Participants in the ELFA MLFI-25:

- ADP Credit

- BancorpSouth Equipment Finance

- Bank of America

- Bank of the West

- BB&T Bank

- BMO Harris Equipment Finance

- Canon Financial Services

- Caterpillar Financial Services

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Equipment Finance, a City National Bank Company

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- Huntington Equipment Finance

- John Deere Financial

- Key Equipment Finance

- M&T Bank

- Marlin Leasing

- Merchants Capital

- PNC Equipment Finance

- RBS Asset Finance

- SG Equipment Finance

- Siemens Financial Services

- Stearns Bank

- Suntrust

- Susquehanna Commercial Finance

- US Bancorp Equipment Finance

- Verizon Capital

- Volvo Financial Services

- Wells Fargo Equipment Finance

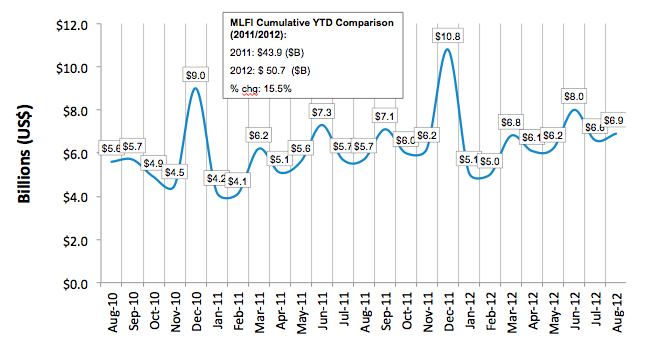

The Equipment Leasing and Finance Association's (ELFA) (MLFI-25), which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for August was $6.9 billion, up 21 percent from volume of $5.7 billion in the same period in 2011. Volume was up 5 percent from the previous month. Year-to-date cumulative new business volume increased 16 percent.

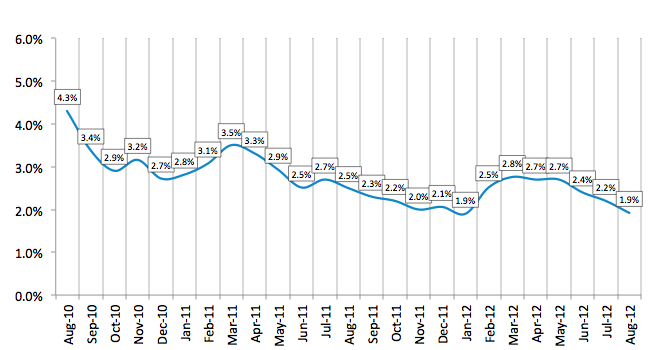

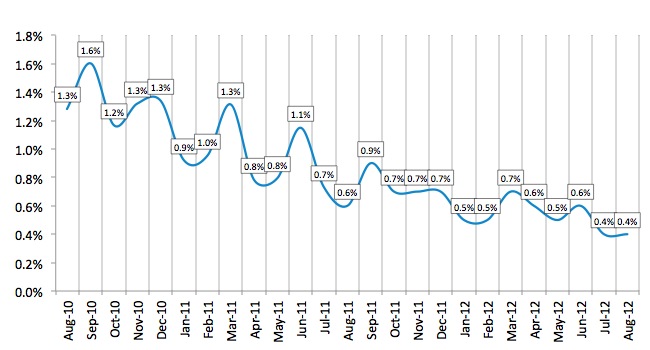

Receivables over 30 days decreased for the third consecutive month to 1.9 percent, down from 2.2 percent in July and down 24 percent when compared to the same period in 2011. Charge-offs were unchanged from the previous month at 0.4 percent, and down by 33 percent compared to the same period last year.

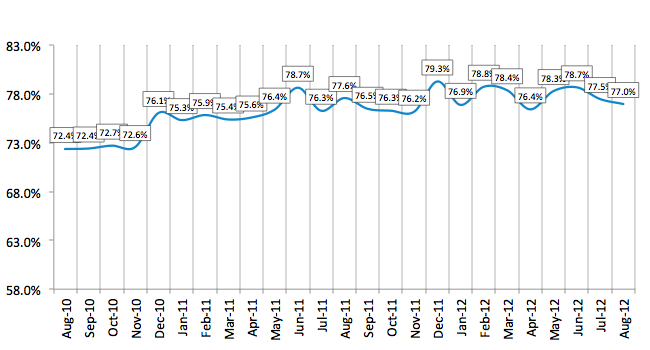

Credit approvals decreased slightly to 77.0 percent in August from 77.5 percent in July. Sixty-two percent of participating organizations reported submitting more transactions for approval during August, down from 65.5 percent the previous month.

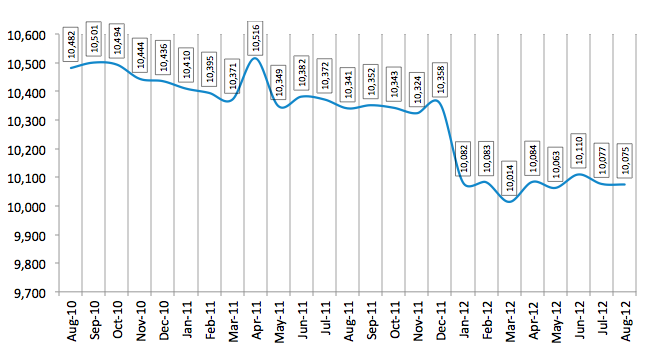

Finally, total headcount for equipment finance companies was unchanged from the previous month, and declined 3.0 percent year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for September is 53.0, up from the August index of 50.2, reflecting increased optimism despite concerns over companies' willingness to expand their businesses in the face of economic and political uncertainty.

ELFA President and CEO William G. Sutton, CAE, said: "The pace of new equipment financing continued throughout the summer months as the housing sector, for one, showed signs of a rebound. However, businesses, both large and small, continue to build up cash reserves, indicating lingering apprehension over increasing energy prices, instability in the Arab world and a still fragile Eurozone economy."

Thomas Depping, Chief Executive Officer, Ascentium Capital, said, "The general origination and credit quality trends detailed above mirror our experience at Ascentium Capital. The credit quality of our applications remains unprecedentedly strong and our delinquencies at historic lows. Although we have hedged ourselves against another possible global economic slowdown, we continue to expand our sales force as we have a generally optimistic view of our future. One thing I have learned over the past 30 years in the industry is that being over-capitalized and having substantial excess liquidity is never a bad thing."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables Over 30 Days:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP