Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Equipment Finance, a City National Bank Company

- First American Equipment Finance

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

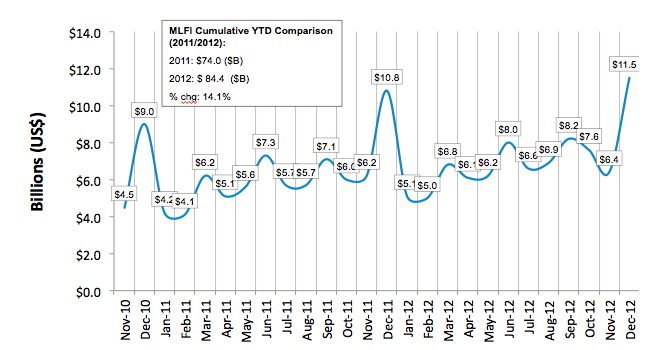

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $725 billion equipment finance sector, showed their overall new business volume for December was $11.5 billion, up 6 percent from volume of $10.8 billion in the same period in 2011. In a typical end-of-year spike, their volume was up 80 percent from the previous month's volume of $6.4 billion. Cumulative new business volume for 2012 rose 14 percent over 2011.

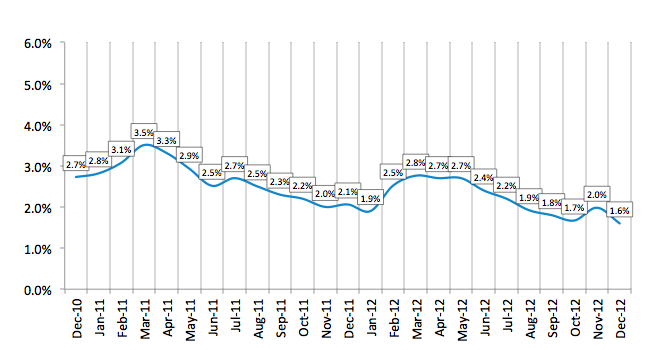

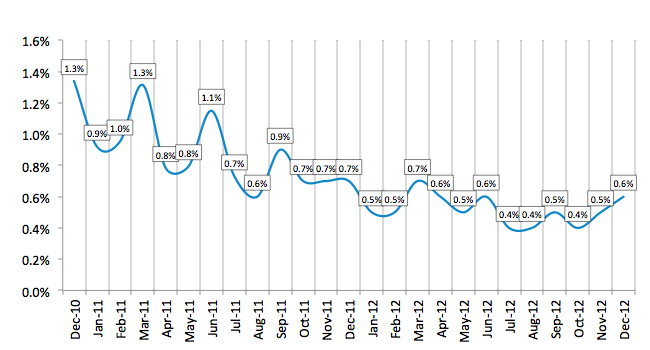

Receivables over 30 days decreased to their lowest level in the last two years at 1.6 percent, down from 2.0 percent in November, and they were down from 2.1 percent in the same period in 2011. Charge-offs were up from the previous month at 0.6 percent, and down by 14.3 percent compared to the same period last year.

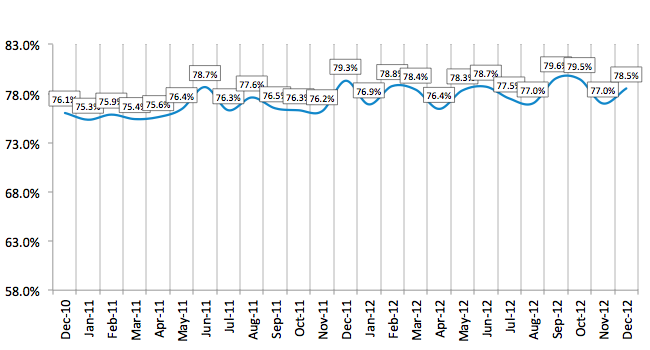

Credit approvals totaled 78.5 percent in December, up from 77.0 percent in November. Seventy-two percent of participating organizations reported submitting more transactions for approval during December, up from 46 percent the previous month.

Finally, total headcount for equipment finance companies was down 0.2 percent from the previous month, and declined 2.7 percent year over year. Supplemental data show that small and medium-sized enterprise customers led the underperforming sectors, followed by trucking.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for January is 54.2, an increase from the December index of 48.5, reflecting industry participants' improved outlook amid ongoing concerns with economic conditions and management of fiscal issues.

ELFA President and CEO William G. Sutton, CAE, said: "While traditional end-of-year business increased considerably from the prior month, and is up moderately compared to the similar period last year, customersÑand potential customers—of ELFA members express varying degrees of caution when considering equipment acquisitions going forward. Pressure on the U.S. economy—notably the still-unresolved debt-ceiling and mandatory spending reduction debate between Congress and the White House—continues to overhang the U.S. economy as we move into the first quarter of 2013. Portfolio and credit quality continue to strengthen but the big uncertainty lies in the inability of policy makers to remove impediments—both perceived and real—to business expansion and economic growth."

Adam Warner, President, Key Equipment Finance, said, "We closed 2012 on a strong note as demonstrated by today's numbers from across the industry and our results at Key Equipment Finance. Looking ahead to 2013, there's a great deal of uncertainty among the business community regarding the debt ceiling, which is causing many businesses to take a 'wait and see' approach to making significant investments like capital equipment. It is my hope that the White House and Congress will act quickly to manage the growing U.S. debt to restore the confidence of business leaders and encourage investment."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

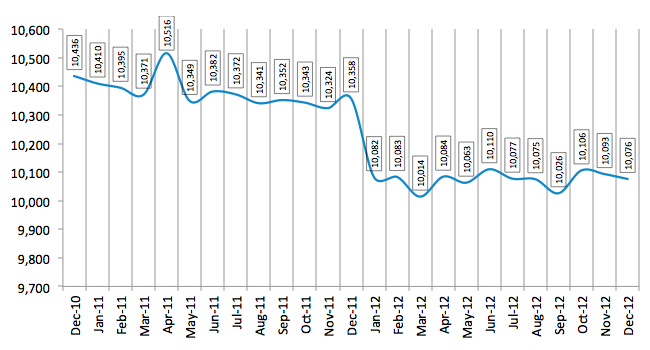

Total Number of Employees

(Year Over Year Comparison)

:: TOP