Participants in the ELFA MLFI-25:

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- Dell Financial Services

- Direct Capital Corporation

- DLL

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- Frost Bank

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SunTrust Equipment Finance Group

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Volvo Financial Services

- Wells Fargo Equipment Finance

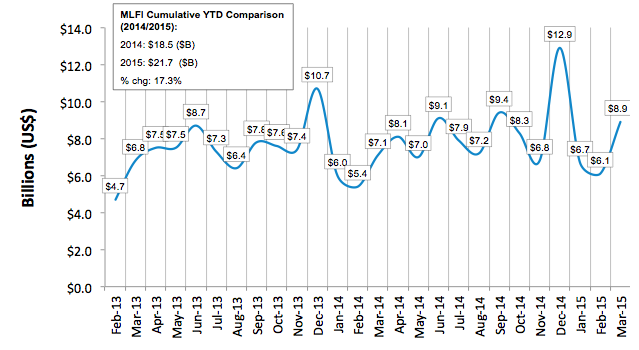

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $903 billion equipment finance sector, showed their overall new business volume for March was $8.9 billion, up 25 percent from new business volume in March 2014. Volume was up 46 percent from $6.1 billion in February. Year to date, cumulative new business volume increased 17 percent compared to 2014.

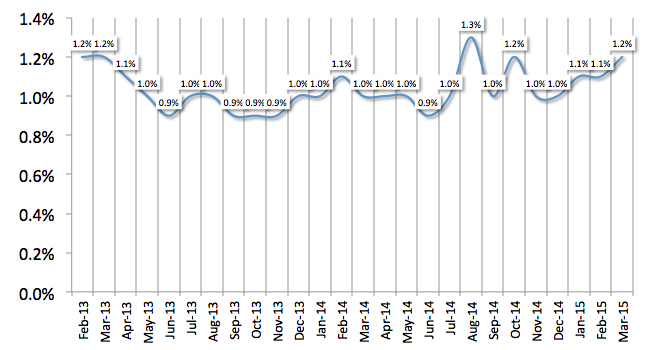

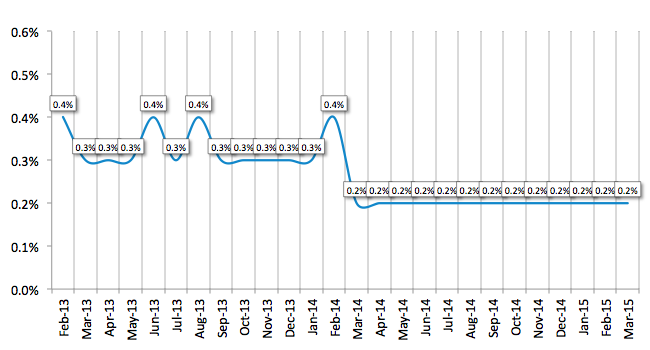

Receivables over 30 days were 1.2 percent, up from 1.1 percent the previous month and from 1.0 percent the same period in 2014. Charge-offs were at an all-time low of 0.2 percent for the 13th consecutive month.

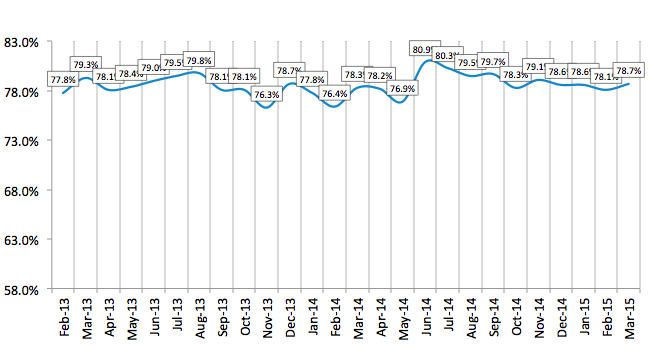

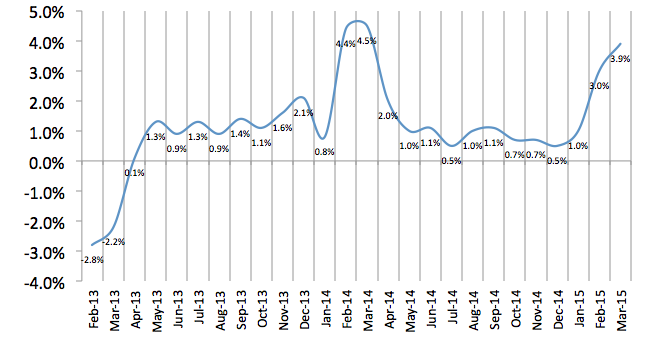

Credit approvals totaled 78.7 percent in March, up from 78.1 percent in February. Total headcount for equipment finance companies was up 3.9 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for April is 70.7, an easing from the March index of 72.1, which was the highest level in four years.

ELFA President and CEO William G. Sutton, CAE, said: "Equipment finance companies in many industry sectors are reporting a robust first quarter of the year. The March new business volume is indicative of strong capital spending, influenced by businesses taking advantage of continued low interest rates, perhaps in anticipation of reported tightening of monetary policy by the Fed. Credit quality metrics are mixed, with delinquencies edging upward counterbalanced by monthly losses remaining at historic lows."

Bradley R. Brolsma, President, Merchants Capital Resources, Inc., said, "While there is a general sense within our industry that deal flow is not where it could be, the 17 percent growth in first quarter new business certainly doesn't seem to bear that out. Clearly, industry numbers are outpacing 2015 expectations of a 4 to 5 percent increase in annual expenditures for equipment and software and that's nothing but good news for our industry. That said, the rather dismal global economic numbers still point to the need for cautiousness in assessments of overall credit conditions going forward. The marketplace doesn't need any bad news or surprises right now."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP