Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance Company

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

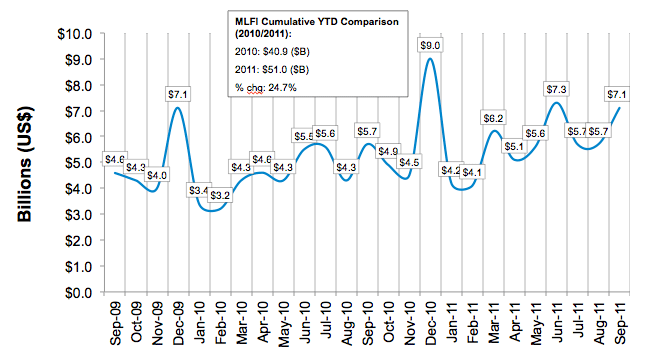

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for October was $6.0 billion, up 22 percent from volume of $4.9 billion in the same period in 2010. Volume was down 16 percent from the previous month. Year-to-date cumulative new business volume is up 25 percent.

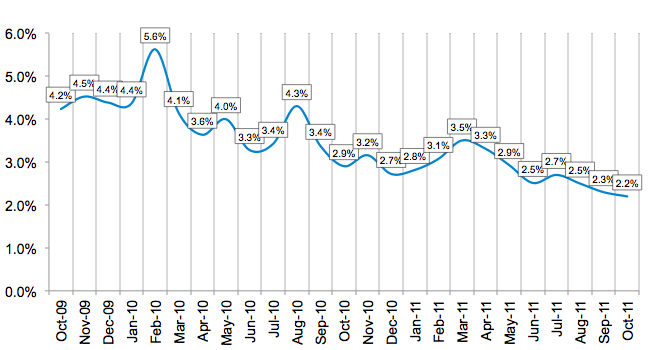

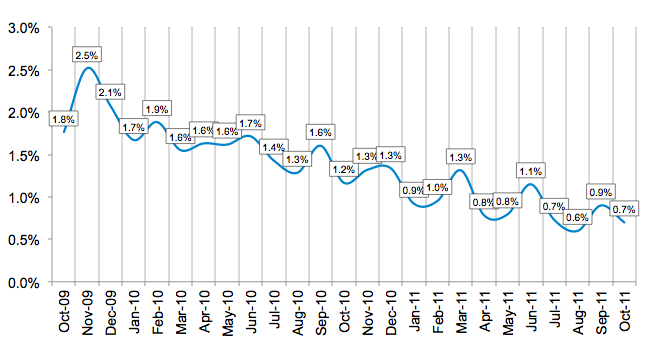

Credit quality metrics were improved. Receivables over 30 days were the lowest in over two years, decreasing 2.2 percent in October from 2.3 percent in September. Charge-offs also declined, from 0.9 percent in September to 0.7 percent in October.

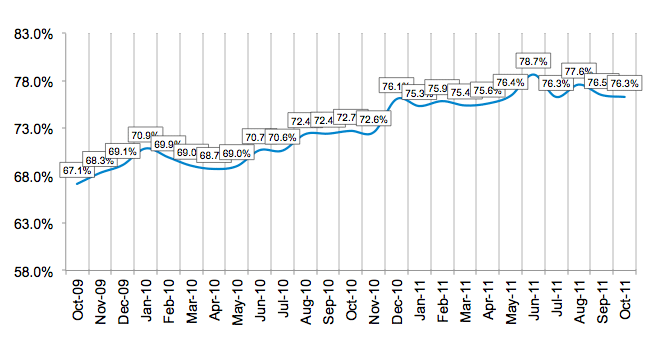

Credit standards tightened in October as the number of lease applications approved decreased nominally to 76.3 percent from 76.5 percent the previous month. Fifty-nine percent of participating organizations reported submitting more transactions for approval during the month.

Finally, total headcount for equipment finance companies in October was unchanged month to month and down 1.4 percent year over year. Supplemental data show that the construction and trucking industries led the underperforming sectors.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for November is 57.4, up from the October index of 50.7, indicating an increase in optimism about business activity despite ongoing concerns about the global economic situation. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, said: "The October decline in new business volume had more to do with typically strong end-of-third-quarter activity than a slowing demand for lease financing of assets by U.S. businesses. While concerns about the global credit markets continue to make headlines, American businesses continue to invest in productive equipment that will help keep the economy steadily moving in the right direction. Credit quality is strengthening, laying the foundation for economic expansion and stability as we lead into the new year."

Jim McGrane, President, EverBank Commercial Finance, Inc., located in Parsippany, NJ, said, "We were pleased to see healthy year over year new business volume growth in October coming off a strong quarter end. Portfolio performance continues to stand out with delinquencies and charge-offs hovering near historical lowsÑa comforting trend in this uncertain economic environment. Continued growth in investment in equipment and software along with a substantive increase in the Monthly Confidence Index causes us to have confidence in future industry performance."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

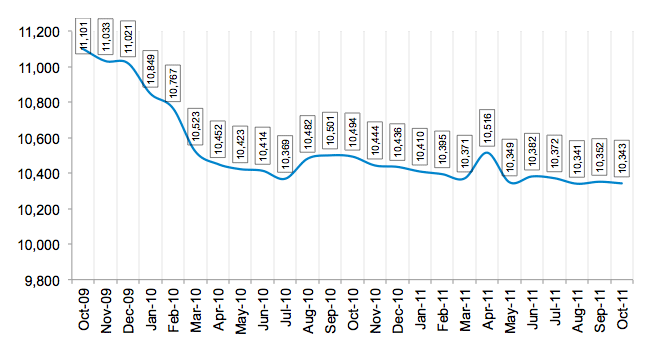

Total Number of Employees

(Year Over Year Comparison)

:: TOP