Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance Company

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Equipment Finance Company

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

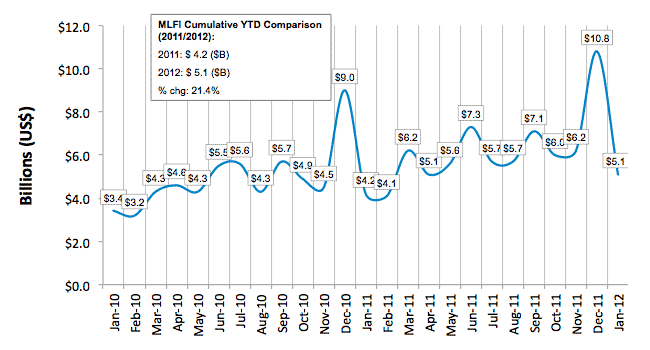

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for January was $5.1 billion, up 21 percent from volume of $4.2 billion in the same period in 2011. Volume was down 53 percent from December, following the typical end-of-quarter, end-of-year spike in new business activity.

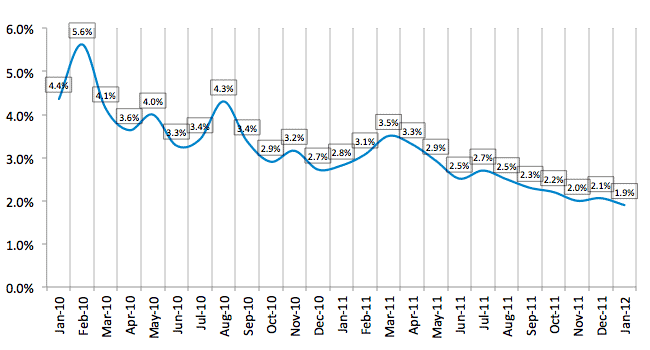

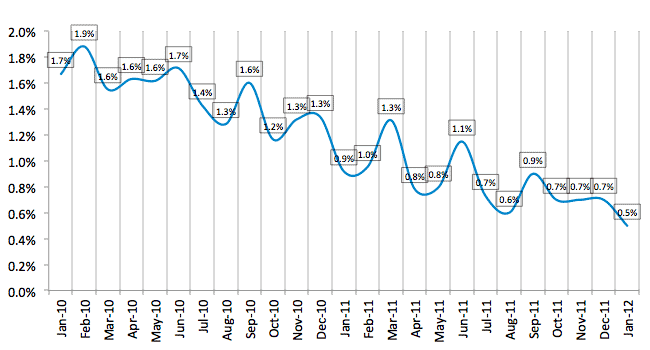

Credit quality metrics continued to improve. Receivables over 30 days decreased to 1.9 percent in January from 2.1 percent in December. Charge-offs decreased to 0.5 percent from 0.7 percent in December.

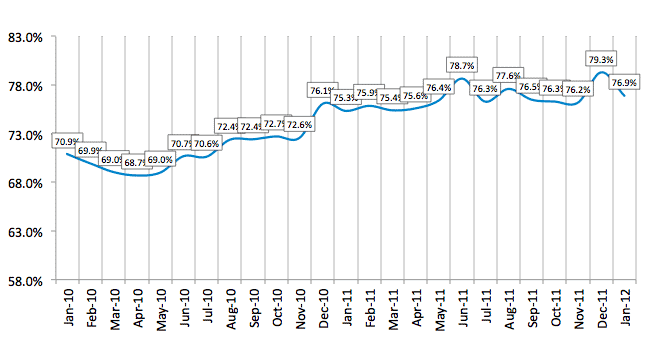

Following an unusually high credit approval ratio in December, credit approvals returned to a more typical level of 77 percent in January. More than 71 percent of participating organizations reported submitting more transactions for approval during January, down from 77 percent in December.

Finally, total headcount for equipment finance companies in January decreased 3.0 percent from December and was down 3.0 percent year over year. Supplemental data show that the construction and trucking industries continued to lead the underperforming sectors.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for February is 59.6, a slight increase from the January index of 59.0, indicating industry participants' optimism is steady despite a cautious outlook about the global economic situation in the coming months. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, said: "January's increase in new business volume returned to a more typical growth pattern following a very busy end-of-year for many leasing and finance companies. The continued strengthening in financing volume and trend toward healthier portfolios provide clear evidence that the equipment finance marketplace is in the midst of regaining some of the momentum lost during the Great Recession."

Daniel McCabe, Senior Vice President, Sales and Marketing, John Deere Financial, located in Johnston, IA, said, "The Agriculture sector continues to operate at very high levels and equipment sales and financing are robust. The construction sector is recovering from a deep recession beginning with increases in the rental fleet portion of the industry. Adequate liquidity and favorable interest rates will support further expansion of the business."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

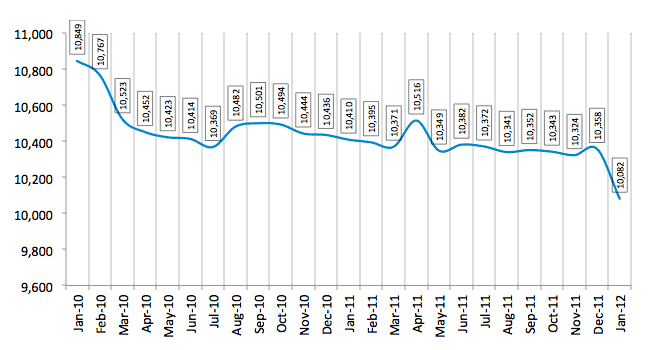

Total Number of Employees

(Year Over Year Comparison)

:: TOP