Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Tygris Vendor Finance

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

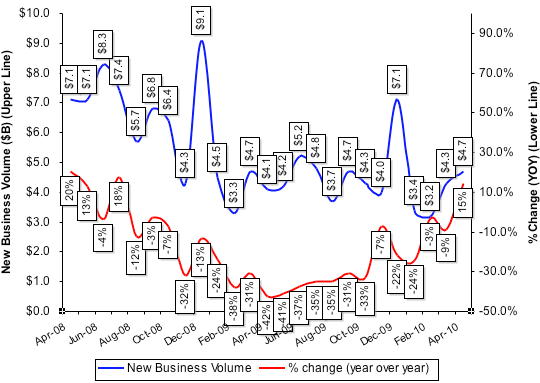

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $518 billion equipment finance sector, showed overall new business volume for April grew 15 percent when compared to the same period in 2009. When compared to the prior month, the MLFI-25 reported new business volume increased by nine percent, from $4.3 billion to $4.7 billion. April originations showed year-over-year growth for the first time since July 2008.

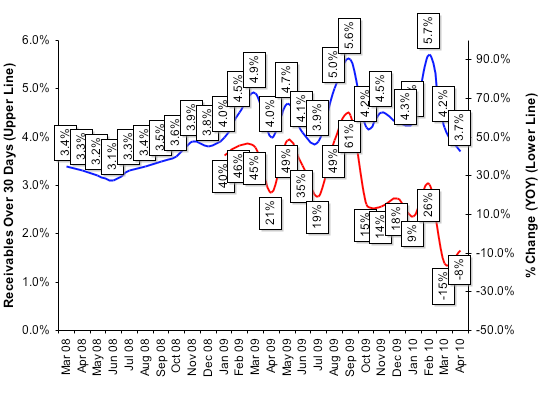

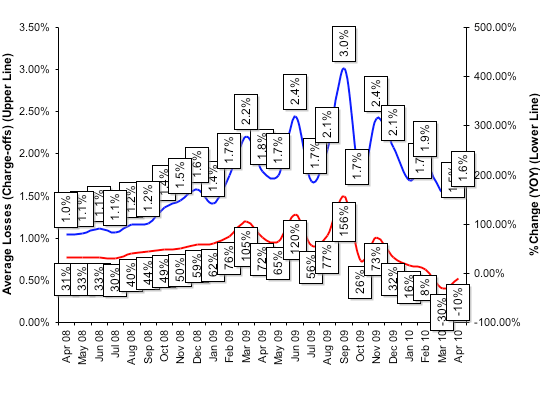

Delinquencies improved as well. Receivables over 30 days declined to 3.7 percent, from 4.2 percent in the prior month and 4.0 percent in the year-earlier period. Charge-offs increased slightly to 1.6 percent, up from 1.5 percent in the prior month, but improved over the year-earlier period.

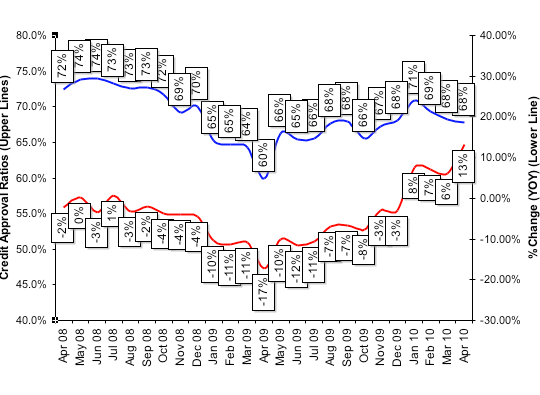

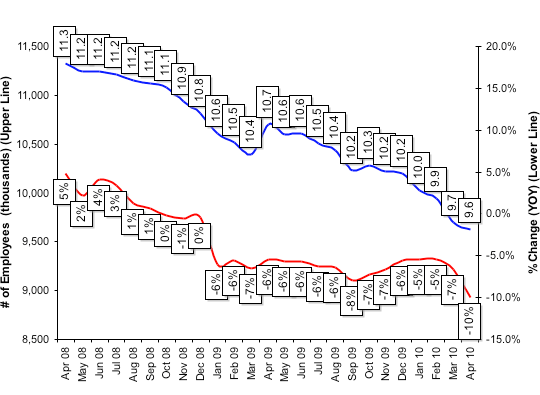

Credit approvals remained flat when compared to March data, but, at 68 percent, increased from same period the prior year. Of participating organizations, 46 percent reported submitting more transactions for approval during the month. Finally, total headcount for equipment finance companies decreased by one percent in the March-April period.

The construction, trucking transportation, and small business categories led the underperforming sectors. While the National Federation of Independent Business's Small Business Optimism Index showed a significant improvement in May, small businesses planning on making capital expenditures remained at an all time low (three points above the 35-year record low).

A related index, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI), for May was at 67.38, the highest to date, up from the April 2010 index of 65.4.

"April's new business volume data is encouraging even though demand is still soft," said David Merrill, President, Fifth Third Leasing Company, located in Cincinnati, OH. "Companies are still searching for signs of a sustained economic recovery before they invest heavily in capital equipment. When viewed in conjunction with the continued improvement in charge-off and delinquency metrics, April's data provides reason for optimism that additional growth will occur in the second half of 2010."

"April's new business volume is indeed a positive sign that businesses are starting to invest in capital assets," said ELFA President William G. Sutton. "The April data support anecdotal evidence from ELFA members that a growth trajectory is beginning to take shape, as pent-up demand gives way to equipment acquisition by business, both large and small."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP