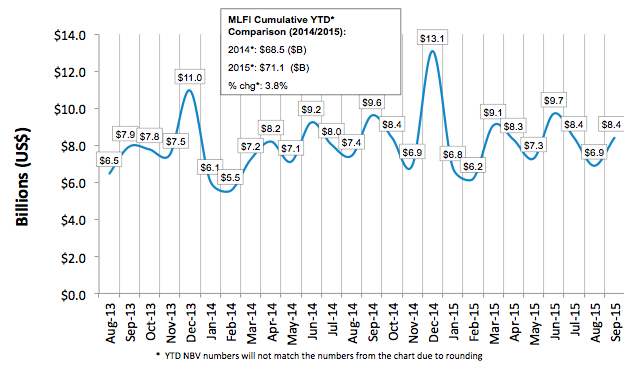

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $903 billion equipment finance sector, showed their overall new business volume for September was $8.4 billion, down 13 percent from new business volume in September 2014. Volume was up 22 percent from $6.9 billion in August. Year to date, cumulative new business volume increased 4 percent compared to 2014.

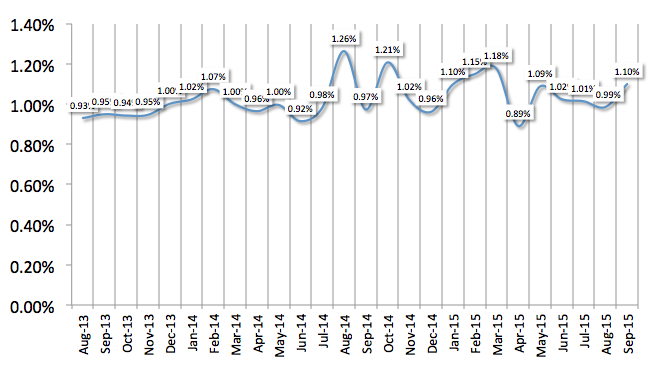

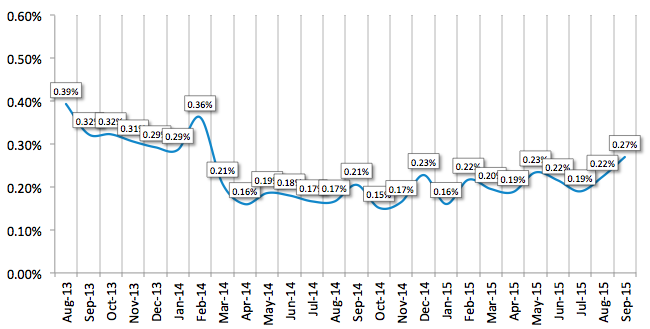

Receivables over 30 days were 1.10 percent, up from 0.99 percent the previous month and up from 0.97 percent in the same period in 2014. Charge-offs were 0.27 percent, up from 0.22 the previous month.

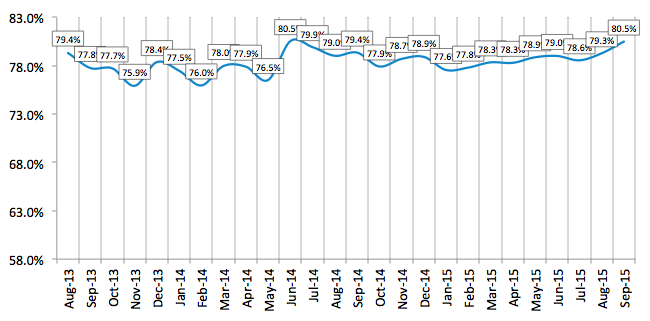

Credit approvals totaled 80.5 percent in September, up from 79.3 percent in August. Total headcount for equipment finance companies was up 5 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for October is 58.7, easing from the previous month's index of 61.1.

ELFA President and CEO William G. Sutton, CAE, said, "Cautious optimism continues as the watch word for MLFI-25 companies who report steady, but slow, growth for the month. While the U.S. economy slogs along, dragged down by low oil demand, an uneven labor market, a volatile equities market and troublesome signals from the Chinese economy, business expansion and demand for productive asset follows suit. Portfolio quality was off, with delinquencies increasing ever so slightly and losses edging upward. Time will tell whether this is a trend to be concerned about or just another blip in the credit cycle."

Michael DiCecco, President, Huntington Equipment Finance, said, "While industry new business volume is up 4 percent year to date, September's MLFI-25 reported decline in year-over-year new business volume reflects a precipitous decline in energy sector spending and the effect fluctuations in global economic activity have on the amount of equipment financed in the U.S."

:: View the full list of participants

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

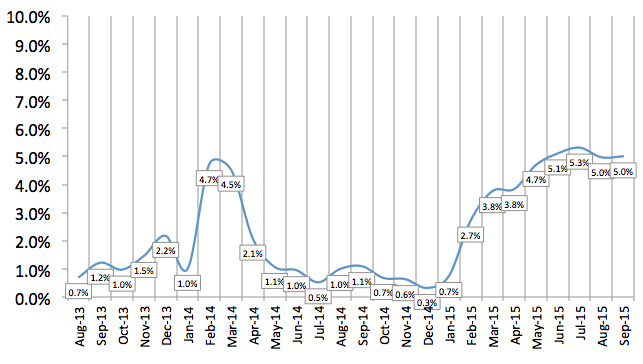

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP