Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

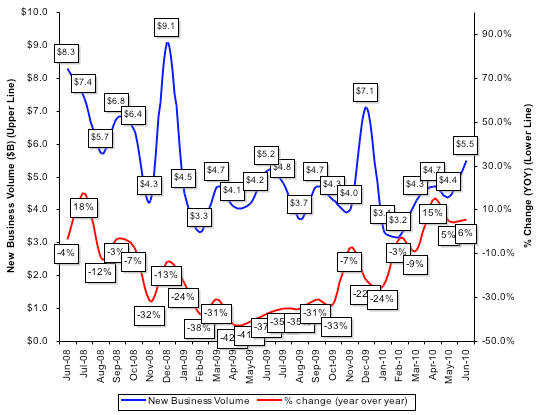

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $518 billion equipment finance sector, showed overall new business volume for June increased six percent when compared to the same period in 2009. When compared to the prior month, the MLFI-25 reported new business volume increased by 25 percent, from $4.4 billion to $5.5 billion. After 20 consecutive months of declines, business volume has shown positive year-over-year growth each month during the second quarter ended June 30.

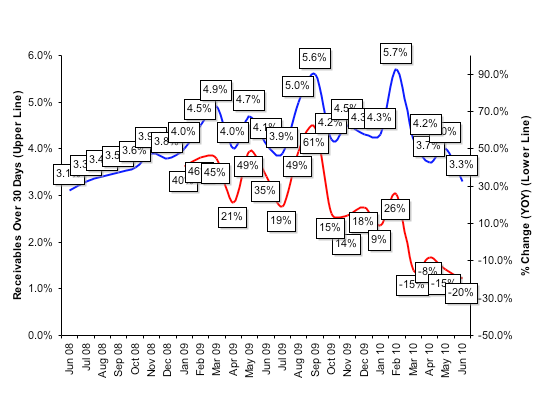

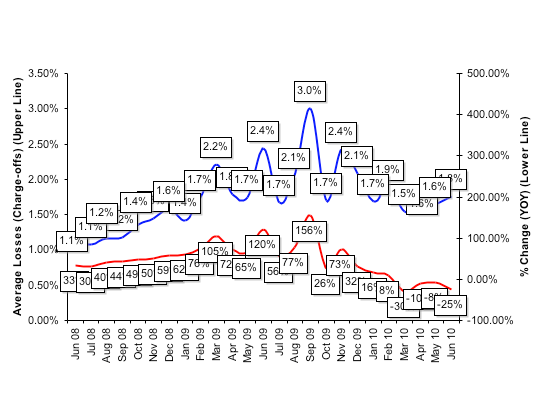

Portfolio quality is also improving. Receivables over 30 days declined to 3.3 percent, down from 4.0 percent in the prior month and 4.1 percent in the year-earlier period. Charge-offs, while increasing slightly from the prior month, showed a steep decline when compared to the year earlier period.

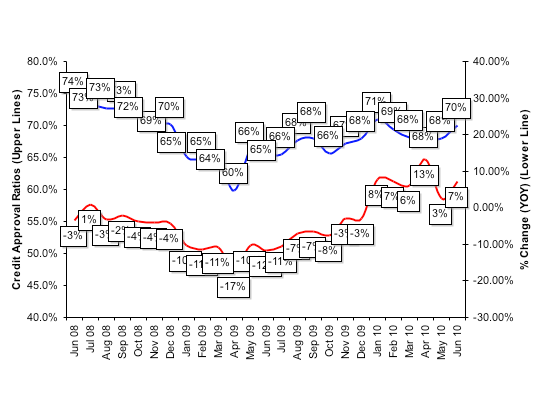

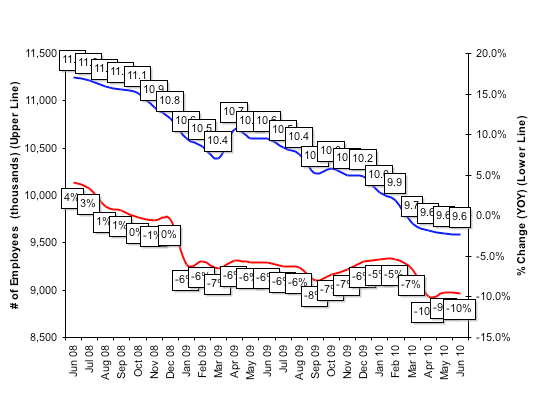

The number of credit approvals climbed to 70 percent in June, up from 65 percent in the same period the prior year. Two-thirds of participating organizations reported submitting more transactions for approval during the month. Finally, total headcount for equipment finance companies remained steady in the May-June period. Construction, truck transportation and small business continue to lead the underperforming sectors.

A related index, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI), for July was at 57.6, a decrease from the June 2010 index of 65.2.

"While volume has improved, we are seeing an increase in month-to-month renewals of existing leases as customers are still hesitant to commit to new capital spending for expansion in what still appears to be a volatile economy," said Jim McGrane, President, EverBank Commercial Finance. "In the healthcare market, for instance, the wave of demand anticipated after passage of the American Recovery and Reinvestment Act has not kicked in as practitioners have not rushed to take advantage of expected reimbursements."

McGrane added, "In general, demand for the equipment we finance is still soft, while credit quality and payment experience have been improving consistently, which we see as setting a positive foundation for future growth."

"Based on our data, the equipment finance industry continues to show gradual but steady growth," said William G. Sutton, ELFA President. "Demand for capital equipment seems to be strengthening, albeit at a slow pace, and credit quality is slowly improving as well."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP