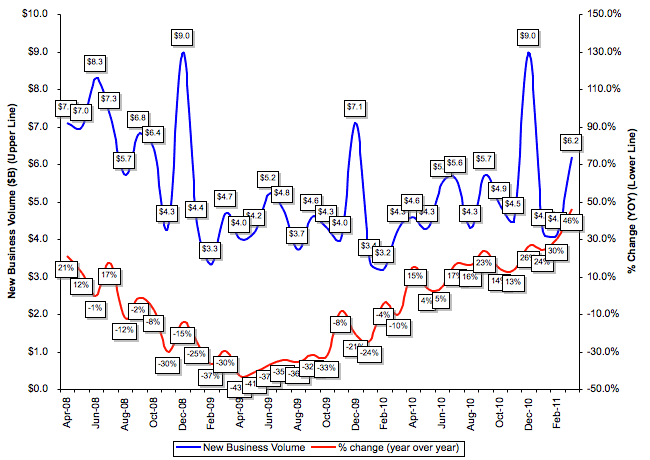

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for March was $6.2 billion, up 44 percent compared to the same period in 2010. Measured against February volume, March volume increased by 51 percent.

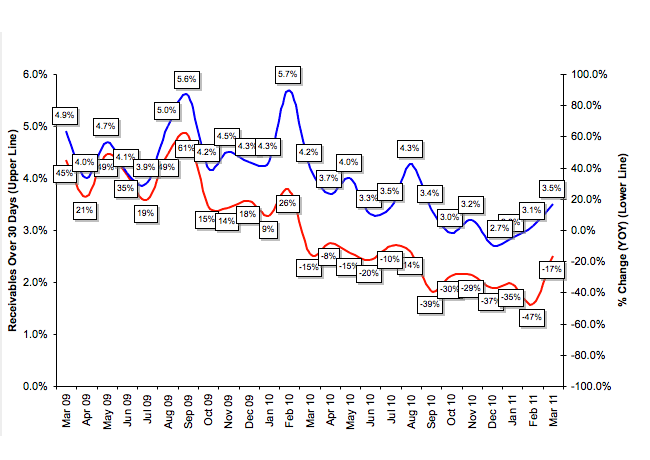

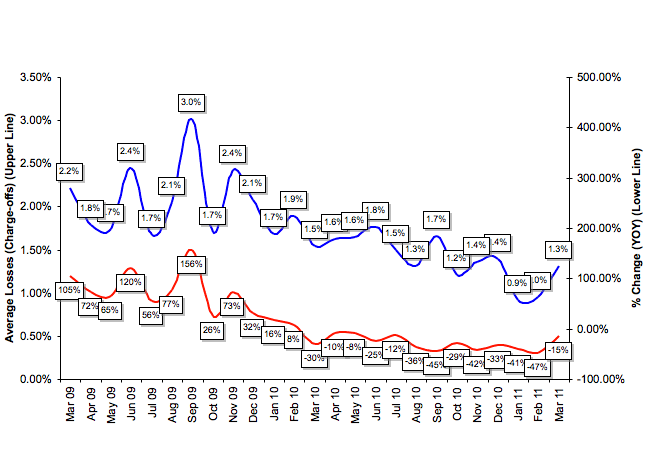

Credit quality continues to be mixed. Receivables over 30 days increased slightly to 3.5 percent in March from 3.1 percent in February, but declined by 17 percent compared to the same period in 2010. Charge-offs also increased slightly, from 1.0 percent in February to 1.3 percent in March, but showed improvement over the same period in 2010.

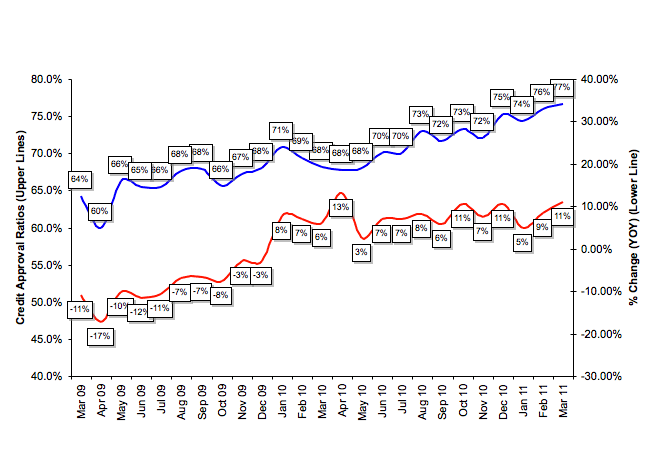

Compared to the year-earlier period, credit standards eased as new application approvals increased to 77 percent in March. Fifty percent of participating organizations reported submitting more transactions for approval during the month, down from 61 percent in February.

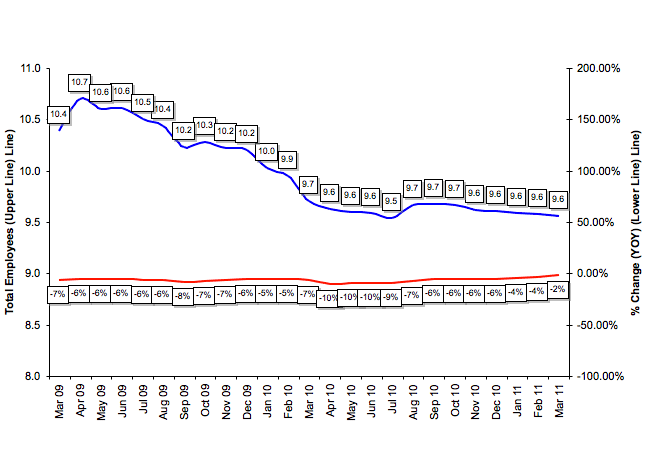

Finally, total headcount for equipment finance companies remained flat for the last five months, but was down two percent year-over-year. Supplemental data shows that the construction and trucking sectors continued to lead the underperforming sectors in March.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for April is 70.3, down from 72.4 in March, and up significantly from the April 2010 index of 65.4. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, said: "The dramatic increase in new business volume is, in large measure, the result of strong demand in business equipment in various industries and markets. For example, in the technology sector, a number of companies are reporting strong earnings as their business customers decide to replace aging equipment and expand capacity in response to a recovering economy. We see this trend continuing."

"SG Equipment Finance supports the technology, industrial and transportation sectors. In terms of new business volume we had a very strong first quarter and a record month of March. This is consistent with the MLFI data," said Larry Scherzer, Chief Sales Officer for SG Equipment Finance based in Jersey City, N.J. "We have seen most of our growth come out of the technology and healthcare sectors, which were resilient throughout the recent economic crisis. We are starting to see signs of recovery in the industrial sector, all of which points to a positive business outlook going into the second half of the year."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP