Participants in the ELFA MLFI-25:

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SunTrust Robinson Humphrey

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

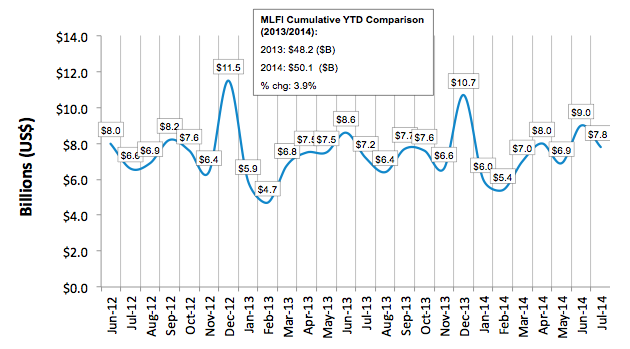

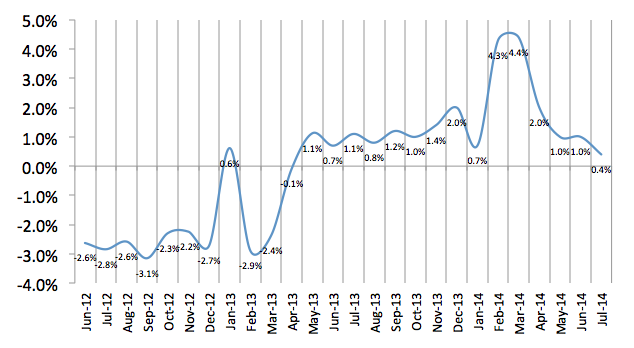

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $827 billion equipment finance sector, showed their overall new business volume for July was $7.8 billion, up 8 percent from new business volume in July 2013. Month over month, new business volume was down 13 percent from June. Year to date, cumulative new business volume increased 4 percent compared to 2013.

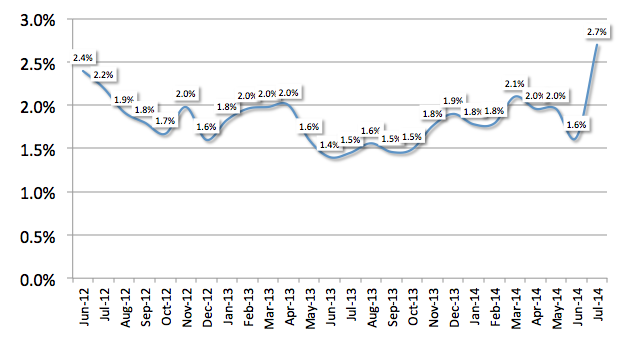

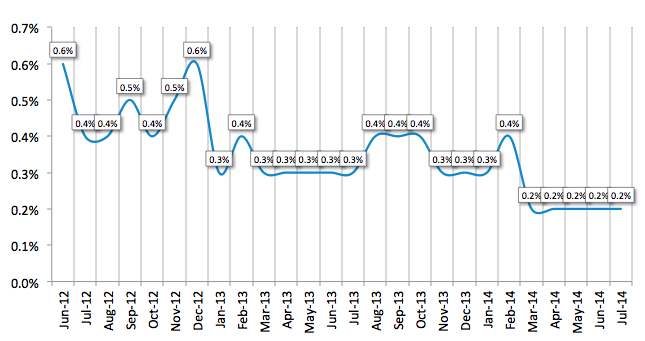

Receivables over 30 days increased from the previous month to 2.7 percent, and were up from 1.5 percent in the same period in 2013. Charge-offs were unchanged for the fourth consecutive month at an all-time low of 0.2 percent.

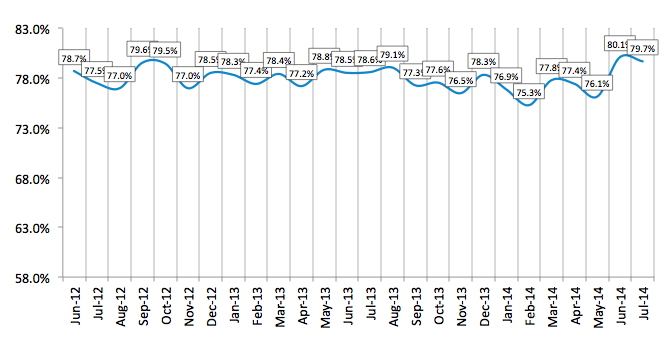

Credit approvals totaled 79.7 percent in July, a slight decrease from 80.1 percent the previous month. Total headcount for equipment finance companies was up 0.4 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for August is 58.9, easing from the previous two months' indexes of 61.4.

ELFA President and CEO William G. Sutton, CAE, said: "After a solid second quarter that saw an overall increase in U.S. GDP and strong business investment, new business volume in the equipment finance sector continued to hold steady in July. Credit performance is mixed: monthly delinquencies were up (as a result of a single respondent-outlier) but charge-offs remained at historically low levels. For now, most ELFA member companies report good, if not spectacular, growth, and conditions appear favorable for this to continue into the late summer and early fall."

Elaine Temple, President, BancorpSouth Equipment Finance said, "The month-over-month drop in new business volume was expected as business volume is typically lower in July and August. The year-over-year growth of 4 percent is encouraging and reflects that the economy is in a recovery, but a slow recovery."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP