Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

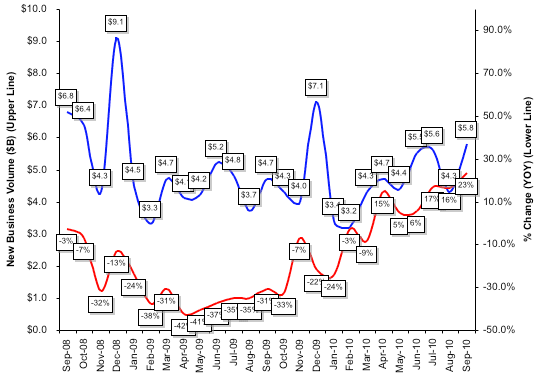

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for September was $5.8 billion, up 23 percent compared to the same period in 2009 and the largest year-over-year increase in two years. New business volume for September increased by 34.8 percent from August's volume of $4.3 billion.

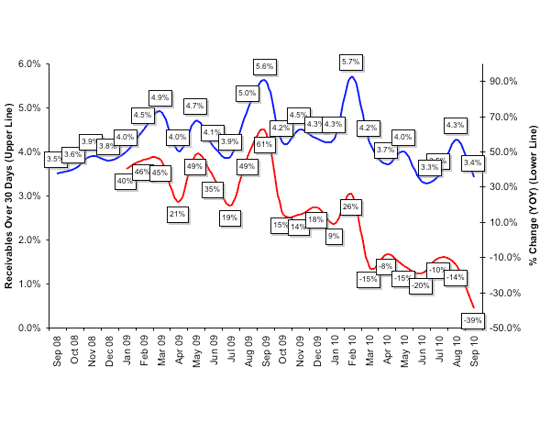

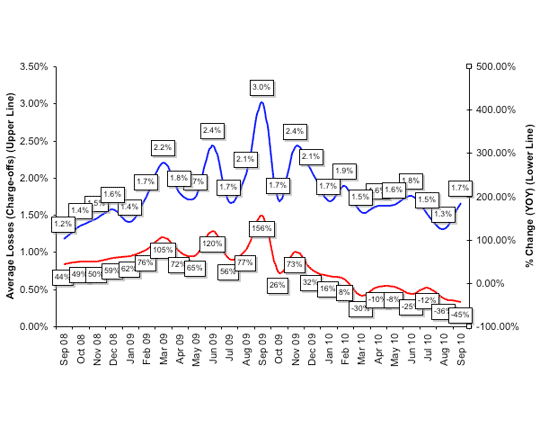

Year-to-date new business volume is $41.2 billion, up 5.1 percent compared to the cumulative year-to-date total from 2009. New business volume in 3Q10 compared to 3Q09 experienced 19 percent year-over-year growth, the largest percentage increase in two years. Credit quality is mixed. Receivables over 30 days decreased to 3.4 percent in September from 4.3 percent in August, the largest year-over-year improvement in two years. This improved picture is accentuated further when the year-earlier receivables data is taken into account. However, losses increased to 1.7 percent in September, up from 1.3 percent in the prior month

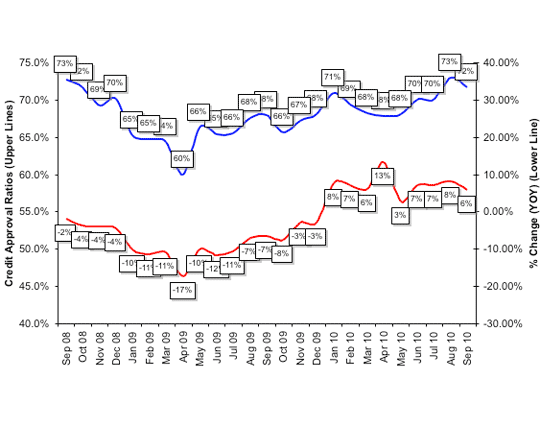

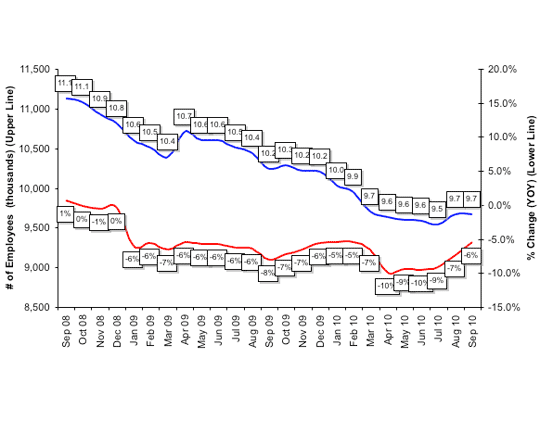

The percentage of credit approvals decreased to 72 percent in September, a percentage point down from August credit approvals, which matched the highest approval ratio since September 2008. Fifty-six percent of participating organizations reported submitting more transactions for approval during the month. Finally, total headcount for equipment finance companies was flat during from August to September. Year-over-year employment is down almost five percent. Supplemental data shows that construction and trucking assets lead the underperforming sectors.

The Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for October is 58.8, an improvement from 56.9 in September. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA president William G. Sutton said, "While September's financing volume is indeed encouraging, some ELFA members are still experiencing soft demand. The trends, however, seem to be heading in the right direction."

"The new business volume increase is indicative of a positive business outlook," said Steve Grosso, President, and Chief Operating Officer, CoActiv Capital Partners, Inc. located in Horsham, PA. "While it's not time to claim we are in a robust environment, clearly businesses are starting to invest in capital equipment. In many cases, we see older equipment that is worn out being replaced, or newer technologies being installed. We haven't seen great large-scale expansion. The technology sector and healthcare seem to be strong versus infrastructure and manufacturing which still remain flat."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP