Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

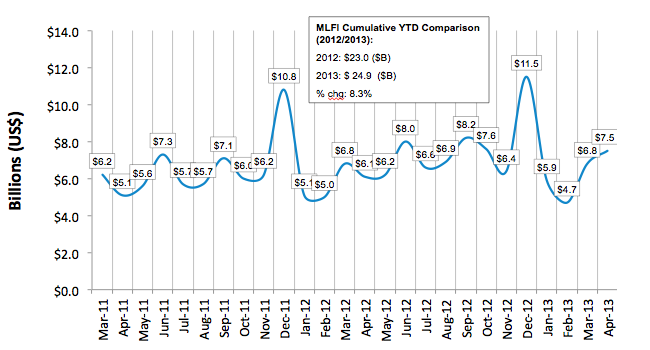

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $725 billion equipment finance sector, showed their overall new business volume for April was $7.5 billion, up 23 percent compared to volume in April 2012. Month-over-month, new business volume was up 10 percent from March. Year to date, cumulative new business volume was up eight percent compared to 2012.

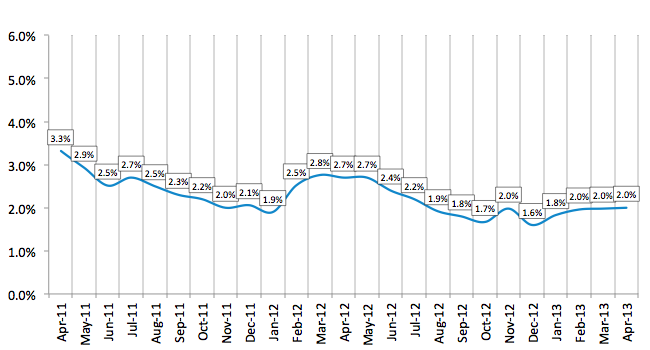

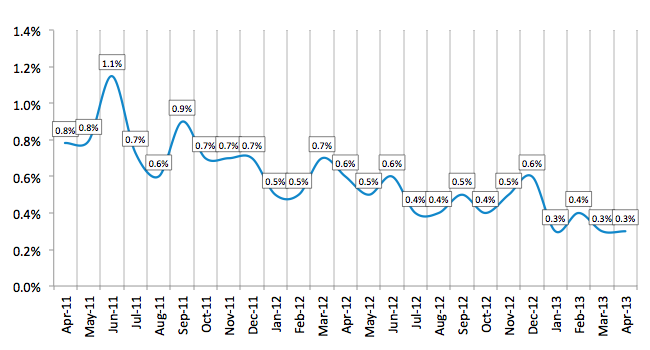

Receivables over 30 days were unchanged in April from the previous two months at 2.0 percent. They were down from 2.7 percent in the same period in 2012. Charge-offs were unchanged from March at the all-time low of 0.3 percent.

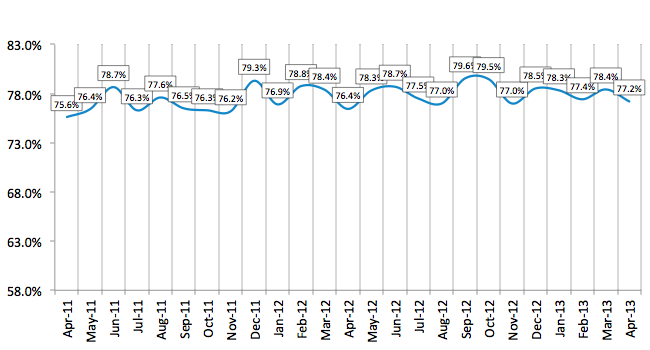

Credit approvals totaled 77.2 percent in April, down from 78.4 percent in March. Seventy-two percent of participating organizations reported submitting more transactions for approval during April, up 50 percent from the previous month.

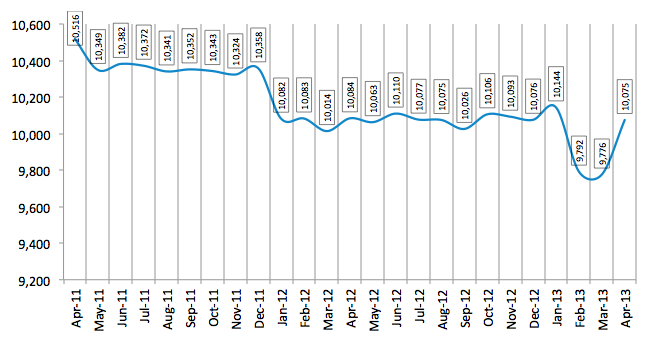

Finally, total headcount for equipment finance companies was up three percent from the previous month, and was unchanged year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for May is 56.7, an increase from the April index of 54.0, reflecting industry participants' increasing optimism despite continuing concerns over the economy and the impact of federal policies on capital expenditures. .

ELFA President and CEO William G. Sutton, CAE, said: "Both performance indicesÑthe MCI as an indicator of future optimism about the direction of the U.S. economy, and the MLFI-25's growth trend in new business activityÑprovide solid evidence that the demand side of the capital investment equation continues to pick up as the broader economy strengthens. It is our hope that this trend pushes into the second half of the year."

Paul J. Menzel, President and CEO, Financial Pacific Leasing, LLC, said: "Over the last four years businesses of all sizes have pursued a defensive strategy of austerity by right sizing their balance sheets, maximizing operating efficiencies, and optimizing cash flow, all while top line revenue growth has remained weak. This has kept many borrowers and lessees on the sidelines despite historically low rates. The anemic revenue story may be coming to an end as businesses seem to be going on the offensive and investing for growth, as this month's MLFI data reflects."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP