Participants in the ELFA MLFI-25:

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- Dell Financial Services

- Direct Capital Corporation

- DLL

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SunTrust Robinson Humphrey

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

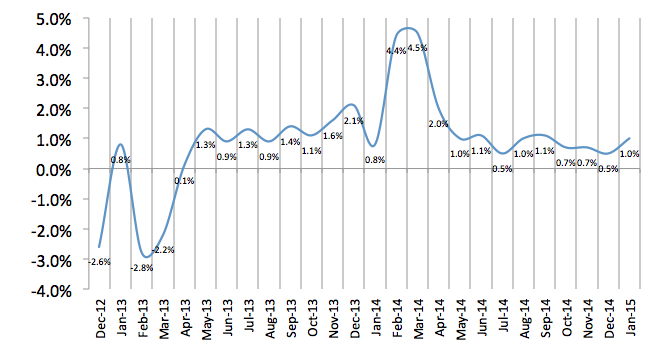

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $903 billion equipment finance sector, showed their overall new business volume for January was $6.7 billion, up 12 percent from new business volume in January 2014. Volume was down 48 percent from December, following the typical end-of-quarter, end-of-year spike in new business activity.

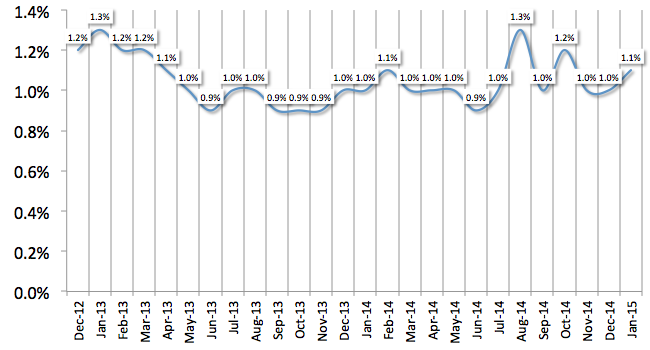

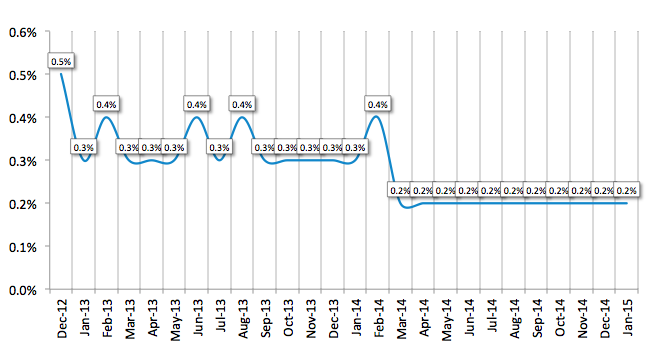

Receivables over 30 days were 1.1 percent, up slightly from 1 percent the previous month and from 1 percent the same period in 2014. Charge-offs were unchanged for the tenth consecutive month at an all-time low of 0.2 percent.

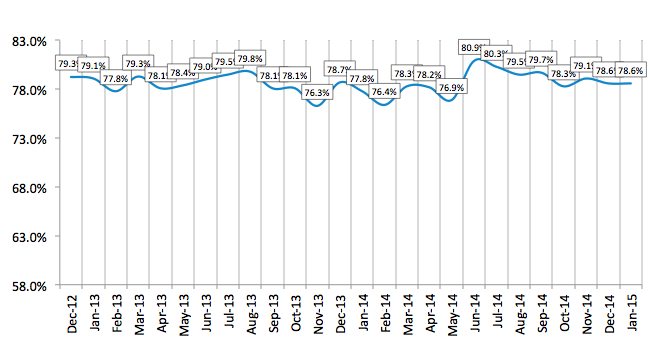

Credit approvals totaled 78.6 percent in January, unchanged from December. Total headcount for equipment finance companies was up 1.0 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for February is 66.3, a slight increase from the January index of 66.1 and the highest level in the last three years.

ELFA President and CEO William G. Sutton, CAE, said: "To begin the year, equipment finance activity picked up where it left off for most of 2014. New business volume continues to grow and portfolios are performing well, despite a slight uptick in receivables over 30 days. Interest rates should remain low--at least into the spring and, perhaps, later--as the Fed keeps a close eye on prospects for inflation and the improving labor markets. As long as the U.S. economy continues to perform, and absent any geopolitical or other external shocks to the system, we are hopeful that these factors will help promote a favorable climate for continued investment by U.S. businesses in capital equipment in 2015 and beyond."

Robert Boyer, President, Susquehanna Commercial Finance, Inc., said, "The MLFI continues to provide encouraging data points indicating sustained growth and stability in our market. In January 2015, we at Susquehanna saw a hangover effect from December, when many of our customers rushed to take advantage of the late passing of the Tax Extenders bill. This had a negative impact on application volume in January, where our comps where lower than January 2014. Most of our customers at Susquehanna are small, domestic focused businesses where low rates and energy prices are driving higher levels of optimism. With the sustained growth and strong aging performance we continue to see, I am wary of the tendency to become complacent."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

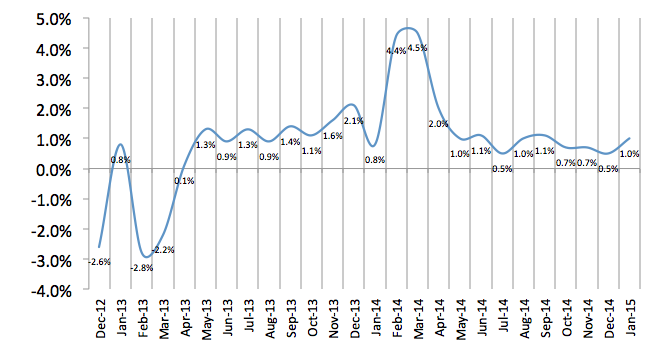

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP