Participants in the ELFA MLFI-25:

- Bank of America

- Bank of the West

- BB&T Bank

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Financial

- Key Equipment Finance

- M&I Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- Siemens Financial Services

- Stearns Bank

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

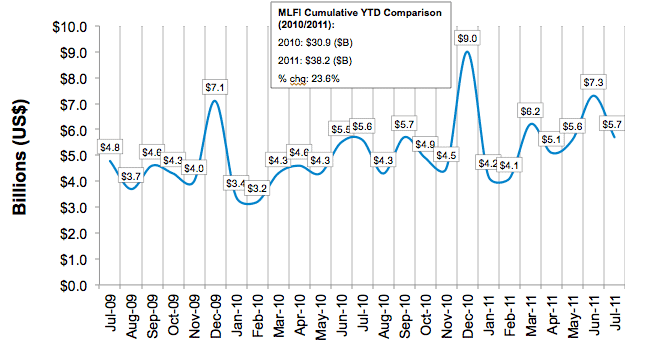

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for July was $5.7 billion, up two percent from volume of $5.6 billion in the same period in 2010. Compared with June volume of $7.3 billion, July volume decreased by 22 percent. Year to date, new business volume is up 24 percent over last year. However, the percentage of responding companies that experienced a drop in volume from the year earlier period rose to 36%.

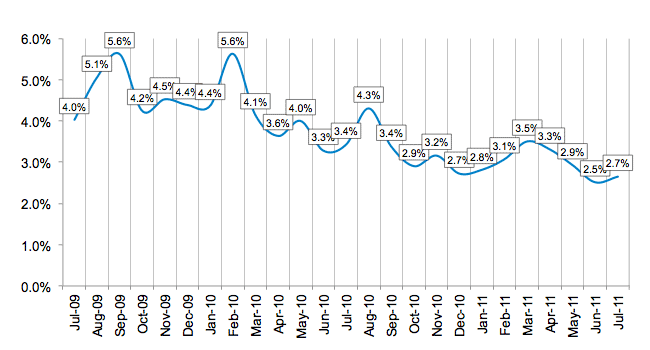

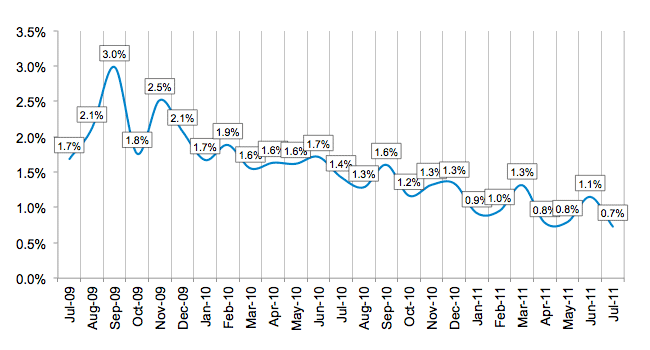

Credit quality is mixed. Receivables over 30 days increased eight percent to 2.7 percent in July from 2.5 percent in June, but declined by 21 percent compared to the same period in 2010. Charge-offs decreased 37 percent in July from the previous month, and decreased by 50 percent from the same period in 2010.

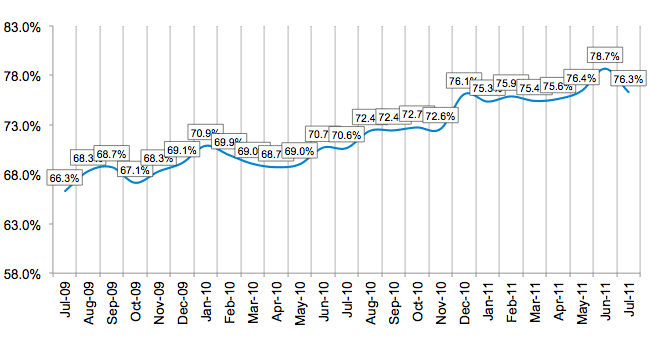

Credit standards tightened in July as the number of lease applications approved decreased to 76.3 percent from 78.7 percent the previous month. Fifty-nine percent of participating organizations reported submitting more transactions for approval during the month, a decrease from 63 percent in June.

Finally, total headcount for equipment finance companies in July showed no significant change month to month and year over year. Supplemental data show that the construction industry and small and medium-sized enterprises led the underperforming sectors.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for August is 50.0, down 11 percent from the July index of 56.2, indicating apparent industry reaction to U.S. economic conditions and federal government fiscal management and policies. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, said: "Compared to a year ago, the equipment leasing and finance industry continues to show improvement. However, the sluggish U.S. economic recovery appears to be responsible, in part, for an uneven demand dynamic for investment in capital equipment."

Anthony Cracchiolo, President and CEO, Vendor Services, U.S. Bancorp Equipment Finance, located in Portland, OR, said, "Our overall business volume continues to improve with solid double-digit growth demonstrated through the first and second quarter, as compared to the same period in 2010. In July, while we continued to show growth, we also began to see a softening in demand. How this plays out throughout the remainder of the year is unclear, but we are hopeful that momentum will build in the fourth quarter."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

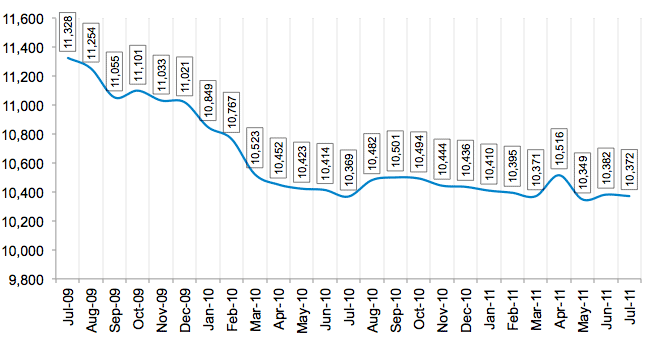

Total Number of Employees

(Year Over Year Comparison)

:: TOP