Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Tygris Vendor Finance

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

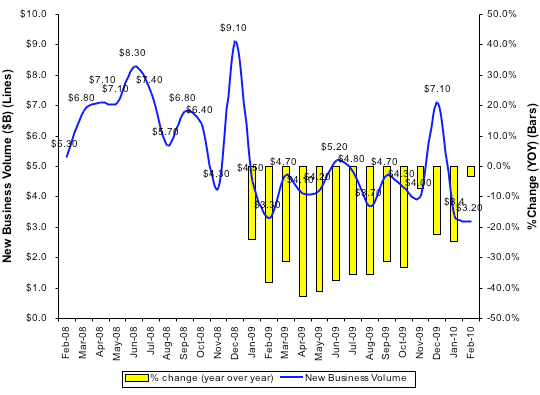

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $518 billion equipment finance sector, showed overall new business volume for February declined three percent when compared to the same period in 2009.

When shown against the prior month, the MLFI-25 reported new business volume decreased by six percent, from $3.4 billion to $3.2 billion. (Of note is the fact that, in the last four years, the average January to February decline averaged approximately 17 percent.)

According to a separate survey commissioned by CFO.com, capital spending is expected to increase nine percent in 2010.

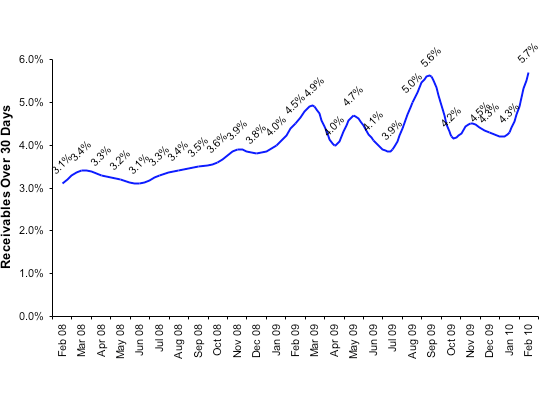

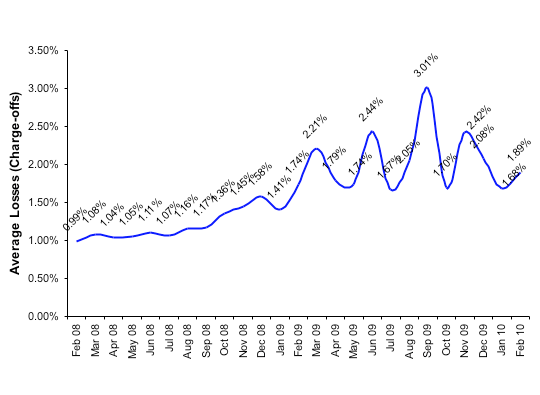

Tempering this advance in new business volume is February data showing a noticeable increase in delinquencies. Receivables over 30 days rose significantly when compared to both the prior month and year-earlier period. However, upon further analysis, this anomaly appears to be the result of one outlier respondent that reported a larger than usual number in the 30-60 day receivables bucket. Charge-offs increased to 1.89 percent, up from 1.68 percent in the prior month.

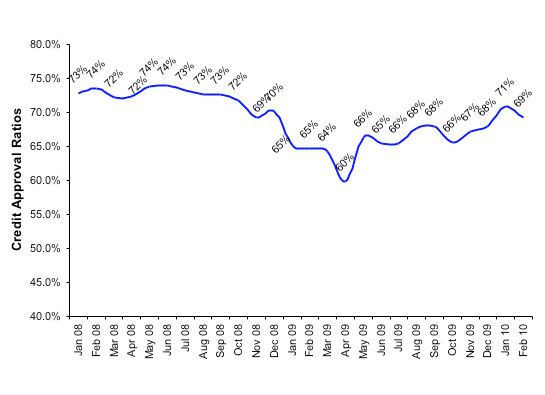

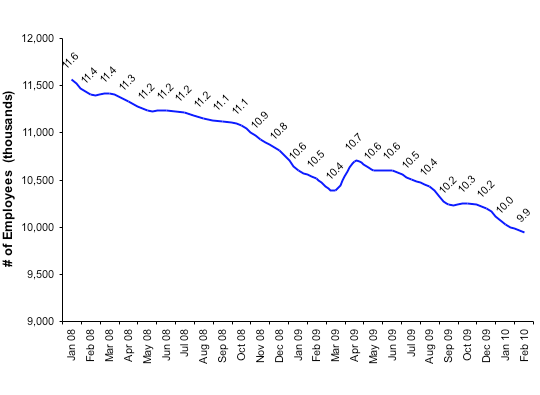

Credit approvals decreased to 69 percent in February, up from 65.0 percent in the same period the prior year. Almost half of participating organizations reported submitting fewer transactions for approval during the month. Total headcount for equipment finance companies decreased by one percent in the January-February period.

And, once again, the construction and trucking transportation industries led the underperforming sectors.

"The fact that February new business volume is down compared to February 2009's anemic numbers tells you that we still have a long way to go in the economic recovery," said Thomas Jaschik, President, BB&T Equipment Finance, located in Towson, MD. "Businesses continue to lack the confidence to make substantial investments in capital equipment. The increase in delinquencies and charge-offs from January to February has a seasonal factor associated with it, but is not a trend you like to see given the run up in these two items in 2009."

"Recent anecdotal information from ELFA members as well as hard data here seem to indicate that the nascent economic recovery is giving at least some businesses reason to feel confident about investing in capital assets," said Ralph Petta, ELFA interim President. "Hopefully, as we move in to the second quarter of the year and beyond, this growth trend continues and is sustainable," said Petta.

A related index, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI), for March was at 60.1, relatively on par with February 2010 index of 60.6.

The MCI-EFI is a monthly survey of equipment finance industry executive leadership that provides a qualitative assessment of both the prevailing business conditions and expectations for the future. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry's confidence. For more information, visit http://www.leasefoundation.org/IndRsrcs/MCI/

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP