Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bancorp South Equipment Finance

- Bank of America

- Bank of the West

- BB&T

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Financial

- Key Equipment Finance

- M&I Equipment Finance

- Marlin Leasing Corporation

- Merchants Capital

- National City Commercial Corp.

- RBS Asset Finance

- Siemens Financial Services

- Stearns Bank

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

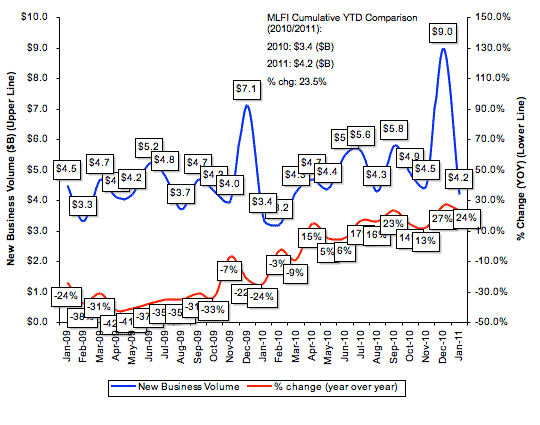

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for January was $4.2 billion, up 24 percent compared to the same period in 2010.

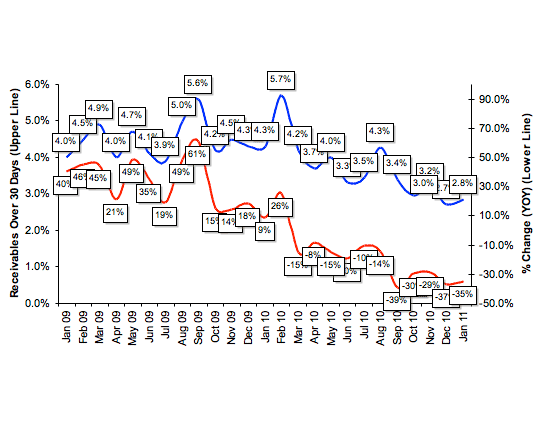

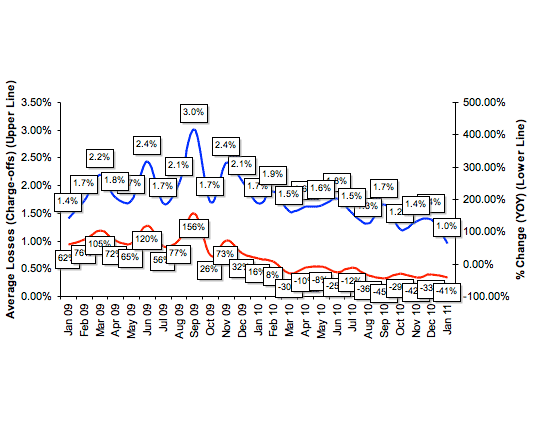

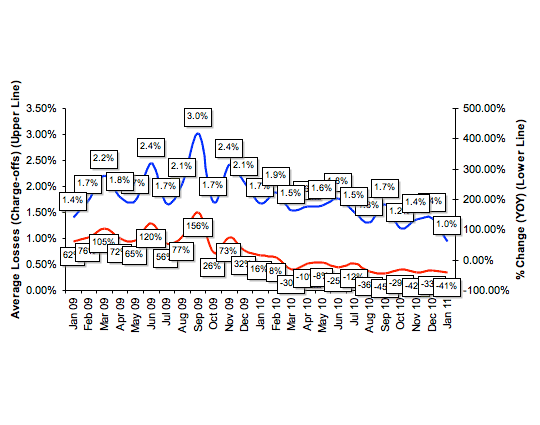

Credit quality is mixed. Receivables over 30 days increased slightly to 2.8 percent in January from 2.7 percent in December, but declined by 35 percent compared to the same period in 2010. Charge-offs declined significantly, falling to 1.0 percent from 1.4 percent in December, and also showed improvement over the same period in 2010.

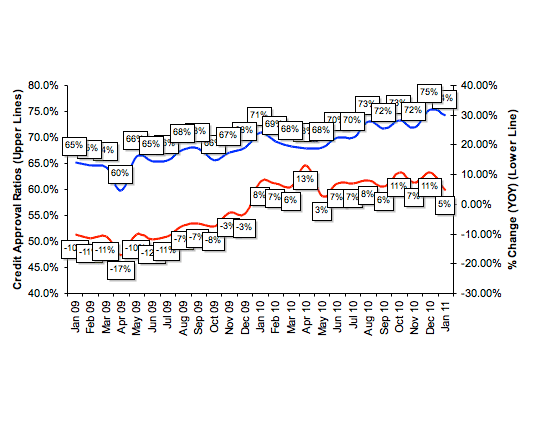

Compared to the year-earlier period, credit standards relaxed as approvals increased to 74 percent in January. And, 56 percent of participating organizations reported submitting more transactions for approval during the month, down from two-thirds of responding organizations in December.

Finally, total headcount for equipment finance companies remained flat for the last three months, and reflected a year-over-year decrease of four percent for January. Supplemental data shows that the construction and trucking sectors once again led the underperforming sectors in January.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for February is 71.6, a new high since the MCI was launched in May 2009, and an increase from the previous high of 69.7 in January. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, said, "After a typical end-of-quarter, end-of-year spike in new business activity, the equipment finance sector seems to be resuming a steady pace of increasing volume. This trend, coupled with a strong outlook by leasing and finance executives about the future of the industry, bodes well for a continued recovery of the sector."

"At Summit Funding Group, we have seen a dramatic increase in customer interest in acquiring new assets," said Richard Ross, President, Summit Funding Group, Inc. located in Cincinnati, Ohio. "The fourth quarter of 2010 finished the year stronger than recent history. These strong results, coupled with the awarded backlog and continued interest in new financing, leads us to believe the last three quarters of the year should produce a sizable increase in lease financing for 2011."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP