Participants in the ELFA MLFI-25:

- ADP Credit Corporation

- Bank of America

- Bank of the West

- Canon Financial Services

- Caterpillar Financial Services Corporation

- CIT

- De Lage Landen Financial Services

- Dell Financial Services

- EverBank Commercial Finance

- Fifth Third Bank

- First American Equipment Finance

- GreatAmerica

- Hitachi Credit America

- HP Financial Services

- John Deere Credit Corporation

- Key Equipment Finance

- Marlin Leasing Corporation

- National City Commercial Corp.

- RBS Asset Finance

- Regions Equipment Finance

- Siemens Financial Services

- Susquehanna Commercial Finance, Inc.

- US Bancorp

- Verizon Capital Corp

- Volvo Financial Services

- Wells Fargo Equipment Finance

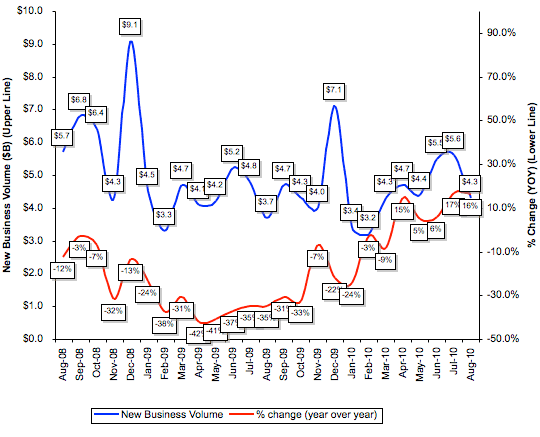

The Equipment Leasing and Finance Association's (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $518 billion equipment finance sector, showed overall new business volume for August increased 16 percent when compared to the same period in 2009. When compared to the prior month, however, the MLFI-25 reported new business volume declined from $5.6 billion to $4.3 billion. This drop follows two consecutive months of growth.

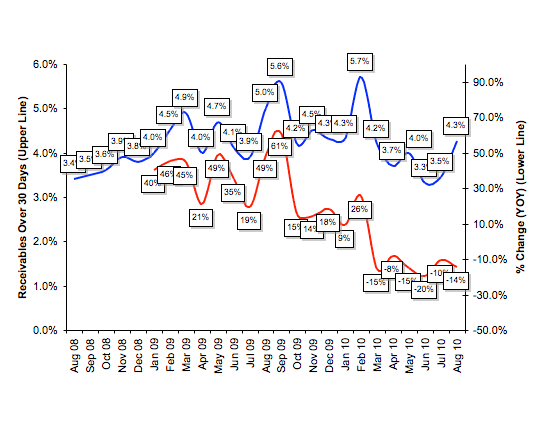

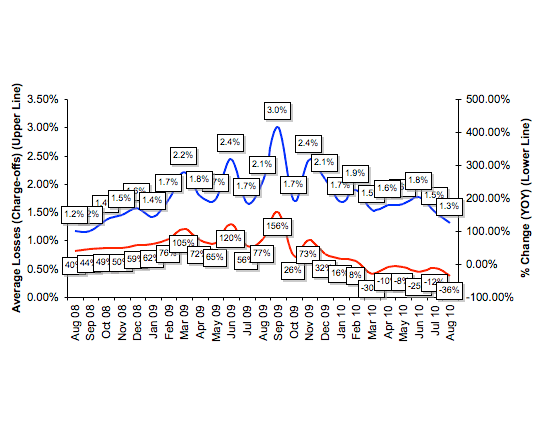

Credit quality is mixed as well. Receivables over 30 days increased to 4.3 percent, up from 3.5 percent in the prior month, but improved when compared to the year-earlier period (5.0%). Charge-offs fell for the second consecutive month, from 1.5 percent in July to 1.3 percent in August. And, there was considerable improvement when compared to the same period in 2009.

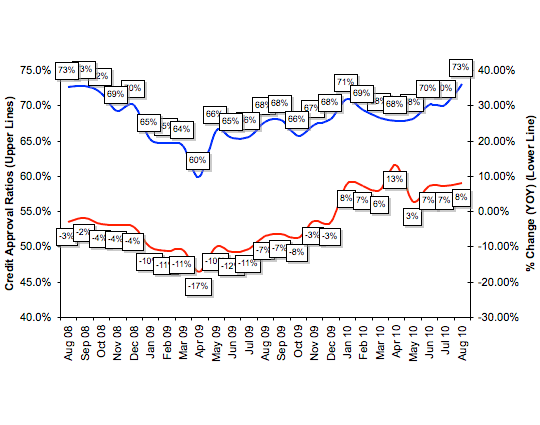

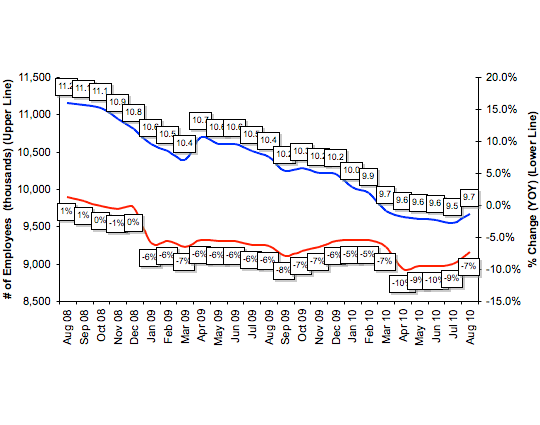

The percentage of credit approvals increased to 73 percent in August, matching the highest approval ratio since September 2008. Sixty-eight percent of participating organizations reported submitting more transactions for approval during the month. Finally, total headcount for equipment finance companies increased during the July-August period. Supplemental data shows that trucking and construction assets lead the underperforming sectors.

"While some equipment financing metrics are improving and moving in the right direction, other data reflect continued uncertainty about the economy and a less-than-robust economic recovery," said ELFA president William G. Sutton. "According to the data provided by ELFA members, a majority of organizations are experiencing a gradual, but uneven, improvement in business activity compared to 2009."

"While CSI would concur that there are some modest improvements in most of the demonstrable year-over-year metrics tracked by the MLFI -25, not enough evidence exists to lead us to believe that we are firmly on the 'yellow brick road' to recovery," said Robert Rinaldi, Senior Vice President, CSI Leasing, Inc. "We have more than anecdotal evidence to suggest that possible corporate tax impacts resulting from fiscal imbalances at the federal, state and local levels, along with dissatisfaction with recently enacted regulatory policies, are still causing businesses to hold back on many of their strategic growth initiatives. Additionally, we think many businesses are just now becoming aware of the looming effects of yet another regulatory initiative that will complicate how they will acquire equipment, i.e., FASB / IASB lease accounting changes. The result of all of this basically is preventing consistently elevated levels in capital equipment acquisitions, in which our industry plays a vital role."

MLFI-25 New Business Volume

(Year Over Year Comparison)

:: TOP

Aging of Receivables:

:: TOP

Average Losses (Charge-offs) as a % of net receivables

(Year Over Year Comparison)

:: TOP

Credit Approval Ratios As % of all Decisions Submitted

(Year Over Year Comparison)

:: TOP

Total Number of Employees

(Year Over Year Comparison)

:: TOP