Participants in the ELFA MLFI-25:

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- Dell Financial Services

- Direct Capital Corporation

- DLL

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SunTrust Robinson Humphrey

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

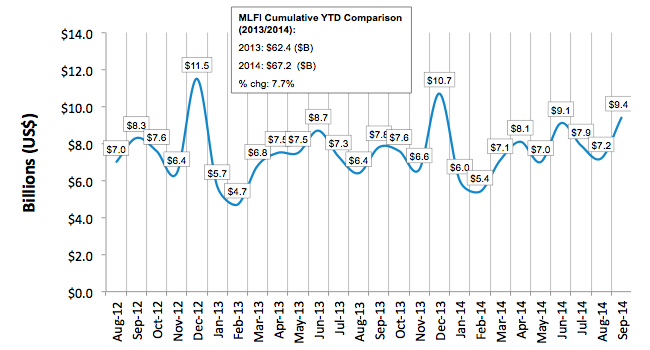

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $827 billion equipment finance sector, showed their overall new business volume for September was $9.4 billion, up 21 percent from new business volume in September 2013. Month over month, new business volume was up 31 percent from August. Year to date, cumulative new business volume increased 8 percent compared to 2013.

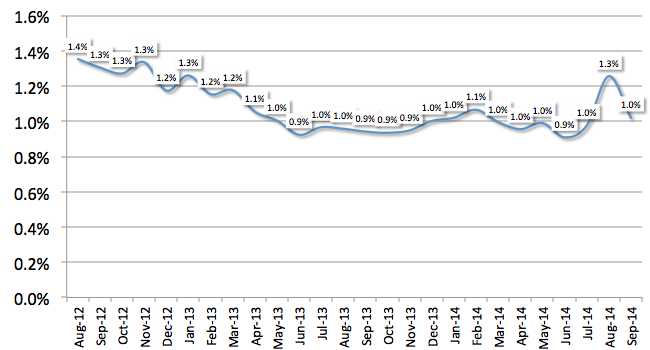

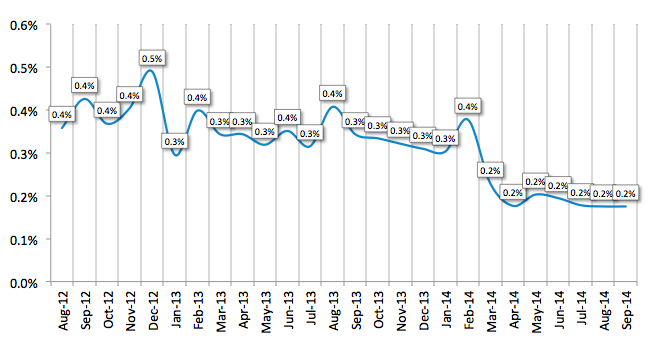

Receivables over 30 days decreased from the previous month to 1.0 percent, and were up slightly from .09 percent in the same period in 2013. Charge-offs were unchanged for the sixth consecutive month at an all-time low of 0.2 percent.

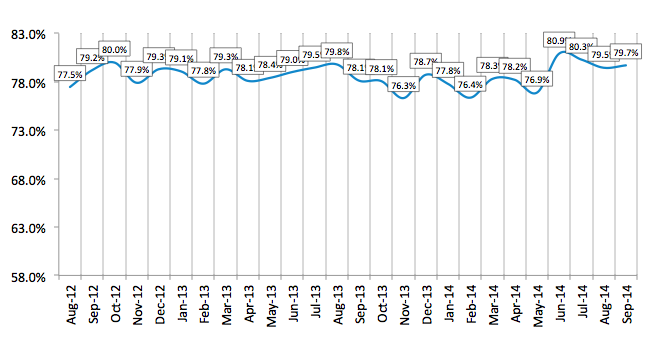

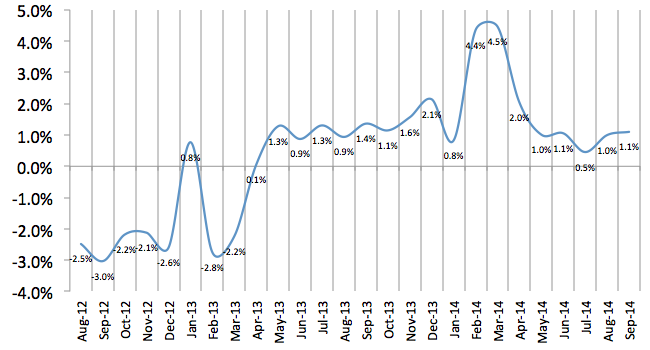

Credit approvals totaled 79.7 percent in September, relatively unchanged from the previous month. Total headcount for equipment finance companies was up 1.1 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for October is 60.4, slightly better than the September index of 60.2, with survey participants indicating increasing or consistent demand tempered by U.S. economic concerns

ELFA President and CEO William G. Sutton, CAE, said: "All MLFI-25 performance metrics for September indicate a favorable environment for business investment. Strong originations and solid portfolio performance, together with a slight uptick in hiring, all point to a robust equipment finance sector as we move into the final quarter of the year. We will keep our eye on these positive indicators as the U.S. economy continues to react to geopolitical events, a worrisome global economic outlook and volatile U.S. equity markets."

William Henak, President and Chief Executive Officer, TCF Equipment Finance, said, "Continued growth in September quarter-end new business volume was both expected and encouraging based on the year-to-date momentum and historically strong performance for this period in the equipment finance sector. The decrease in portfolio delinquency levels back to the 1.0% level in September was a positive sign, yet the 1.3% spike in August was a good reminder that strong credit discipline remains important in this competitive environment as everyone looks to grow portfolios. Concern for the rest of the year remains due to the growing number of negative news headlines, volatile capital and equity markets, unresolved tax extender legislation, and the potential for Federal Reserve actions that may influence interest rates. All of these factors could negatively impact new business volume in the 4th quarter, which is historically strong. Despite these concerns, this year is expected to finish strong. Our industry has always been very resilient and found ways to turn uncertainty into opportunity."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP