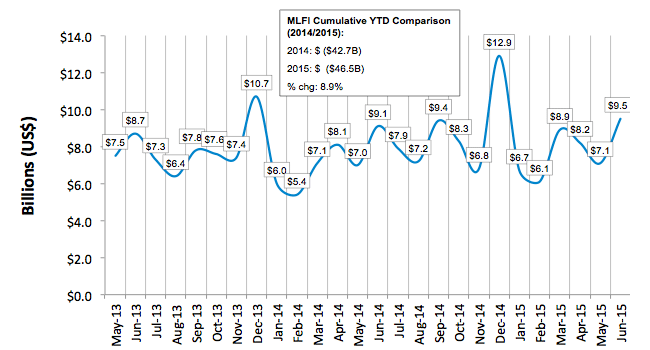

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $903 billion equipment finance sector, showed their overall new business volume for June was $9.5 billion, up 4 percent from new business volume in June 2014. Volume was up 34 percent from $7.1 billion in May. Year to date, cumulative new business volume increased 9 percent compared to 2014.

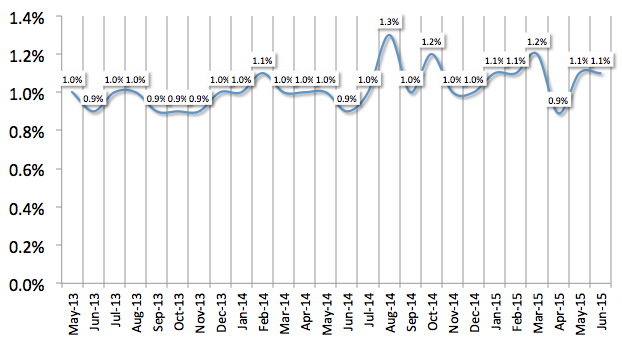

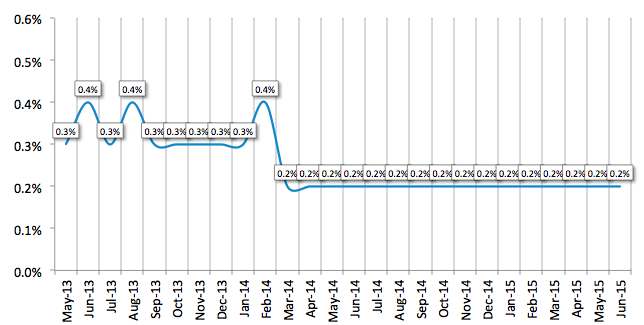

Receivables over 30 days were 1.1 percent, unchanged from the previous month and up from 0.9 percent the same period in 2014. Charge-offs remained at an all-time low of 0.2 percent for the 16th consecutive month.

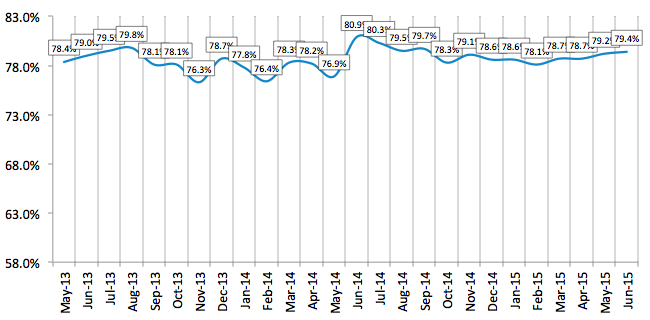

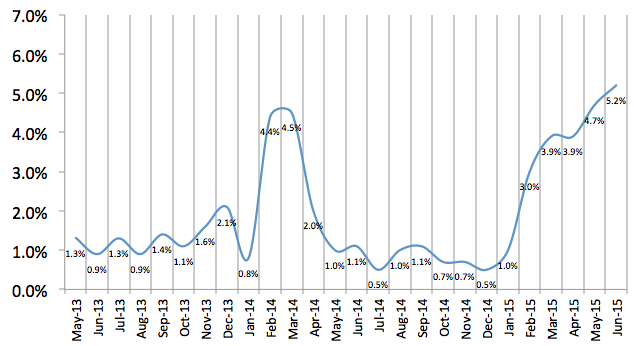

Credit approvals totaled 79.4 percent in June, up slightly from 79.2 percent in May. Total headcount for equipment finance companies was up 5.2 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for July is 62.6, remaining essentially the same as the June index of 63.0.

ELFA President and CEO William G. Sutton, CAE, said, "The level of new business volume at the halfway point in the year is higher than in any similar period since at least the Great Recession. In most sectors, ELFA members report robust performance, in terms of both originations and portfolio quality. Tempering this 'things can't get much better' mantra is a realization that various internal and external influences, including a gradually higher interest rate environment domestically and economic woes experienced by our trading partners in the Eurozone and elsewhere, could well slow the trajectory and velocity of capital spending. Time will tell."

Daniel P. Dyer, Co-founder and Chief Executive Officer, Marlin Business Services Corp., said, "MLFI-25 new business activity indicates choppy but steady growth over this past year. Market and competitive forces are contributing to a multi-year trend toward lower portfolio net margins. Credit performance remains stable and favorable despite the rise in the competitive environment."

:: View the full list of participants

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP