The economic outlook for 2026 points to a U.S. economy that can generate moderate expansion, with equipment demand and AI-driven capital expenditure (capex) remaining important sources of growth.

According to the 2026 Equipment Leasing & Finance U.S. Economic Outlook released by ELFA and the Equipment Leasing & Finance Foundation, these high-level expectations come with a few caveats. The overall economy’s outlook is tempered by increasing exposure to policy uncertainty, market volatility and widening consumer disparities. And in this environment, expansion in the equipment finance sector is increasingly vulnerable to policy missteps and market shocks, leaving the balance of risk tilted modestly to the downside.

As businesses look to navigate the economic and market landscape and align their strategy for growth, the following are six forces to watch in 2026:

1. A Modest Economic Slowdown

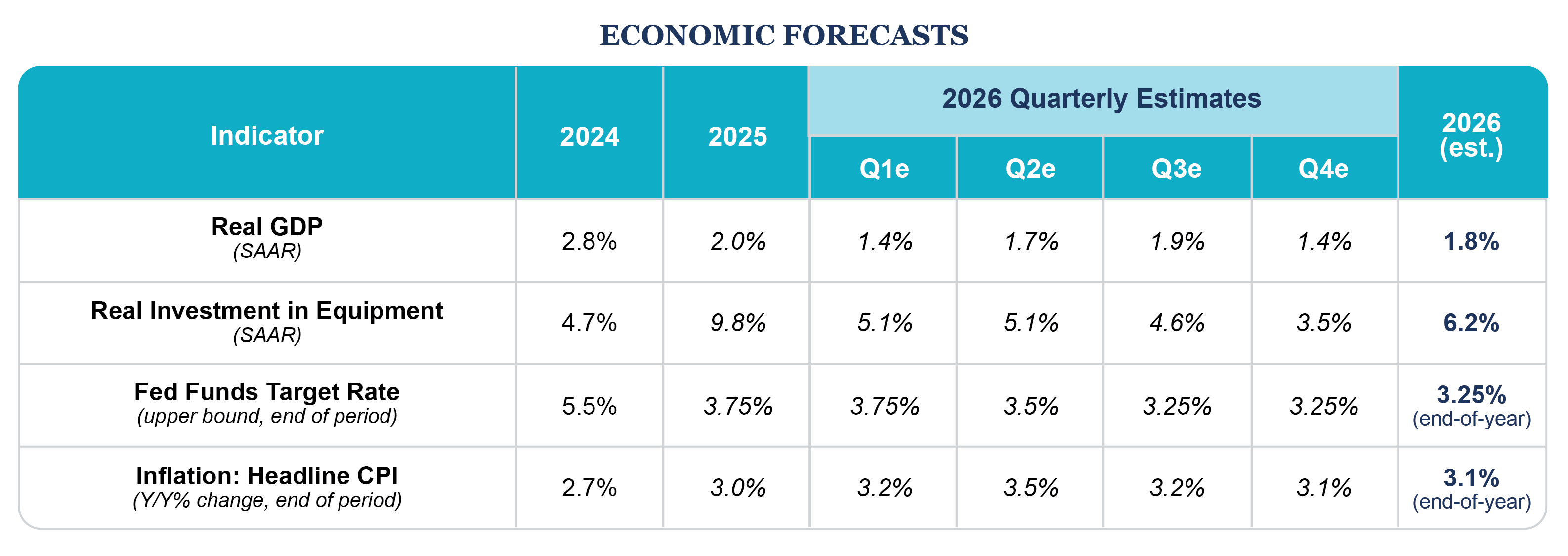

The economy remained on track in 2025 despite policy turbulence, fueled by a historic AI-related investment surge and resilient consumers. While official data is unusually lagged due to the fall government shutdown, GDP appears to be on track to expand by 2.0% in 2025. The forecast for 2026 is for a modest slowdown to 1.8% growth. Headline consumer price index (CPI), the all-inclusive measure of inflation, is expected to rise to 3.5% this summer before falling back to 3.1% by the end of the year.

2. Historically Strong Equipment and Software Investment

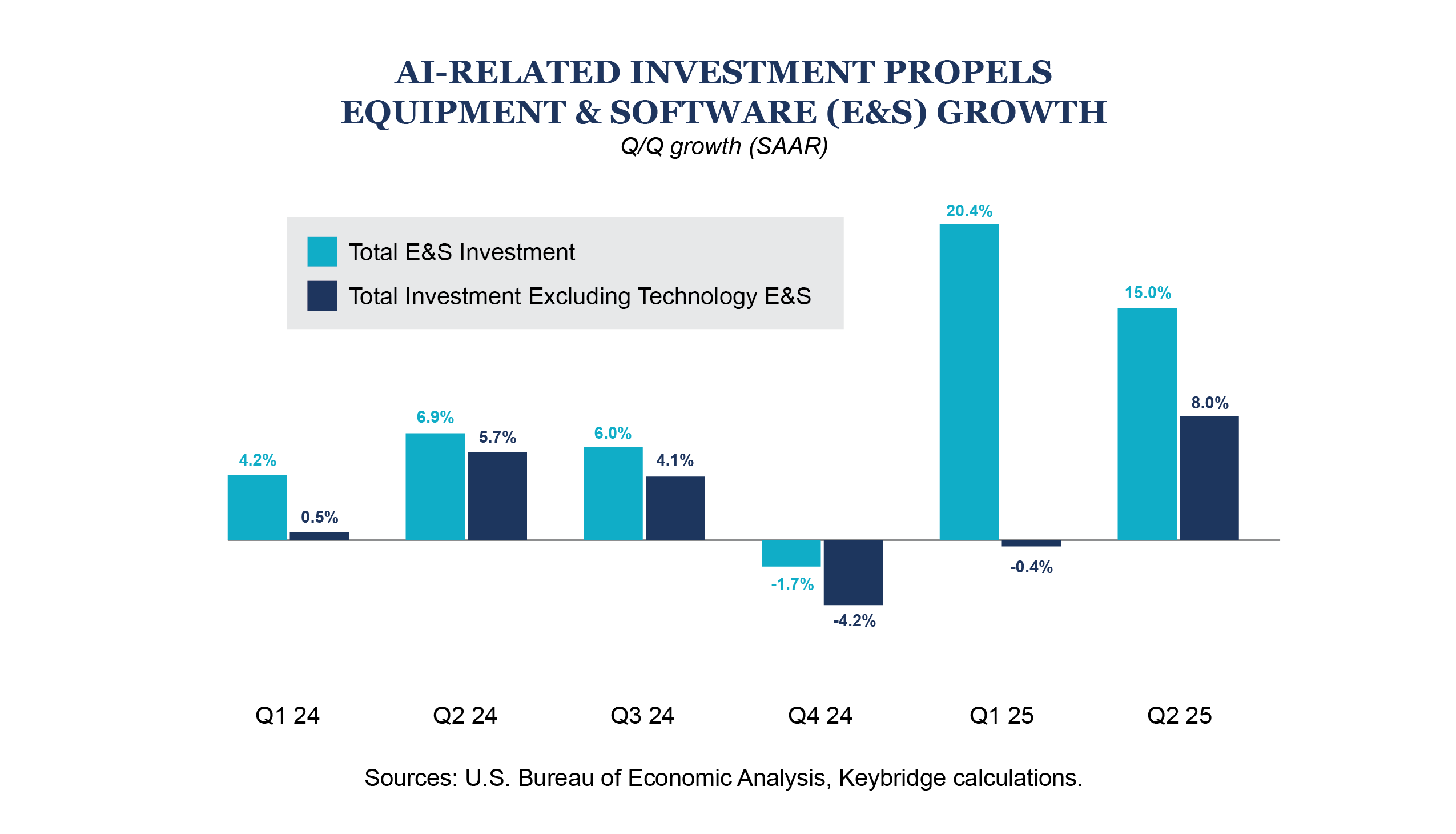

Real equipment and software investment posted its strongest two-quarter performance in at least 20 years (excluding the pandemic rebound) during the first half of 2025, with likely expansion of 9.8% for 2025 overall. The gains have been highly concentrated, with technology equipment and software accounting for most of the expansion. Investment growth has been more muted outside these verticals. For example, industrial equipment investment rose just 1.9% in Q2, while energy and electrical equipment investment contracted by 10%.

The 2026 forecast calls for projected growth of 6.2%, easing from 2025’s standout pace but still strong by historical standards.

Source: 2026 Equipment Leasing & Finance U.S. Economic Outlook

Source: 2026 Equipment Leasing & Finance U.S. Economic Outlook

3. Mixed Equipment Investment Momentum

Many key government-produced economic reports are still significantly delayed from the fall shutdown, including the latest GDP release that contains estimates for Q3 2025 equipment and software investment growth. Based on data available at the time of publication, investment momentum for the first half of 2026 appears to be mixed, according to the Foundation’s U.S. Equipment & Software Investment Momentum Monitor.

The Momentum Monitor tracks seven equipment and software investment verticals. Based on currently available indicators, expectations for equipment investment momentum over the next six months (on a year-over-year basis) include:

- Strong and accelerating momentum for agricultural machinery, construction machinery, and energy and electrical equipment investment growth.

- Weak and accelerating momentum for technology equipment and software investment growth. transportation equipment investment growth.

- Weak and decelerating momentum for industrial equipment, medical equipment, and transportation equipment.

4. Continued AI Boom

The AI investment boom remains the primary engine of economic and industry growth. AI-related firms continue to drive a disproportionate share of S&P 500 gains and corporate earnings. A massive wave of capital spending from large tech firms led to $350 billion in AI infrastructure investment in 2025, and some projections see global AI spending reaching $3-4 trillion by the end of the decade.

The gains, however, have been highly concentrated, with much of the investment and earnings tied to a narrow group of firms, technologies and equipment verticals, particularly technology equipment and software investment. There continues to be abundant optimism about AI’s potential to transform the economy and boost productivity over time, but the rapid run-up has brought clearer signs of strain. Valuations look increasingly stretched, financing structures have become more complex and debt-dependent, and investors are increasingly wary that an AI-driven correction could disrupt both markets and capital spending.

Expectations are that the AI buildout will continue to provide a significant boost to the economy in 2026. However, the question remains whether an AI bubble is legitimate given current valuations, underlying financing dynamics, and if near-term productivity gains can meet the market’s lofty expectations.

5. Uncertain Trade Policy Impacts

The expectation is that trade policy will continue to drive the macroeconomic narrative during the first half of 2026. Tariffs, which have been a central component of the administration’s economic strategy, have increased roughly eightfold over the last 12 months. Yet, due to factors including pass-through delays and limited retaliation from foreign governments, the overall impact on the economy has been less severe than many economists expected.

The Supreme Court’s decision (upcoming at time of this publication) on the administration’s use of the International Emergency Economic Powers Act will determine whether the current tariff regime continues or is replaced by a more procedurally constrained framework. Either outcome carries significant economic implications. Tariffs imposed will likely put continued upward pressure on inflation and lead to slower GDP growth. If the tariffs are struck down, a messy transition period may ensue.

6. Monetary Policy Dynamics

The situation may best be described as “delicate.” The Federal Reserve cut rates three times in the fourth quarter of 2025 amid mounting labor-market softness, and markets expect further easing in 2026. Still, core inflation remains elevated, and recent price pressures tied to tariff pass-through could push inflation higher in 2026. Some Federal Open Market Committee (FOMC) officials have signaled they may “look through” tariff-driven inflation if it appears temporary and not rooted in underlying demand. That perspective may provide the Fed more flexibility to continue lowering rates, even if core inflation remains elevated.

Leadership changes add another layer of uncertainty. With Jay Powell’s term ending in May, the FOMC is likely to tilt more dovish. If, though, the new chair is perceived as being too aggressive in lowering borrowing costs, bond traders may push long-term yields higher.

What it All Means for the Equipment Finance Industry

The AI-related investment boom was a major bright spot in an otherwise cooling economy in 2025, providing a major tailwind for the equipment finance industry. The AI buildout will continue to provide a significant boost to the economy and the industry in 2026. The Foundation’s Monthly Confidence Index and ELFA’s CapEx Finance Index agree, indicating resilient new business volume, healthy financial conditions and industry confidence above the historical average. Three Fed rate cuts across the fourth quarter of 2025 should also give a boost to the industry as borrowing costs fall and credit conditions potentially ease.

Leigh Lytle, President and CEO of ELFA, agrees. “Despite ongoing economic uncertainty and trade volatility, the economy carries some momentum into 2026, due in large part to business investment growth, the lifeblood of the equipment finance industry. Last year was a strong year for the industry, and while economic growth may slow somewhat in the months ahead, the Fed’s recent rate cuts should help to bolster labor markets and encourage investment activity.”