Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- Direct Capital Corporation

- EverBank Commercial Finance

- Fifth Third Equipment Finance

- First American Equipment Finance, a City National Bank Company

- GreatAmerica Financial Services

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- LEAF Commercial Capital Inc.

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- SunTrust Robinson Humphrey

- Susquehanna Commercial Finance

- TCF Equipment Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

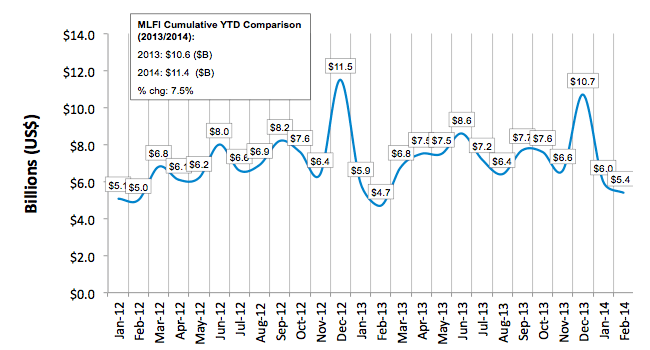

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $827 billion equipment finance sector, showed their overall new business volume for February was $5.4 billion, up 15 percent from new business volume in February 2013. Month-over-month, new business volume was down 10 percent from January. Year to date, cumulative new business volume increased 8 percent compared to 2013.

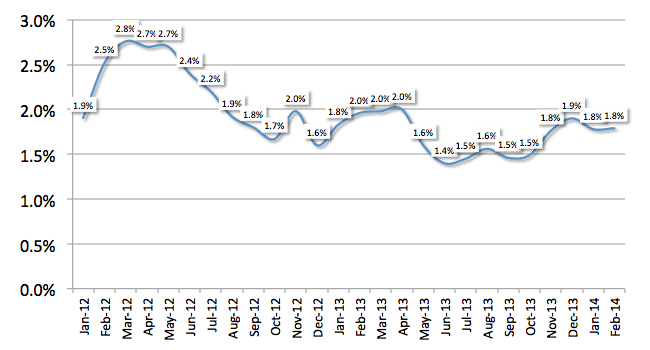

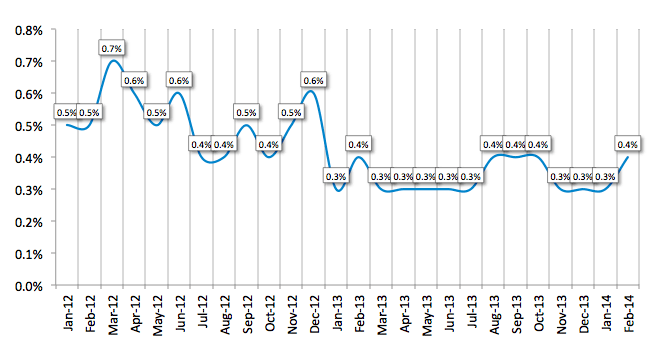

Receivables over 30 days were unchanged from the previous month at 1.8 percent. Delinquencies were down from 2.0 percent during the same period in 2013. Charge-offs were up slightly at 0.4 percent from the previous three months' all-time low of 0.3 percent.

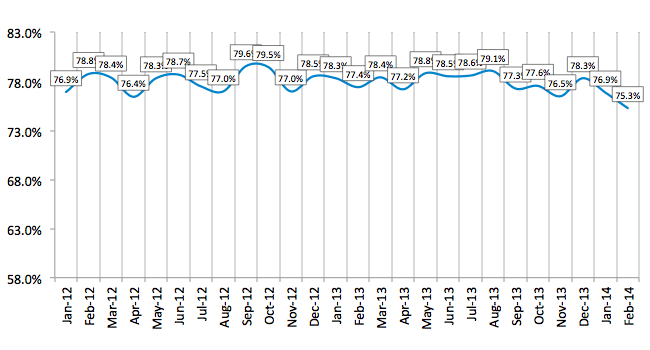

Credit approvals totaled 75.3 percent in February, a decrease from 76.9 percent the previous month. Fifty-three percent of participating organizations reported submitting more transactions for approval during February, a decrease from 54 percent during January.

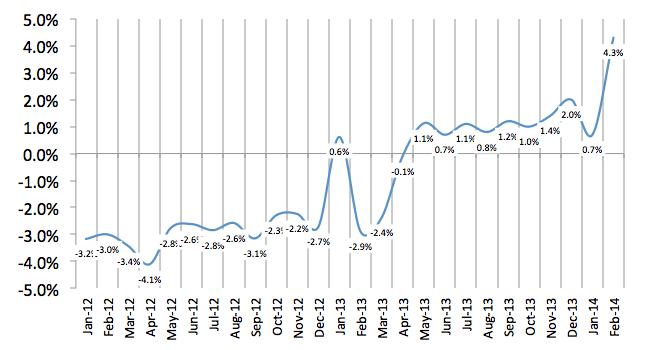

Finally, total headcount for equipment finance companies was up 4.3 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for March is 65.1, the highest index in two years and an increase from the February index of 63.3.

ELFA President and CEO William G. Sutton, CAE, said: "This month's increase in financing activity reflects a strengthening economy evidenced by a resilient housing market trying to return to pre-recession levels, moderate GDP growth and an improving jobs picture. It is too early to tell whether the positive economic momentum created in the first two months of the year will be sustainable for the balance of 2014, particularly as Fed policy begins to push up long-term interest rates and geopolitical headwinds emerge anew in Eastern Europe. Credit markets continue to perform well."

Gary Kempinski, GM, GE Capital Transportation Finance's Navistar Capital program, said "I think the positive new business volume trend for the month, in light of the adverse weather across much of the country, combined with the upward tick in industry employment, signals the strength of our industry. The charge-offs indicated by the MLFI-25 survey are similar to last year's pattern. When paired with what look like slightly tighter underwriting standards on approvals, I think the industry is acting responsibly to ensure credit stability. Taken together with what we hear from our customers about how well they believe their businesses are performing, I think the MLFI survey indicates equipment customers and financers are feeling pretty good this month."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP