Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Tygris Vendor Finance

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

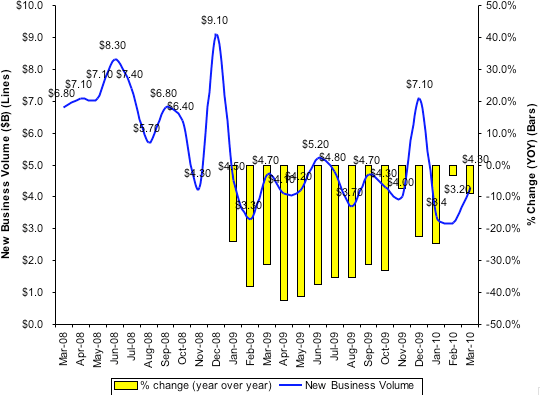

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $518 billion equipment finance sector, showed overall new business volume for March declined nine percent when compared to the same period in 2009. When compared to the prior month, the MLFI-25 reported new business volume increased by 34 percent, from $3.2 billion to $4.3 billion. In fact, March originations represent the strongest showing in that category thus far this year.

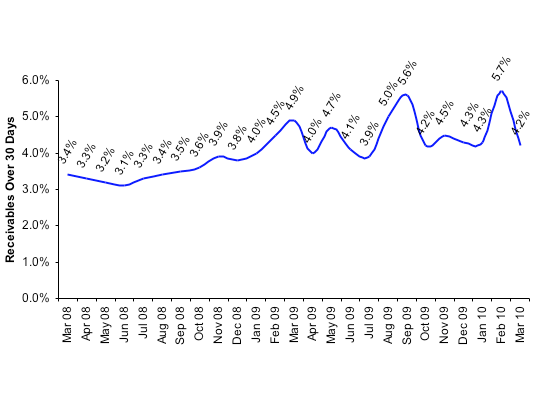

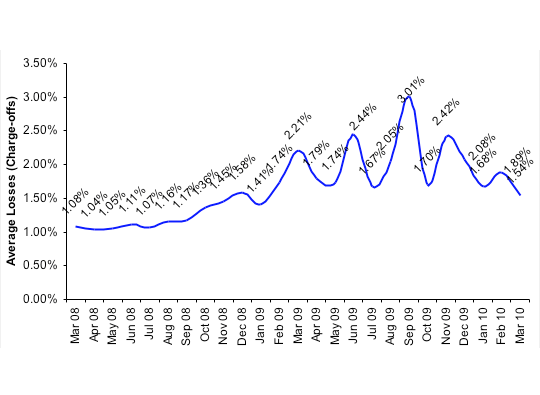

Delinquencies improved markedly as well. Receivables over 30 days declined sharply to 4.2 percent, down from 5.7 percent in the prior month and 4.9 percent in the year-earlier period. Charge-offs decreased to 1.54 percent, down from 1.89 percent in the prior month. Losses have dropped to levels unseen during past 14 months.

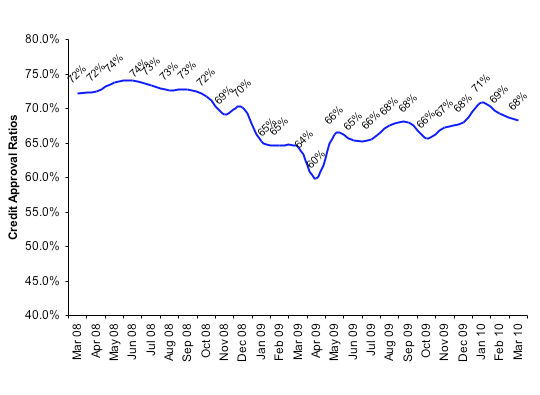

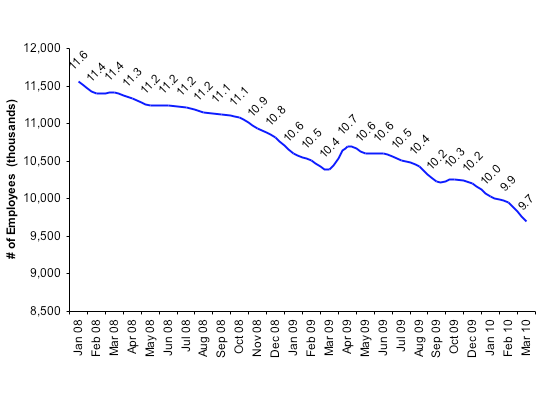

Credit approvals decreased to 68 percent in March, up from 64 percent in the same period the prior year. Of participating organizations, 62 percent reported submitting more transactions for approval during the month. Not since September 2008 have a larger percentage of respondents reported putting more transactions through the credit approval process. Finally, total headcount for equipment finance companies decreased by two percent in the February-March period.

And, once again, the construction and trucking transportation industries led the underperforming sectors.

"Demand for equipment leasing appears to be on the upswing," said David Schaefer, President, Orion First Financial, LLC, located in Gig Harbor, WA. "We are seeing delinquencies begin to stabilize and losses have been improving over the past six months. While the economy and leasing industry are both a long ways away from getting back to where they once were, it appears that business and consumer confidence is building."

Schaefer added, "Business decision makers are beginning to focus on how they can grow their companies versus contracting them and as such we expect capital expenditures to gain momentum as the year progresses."

"Signs of lower credit losses are encouraging," said Ralph Petta, ELFA interim President. "While the level of new business volume continues to reflect rather sluggish demand for equipment financing, we are nevertheless optimistic that the economy will continue to strengthen, providing a more favorable climate for businesses to invest in productive assets."

A related index, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI), for April was at 65.4, up from the March 2010 index of 60.1.

About the ELFA's MLFI-25

The MLFI-25 is the only index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 9:00 a.m. Eastern time from Washington, D.C. each month, on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The latest Monthly Leasing and Finance Index, including methodology and participants is available below and also at

http://www.elfaonline.org/ind/research/MLFI/

MLFI-25 Methodology

The ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP