Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Tygris Vendor Finance

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

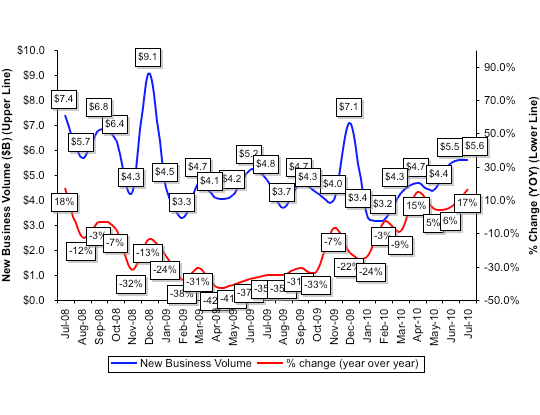

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $518 billion equipment finance sector, showed overall new business volume for July increased 17 percent when compared to the same period in 2009. When compared to the prior month, the MLFI-25 reported new business volume increased slightly, from $5.5 billion to $5.6 billion. After 20 consecutive months of declines, business volume continues to show positive year-over-year growth in each of the last four months. The July increase in originations was the strongest in two years.

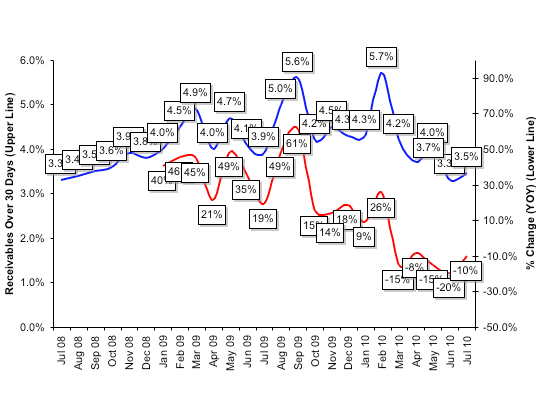

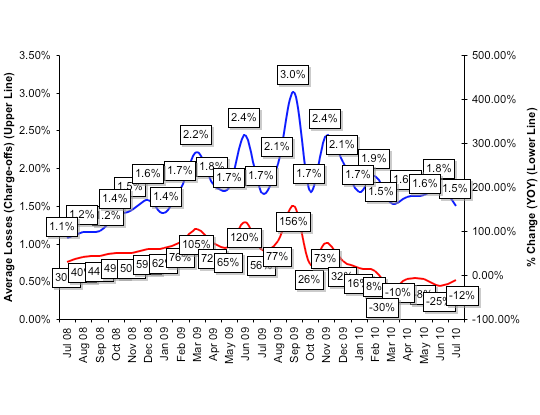

Credit quality is mixed. Receivables over 30 days increased marginally to 3.5 percent, up from 3.3 percent in the prior month, but improved when compared to the year-earlier period (3.9%). Charge-offs fell to 1.5 percent when compared to the previous month (1.8%) and the same period in the previous year (1.7%).

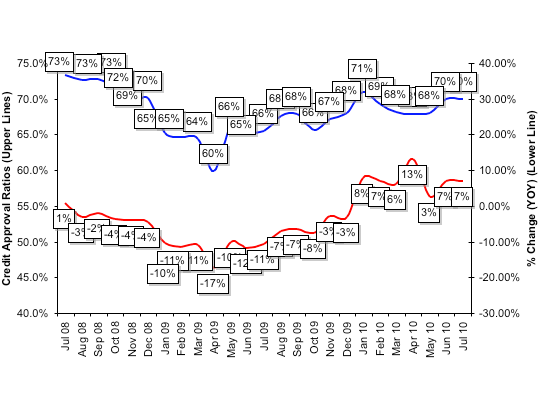

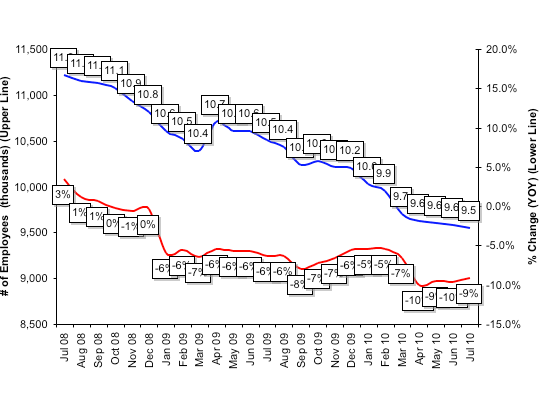

The number of credit approvals stabilized at 70 percent in July compared to the previous month, and improved compared to the same period the prior year (66%). Thirty-six percent of participating organizations reported submitting more transactions for approval during the month. Finally, total headcount for equipment finance companies remained relatively flat during the June-July period. Supplemental data shows that small business and construction lead the underperforming sectors.

"Financing demand appears to be picking up," notes ELFA president William G. Sutton. "Our data mirrors recently reported government statistics showing the annual rate of overall business investment in equipment and software up nearly 22 percent in the second quarter. It appears we're heading in the right direction and our members remain cautiously optimistic that this trend will continue."

To underscore this point, a related survey, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI), for August was at 58.2, an increase from the July 2010 index of 57.6.

There have been some positive signs in the industry," said Crit DeMent, Chairman, CEO, LEAF Financial Corporation. "In addition to the recent encouraging trends in origination growth and portfolio performance, the asset back securitization market seems to be strengthening for equipment leasing. Several lessors have completed transactions in 2010, and investors have been very receptive to our asset class because of its relatively good performance. The latter half of the year promises to be even stronger as issuers and rating agencies become more comfortable operating under some of the new government regulations. The return of this critical source of capital is a vital component to the long-term success of many in our industry, especially among independents and captives."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP