Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance Company

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Equipment Finance Company

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

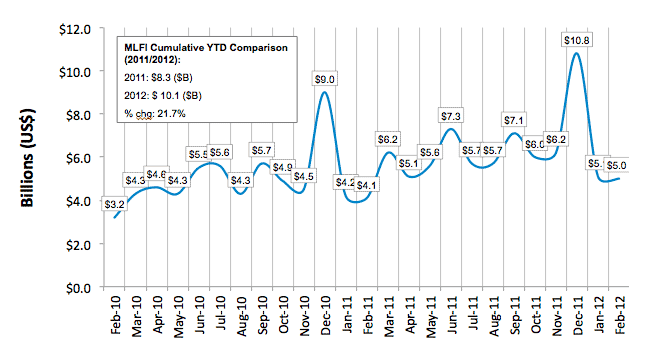

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for February was $5.0 billion, up 22 percent from volume of $4.1 billion in the same period in 2011. Volume was down two percent from the previous month. Year-to-date cumulative new business volume is up 22 percent.

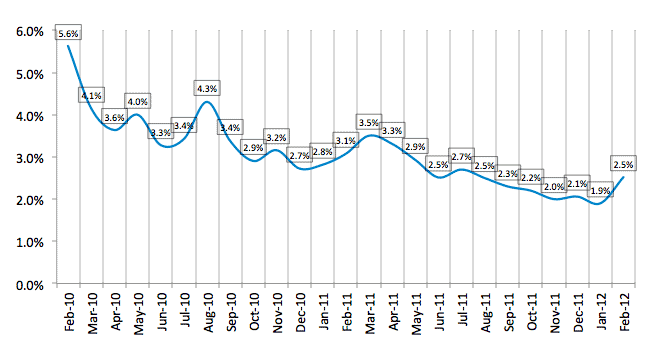

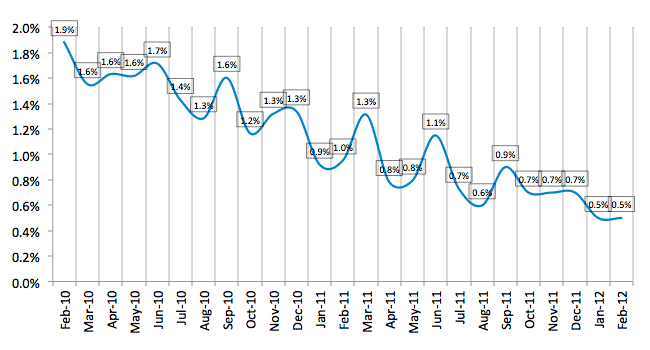

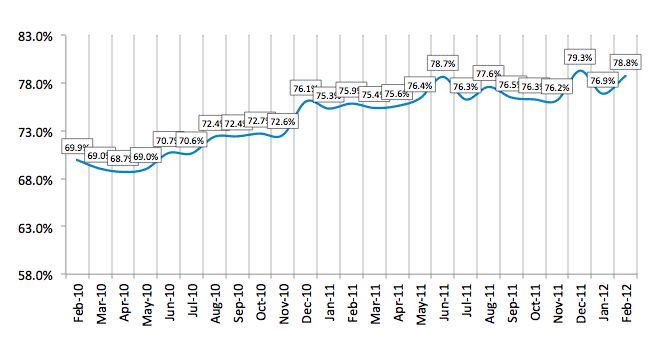

Credit quality metrics were mixed. Receivables over 30 days increased to 2.5 percent in February, up from a two-year low of 1.9 percent in January, due to higher-than-normal delinquencies reported by one of the 25 companies responding to the survey. Charge-offs were unchanged from the previous month at 0.5 percent. Credit approvals rose to 79 percent in February up from 77 percent in January.

Finally, total headcount for equipment finance companies in February remained unchanged from the previous month, and was down 3.0 percent year over year. Supplemental data show that the construction and trucking industries continued to lead the underperforming sectors.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for March is 61.7, up from the February index of 59.6, indicating industry participants are optimistic despite concerns that external factors, including gas prices and the upcoming elections, may have on the market. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, said: "The data show that companies continue to invest in equipment, replacing obsolete and worn assets in some sectors while beginning to expand in others. The roller coaster trend pattern of our credit-quality metrics, aging of receivables, charge-offs and credit approvals are caused by the unique aspects of different sectors and their cash-flow cycles. However, we see them continuing to move in a positive direction overall."

Jerry Newell, Executive Vice President, Bank of the West, headquartered in San Francisco, CA, said, "Bank of the West Equipment Finance has seen an increase in capital spending and equipment finance activity across most equipment sectors including technology, manufacturing, construction, healthcare, and agriculture. Much of this activity is for replacement equipment that was deferred in the downturn, but we have also noted capital spending for expansion which is a positive sign. While a few industry segments remain soft, overall we are cautiously optimistic that the equipment leasing and finance industry will continue to see growth at a moderate pace this year."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

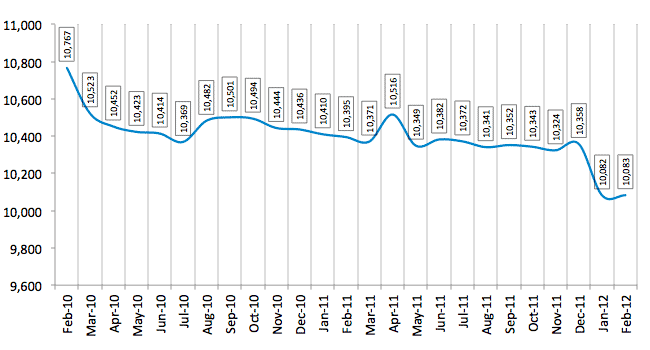

Total Number of Employees

(Year Over Year Comparison)

:: TOP