Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

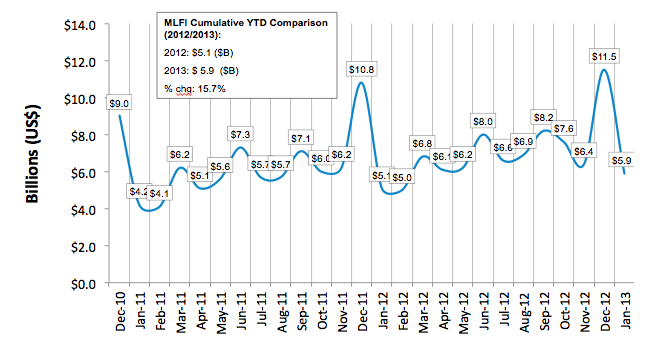

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $725 billion equipment finance sector, showed their overall new business volume for January was $5.9 billion, up 16 percent from volume of $5.1 billion in the same period in 2012. Volume was down 49 percent from December, following the typical end-of-quarter, end-of-year spike in new business activity.

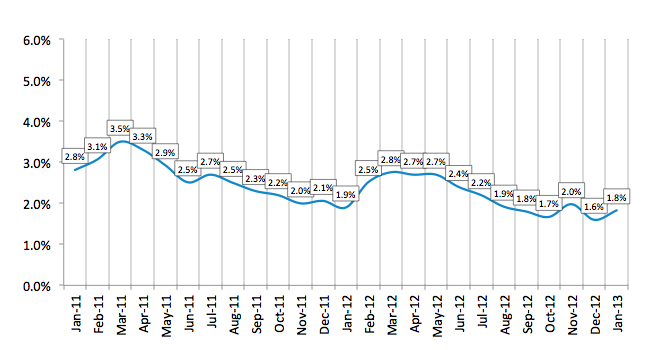

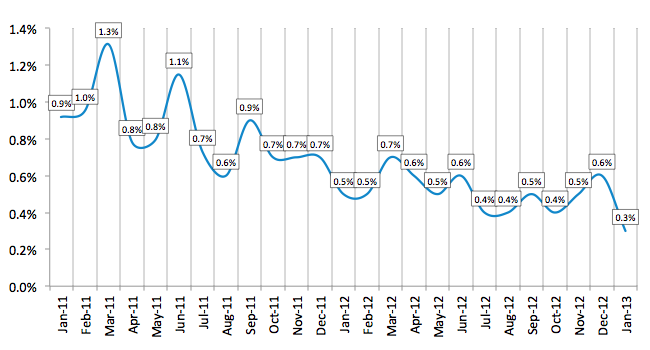

Receivables over 30 days increased to 1.8 percent in January after hitting their lowest level in the last two years in December at 1.6 percent. They were down from 1.9 percent in the same period in 2012. Charge-offs were at an all-time low of 0.3 percent, down from 0.6 percent the previous month.

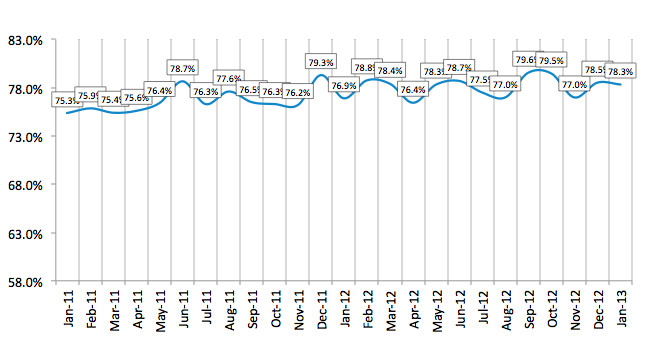

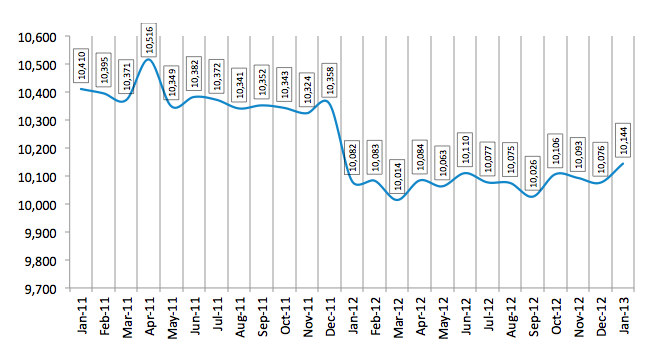

Credit approvals totaled 78.3 percent in January, down 0.3 % from December. Finally, total headcount for equipment finance companies was up 0.7 percent from the previous month, and increased 0.6 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for February is 58.7, an increase from the January index of 54.2, reflecting industry participants' increasing optimism despite a wary eye on economic conditions and government management of fiscal policies.

ELFA President and CEO William G. Sutton, CAE, said: "The year begins where 2012 left off—on a positive note—as new business volume continues to trend in a positive direction. A flurry of activity at the end of the year gave way to more moderate growth in January. MLFI-25 participants also indicate strong credit quality metrics as both losses and delinquencies improved over the year-earlier period. This good news belies an overhang of continued uncertainty that lingers in the marketplace, as policy makers in Washington continue to struggle with fiscal matters, which only serves as a damper to economic growth."

Irv Rothman, President & CEO, HP Financial Services, located in Berkeley Heights, NJ, said, "We remain optimistic for industry growth as enterprise and government entities increasingly utilize leasing and financing offers to help keep pace with technology change. With rapidly evolving business and IT demands, we continue to see interest from customers for the flexibility leasing, financing and lifecycle asset management provides."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP